Bourse on downward trend

Image collected

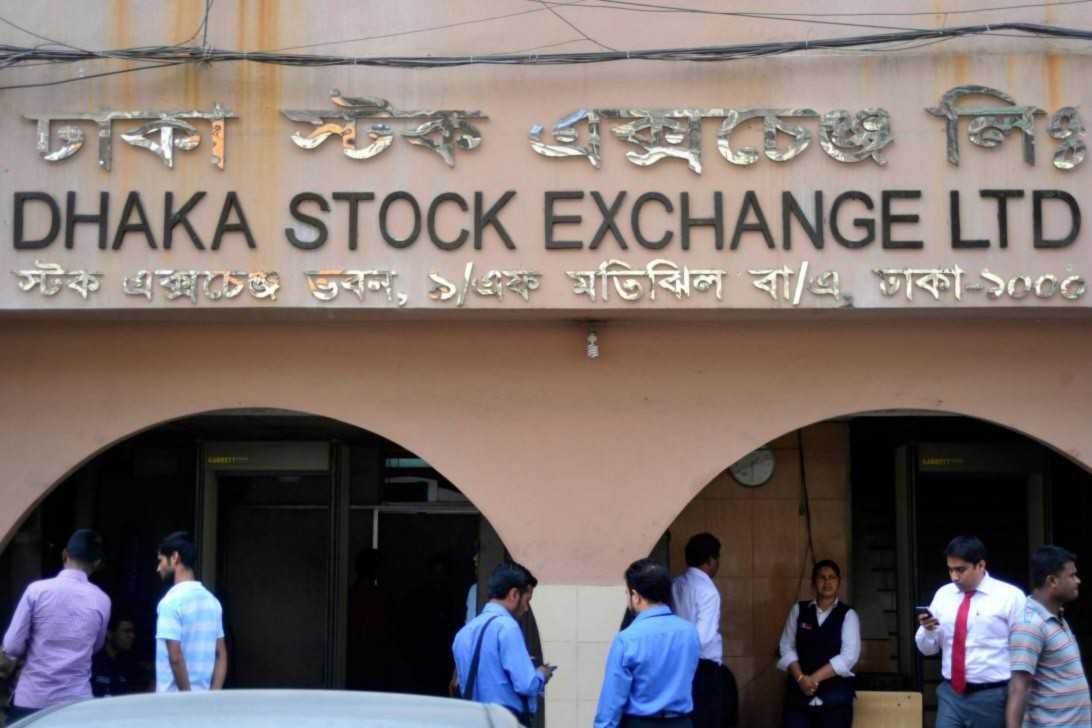

Investors involved in the country’s premier bourse, the Dhaka Stock Exchange (DSE) have reportedly lost Tk 31,349 crore. DSE index has slumped to a 33-month low since July 2. Market insiders tell us that a series of recent decisions by the regulator have failed to beef up DSE. In May, the central bank widened banks’ scope to invest in the stock market in an effort to stop it sliding further. It allowed for banks to invest in non-convertible bond, debenture, and open-ended mutual funds, none of which have capital market exposure.

When we look at the latest budget, the decision to double tax-free dividend up to Tk 50,000 for individuals had little effect. Of the 22 initiatives the regulator took in consultation with Bangladesh Securities Exchange Commission and stakeholders, there was a provision to raise quota for general investors to 50 percent, as opposed to 30 percent earlier. Unfortunately, none of these worked. Because the real causes remain unaddressed, viz. liquidity crisis, deteriorating financial health of banks, lack of good quality stocks in the market and the continued share manipulation in the bourse.

Both banks and non-banking financial institutions (NBFIs) are suffering from a liquidity crunch. Continuous rescheduling of bad loans has not helped matters. Investors are not interested in putting money on low-grade stocks and confidence cannot be restored unless reputed companies, local or otherwise, come to the market. There is also fear over the BTRC-telecom spat that has given the biggest stock a price hit and that also contributed to the slide in the index. It would be prudent to find a solution to this standoff as soon as possible.

On the question of lack of liquidity, there is no recourse to re-establishing good governance in the financial sector, an issue that we keep stressing upon but to little effect. The government has the ability to bring in good stocks to the market. For years, we have been hearing talk about offering shares of profit-making state-owned enterprises but that’s about it. As long as uncertainty exists, foreign investors will keep dumping stocks and pulling out. Restoring investors’ confidence will require policymakers taking some hard decisions on the state of the financial sector and clamping down on share manipulation.

Source: https://www.thedailystar.net

Tags :

Previous Story

- BSEC approves Standard Bank’s subordinated bond of Tk500cr

- Stocks dip to 33-month low despite Kamal’s meeting

- Stocks inch up ahead of Mustafa’s meeting with...

- BSEC approves 60 IPOs despite DSE’s reservations

- DSE yet to get benefits from strategic partner

- 4 major reasons acting behind liquidity crisis in...

- Stocks continue to bleed

- PLFS’s stock trading suspension continues