Canada: Expect Strong Growth As Tariff Bruises Are Yet To Show

Summary

- A widening trading relationship between the US and Canada would make a trilateral NAFTA appear off the cards.

- Implications for growth and the Bank of Canada.

By James Smith, Developed Markets Economist

A strong 3% Canadian growth figure on Thursday would indicate the actual impact of the global trade war so far has been fairly modest. But despite hints of NAFTA progress, trade tensions are likely to remain a major uncertainty in the second half of 2018.

So far at least, there are few signs that the uncertainty surrounding US trade policy is translating into slower Canadian growth. That's the story we're likely to get from Canada's 2Q GDP release on Thursday, where we expect a firm 3% annualised growth figure.

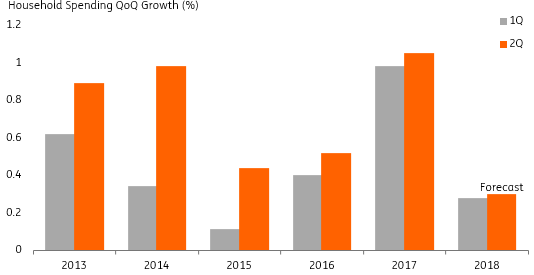

Investment and exports, particularly in the manufacturing sector, are likely to be key drivers as firms continue to benefit from strong overseas demand. This may be somewhat dampened by household spending, which took a hit from cold weather back in April, and is likely to be increasingly restrained by the combination of higher interest rates and tighter mortgage rules. Although 2Q growth in spending is still expected to be seen, albeit more moderated.

A widening trading relationship between the US and Canada would make a trilateral NAFTA appear off the cards

So, what next? Well, as the headlines over the past couple of days have shown, there's still a clear threat that tensions with the US on trade could escalate further. Following his agreement with Mexico, President Trump is putting pressure on Canada to get on board quickly and accept a deal or risk facing tariffs on all auto exports to the US.

Source: https://seekingalpha.com