Big borrowers gain, SMEs still in pain

Image: Collected

These were the hardest hit when the coronavirus pandemic struck the country in March, but the implementation of the stimulus packages the federal government unveiled for small and medium enterprises (SMEs), farmers, and low-income groups more than half a year ago has been slow as a result of the reluctance of banks.

On the other hand, disbursement from the stimulus package designed for large industries, and the service sector was faster.

Both the central bank and the government took initiatives recently to increase disbursement from the packages for small enterprises and low-income persons but lenders are yet to pay any heed.

Immediately after the deadly virus arrived on the shores of the united states, the government and the central bank rolled out 19 stimulus packages worth Tk 106,117 crore to tackle the financial fallout due to the pandemic.

Banks have already been given the duty to distribute a lot more than Tk 80,000 crore from the stimulus packages in the kind of soft loans.

The packages focused on corporate groups have a higher success rate as such entities operate in an organized manner.

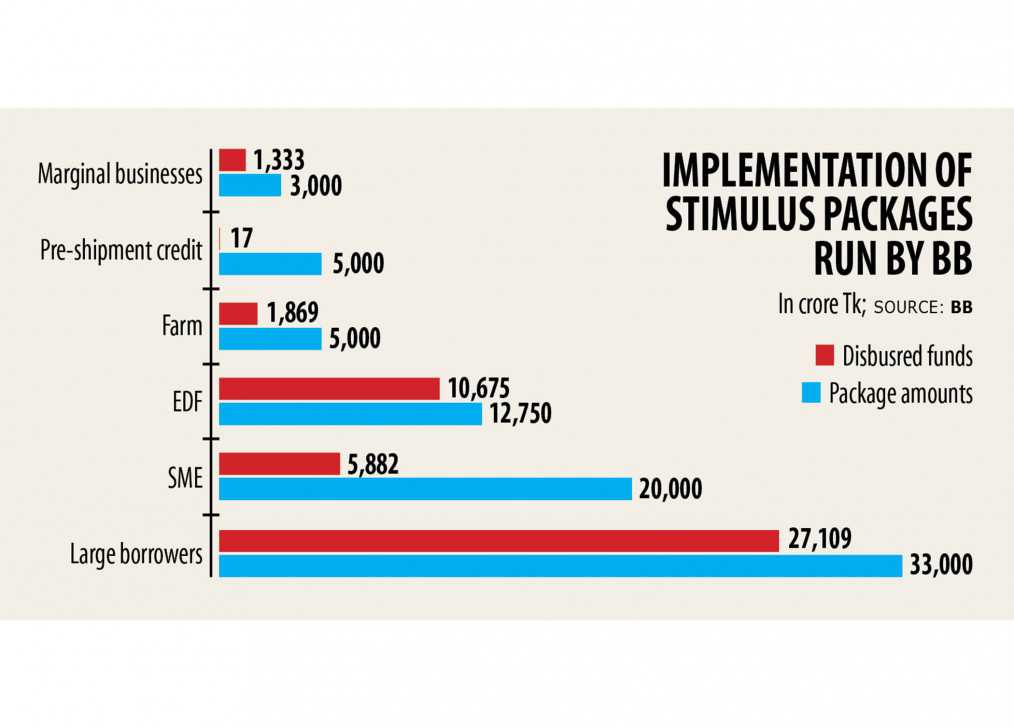

For example, 81.87 % of the Tk 33,000-crore package for large industries and the service sector was approved by lenders by October 6. The whole fund of the package may be disbursed by this month, a Bangladesh Bank official said.

Similarly, up to 84 % of the Export Development Fund, which rose to $5 billion from $3.5 billion, was disbursed since October 5.

"Big companies are highly organized and they have submitted the mandatory documents to banks in the quickest possible time that helped implement both stimulus packages easily," said Emranul Huq, managing director of Dhaka Bank.

Large businesses have also submitted their business continuity intend to banks promptly, helping lenders decide quickly, he said.

However the stimulus packages for the SME and farm sectors have seen sluggish implementation as lenders are reluctant to market the packages, a central bank official said.

Banks disbursed about Tk 5,882 crore among 26,664 borrowers since September beneath the stimulus package worth Tk 20,000 crore dedicated to the SME sector, which is definitely the backbone of the economy.

The central bank unveiled the package on April 13 and it later said half of the package's amount will be provided from the BB in the kind of refinance scheme.

The loan will be given at 9 % interest. Of the interest, 4 percent will be borne by the borrowers and 5 % by the government.

The SME sector was hit hard by the ongoing monetary fallout than the large businesses.

SMEs usually make a sizable portion of profit before Eid-ul-Fitr and Eid-ul-Azha, the greatest religious festivals for Muslims. However they didn't do so within the last two festivals due to the pandemic.

"SMEs are yet to remove the crisis. Many SMEs are still feeling shy to take loans from banks," Huq said.

Occasionally, banks are also going for a cautious stance to disburse loans as a result of fragile health of the SMEs.

"We have to increase the loan disbursement to the SME sector no matter what in the greater interest of the economy," Huq said.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the central bank cannot avoid its responsibility as it is yet to notify the credit guarantee scheme for the SME sector.

Although the scheme has already been created by the central bank, it has yet not been introduced, he said.

On July 23, the central bank made a decision to introduce the Tk 2,000 crore scheme to provide coverage to the stimulus fund.

A credit guarantee scheme provides a third-party credit risk mitigation to lenders through the absorption of some of the lender's losses on the loans made to SMEs in case of default, typically in substitution for a fee.

The stimulus package for the SME sector ought to be raised to Tk 40,000 crore to Tk 50,000 crore given the quantity of the economy, said Mansur, also a former high official of the International Monetary Fund.

"We are a long way away from the target. The SMEs have already been damaged the most from the economical hardship," he said.

The quantity of cottage, micro, small and medium enterprises in Bangladesh is 7.76 million. Of these, 99.84 % are privately owned, said Abul Kasem Khan, chairperson of the Business Initiative Leading Development, throughout a webinar on September 30.

Of the total professional employment, 80 % are in the CMSMEs. The units take into account 35.5 % to 50 % of the full total employment in Bangladesh.

In comparison to large corporates, small firms have thin cash buffers, are more leveraged, and they rely mainly on short-term loans and retained earnings. From this "crisis like no other," smaller businesses face extreme cashflow shortfalls with few financing alternatives, according to Chang Yong Rhee, director of the Asia and Pacific Department of the IMF, and Kenneth Kang, a deputy director.

"Against the backdrop, the speedy implementation procedure for the stimulus package is very important," Mansur said.

As of September 30, banks disbursed Tk 1,869 crore among 87,526 borrowers beneath the Tk 5,000-crore stimulus package for the farming sector.

The banking regulator has issued a letter to banks asking them to increase the disbursement, another central bank official said.

The Tk 5,000-crore stimulus package in the sort of pre-shipment credit for the export sector made the worst start as only Tk 16.61 crore has up to now been disbursed.

Exporters usually avail the loans before shipping products to complete packaging.

The central bank initially asked banks to use to it for the loan within a week after shipping goods. But this is very impossible for the exporters, prompting the central bank to revise the provision last month.

As per the brand new condition, banks will now connect with the central bank for the loans within a week once they bankroll clients. The revised regulation can help clients get loans from the package smoothly, the central banker said.

Banks approved 44.43 per cent of the Tk 3,000 crore stimulus package for the low-income professionals, marginal farmers and micro-enterprises.

The disbursement from the package could have increased if state lenders had taken timely initiatives.

Seven state lenders didn't distribute any fund from the package, forcing the central bank to issue a show-cause notice on them on Thursday.

Source: https://www.thedailystar.net

Previous Story

- Goods trade data hints at recovery, albeit at ...

- Apparel leads export revival

- UK businesses finding more prospects for trade, investment...

- Indian onion trucks waiting to enter Bangladesh turn...

- Partnerships will drive the economy

- UK to aid Bangladesh economy

- UK to support Bangladesh economy

- Exporters pin big hopes on Bhutan