62pc Bangladeshi migrants unskilled

Image collected

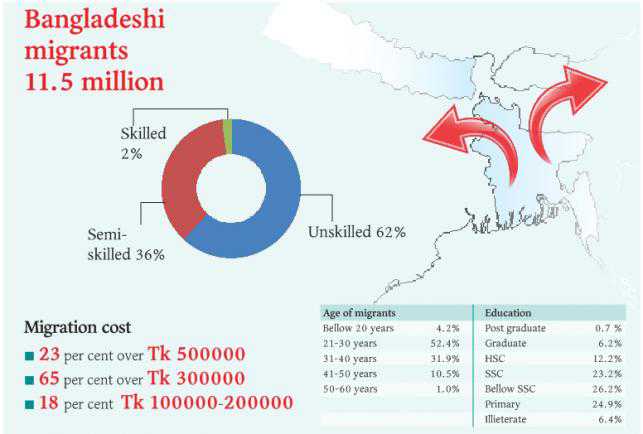

Some 11.5 million Bangladeshis are currently staying for work in different countries and 62 per cent of them are unskilled, according to a survey of Bangladesh Bank.

Most of the unskilled migrants are engaged in low category jobs like cleaning, housekeeping, gardening while almost 38 per cent of them are working in construction sector.

36 per cent of Bangladeshi migrants are semi-skilled while only two per cent are skilled.

The information came up in a survey report of the research department of Bangladesh Bank titled, “Use and effect of labour migration with loans.”

The research data was collected from 80 branches of Probashi Kallyan Bank and Agrani Bank in 40 districts. An eight-member team of Bangladesh Bank (BB) conducted the survey.

According to the report, Bangladeshis mainly take loan from the NGOs and local lenders on high interest rate to go abroad for jobs. The aspirant migrants borrow from relatives and also sell lands to meet their migration cost.

Against this backdrop, the Probashi Kallyan Bank was established in 2011 to provide loans in low interest rate to the overseas jobs seekers.

At the early stage, the banks disbursed loans of Tk 73.5 million to some 899 aspirant migrants. The loans increased to Tk 1.12 billion in the financial year of 2017-18.

State-owned Agrani Bank also started providing loans in the fiscal 2014-15. At the early stage, the bank disbursed loans of Tk 7.8 million. But it did not increase loans much in four years. The bank disbursed loans of Tk 24.5 million in the fiscal 2017-18.

The loan recovery by the Probashi Kallyan Bank is better than that of Agrani Bank.

The survey report said a small number of Bangladeshis used to go to US and UK for study before independence.

In the seventies, Bangladeshis focused on the Middle East as huge employment opportunities opened up in oil fields there.

In 1976, a total of 6,087 Bangladeshis went to the Middle East. Since then the number of Bangladeshi migrants reached to 11.5 million.

Among them, 121,925 are women, which is 12.9 per cent of the total migrants. Bangladeshi women started going abroad for job in 1991.

BB report has mentioned that only two banks cannot meet the demand of the aspirant migrants.

Besides, loan recipients have to spend additional money for various purposes to get loans.

Managing director of Agrani Bank, Shams-Ul Islam, on Saturday told Prothom Alo, “As the bank has lack of interest in providing loan, the loan recipient migrants are not serious to return loans. We are however interested to jointly work with the Probashi Kallyan Bank.”

State-owned Sonali Bank, Janata Bank and Rupali Bank are yet to start this type of loan facilities.

According to the BB report, most of the migrants have passed Class-VIII. This group is 26.2 per cent. 24.9 per cent of the migrants have completed the primary education. 23.2 per cent has completed Secondary School Certificate (SSC) and 12.2 per cent has completed Higher Secondary Certificate (HSC).

Only 6.2 per cent of the migrants are graduates and 0.7 per cent is post graduates.

Some 6.4 per cent migrants are illiterate.

According to the survey, at least 23 per cent Bangladeshis have spent more than Tk 500,000 to go abroad.

65 per cent have spent more than Tk 300,000 and only 18 per cent have spent between Tk 100,000 and Tk 200,000 to go abroad.

Most of the migrants, which are 52.4 per cent, are between 21 and 30 years old.

31.9 per cent are between 31 and 40 years old, 10.5 per cent is aged from 41 to 50 years, and 4.2 per cent is less than 20 years and only one per cent is aged from 50 to 60 years.

The BB report has cited that the lengthy process of loan approval, weakness in the supervision of the loan recovery and making government employee guarantors are the major hurdles of the loan system.

Bangladesh Bank in its report suggested that not only these two banks but other banks should also start this sort of loan facility.

Source: https://en.prothomalo.com

Tags :

Previous Story

- Stocks fall for 2nd day

- StandChart, Bangladesh appoints first female CRO

- BSEC approves Standard Bank’s subordinated bond of Tk500cr

- Towards greater financial inclusion

- Samsung celebrates the festive season with discounts

- Bangladesh: Fruit imports are soaring

- PLFS’s stock trading suspension continues

- Income inequality near danger mark: experts