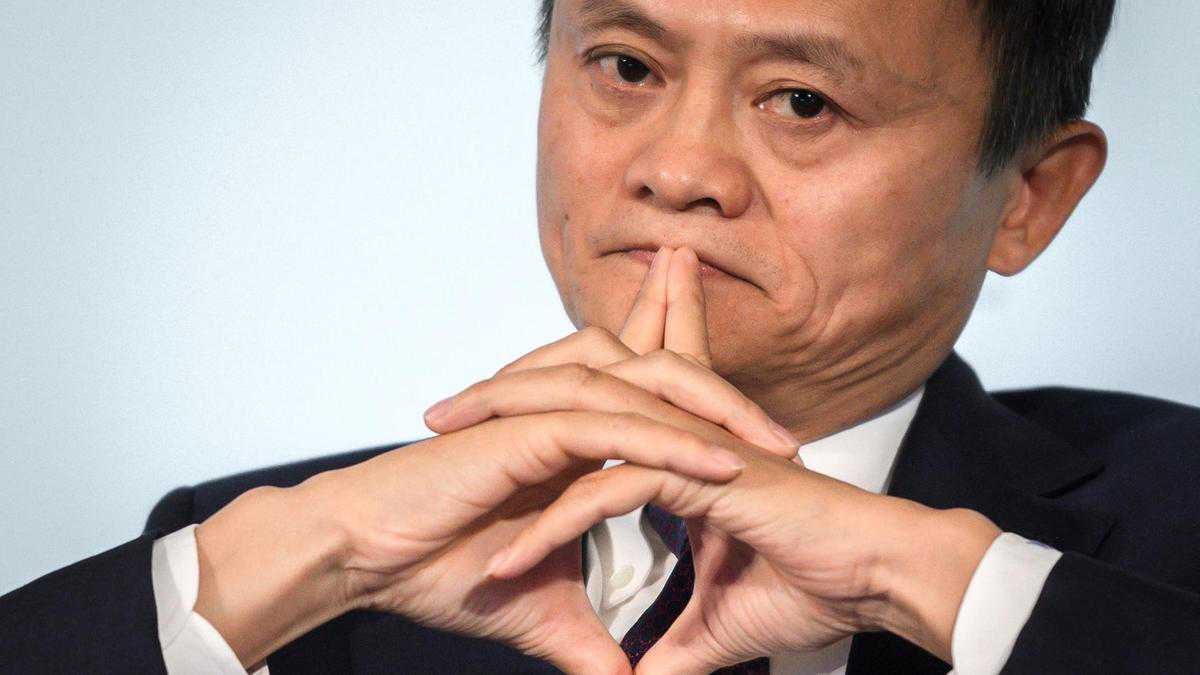

China begins monopoly investigation into Jack Ma’s Alibaba empire

Image: Collected

China kicked off an investigation into alleged monopolistic procedures at Alibaba and summoned affiliate marketer Ant Group to a good high-level meeting above financial regulations, escalating scrutiny above the twin pillars of billionaire Jack Ma’s net empire.

The Status Administration for Market Regulation is investigating Alibaba, the top antitrust watchdog said in a statement. Regulators, like the central lender and banking watchdog, will separately summon affiliate marketer Ant to a meeting designed to drive home significantly stringent personal regulations, which today pose a threat to the expansion of the world’s most significant online financial services organization. Ant said in a affirmation on its established WeChat account it'll study and adhere to all requirements.

Once hailed as motorists of monetary prosperity and symbols of the country’s technological prowess, Alibaba and rivals like Tencent face increasing pressure from regulators after amassing hundreds of millions of users and gaining impact over nearly every aspect of daily life in China.

Alibaba’s Hong Kong stock slid up to 7.7 % to a five-month intraday trough, while Tencent and internet offerings giant Meituan declined a lot more than 1 per cent. Shares in SoftBank, Alibaba’s major shareholder, erased benefits to trade just as much as 2.7 % lower in Tokyo.

Investors are divided above the extent to which Beijing might go after Alibaba - Asia’s largest corporation after Tencent - and its own compatriots seeing that Xi Jinping’s authorities prepares to roll out a good raft of new anti-monopoly regulations.

The country’s leaders have said little about how harshly they intend to clamp straight down or why they decided to act now. Draft rules released in November supply the government unusually wide latitude to rein in tech business owners like Mr Ma, who until recently enjoyed an unusual volume of freedom to extend their empires.

“It’s clearly an escalation of coordinated work to rein found in Jack Ma’s empire, which symbolised China’s new ‘too-big-to-fail’ entities,” said Dong Ximiao, a researcher at Zhongguancun Internet Financing Institute. “Chinese authorities wish to see a smaller, much less dominant and extra compliant firm.”

The flamboyant Alibaba co-founder has all but vanished from public view since Ant’s initial public offering got derailed.

The country’s internet ecosystem - much time protected from competition by famous brands Google and Facebook - is dominated by two companies, Alibaba and Tencent, through a labyrinthine network of investment that encompasses almost all the country’s start-ups in arenas from AI to digital finance. Their patronage in addition has groomed a new generation of titans including food and travelling giant Meituan and Didi Chuxing - China’s Uber. The ones that prosper outside their aura, the major being TikTok-owner ByteDance, are rare.

The anti-monopoly rules now threaten to upset that status quo with a variety of potential outcomes, from a benign scenario of fines to a break-up of industry leaders. Beijing’s various agencies now appear to be coordinating their efforts - a bad sign online sector.

The People’s Daily newspaper warned on Thursday that fighting alleged monopolies was now a high priority. “Anti-monopoly has become an urgent issue that concerns all issues,” it stated in a commentary coinciding with the probe’s announcement. “Wild growth” in markets should be curbed for legal reasons, it added.

In November, after Mr Ma famously attacked Chinese regulators in a open public address for lagging the changing times, market overseers subsequently suspended Ant’s IPO - the world’s greatest at $35 billion - while the anti-monopoly watchdog threw markets into a tailspin shortly after with its draft legislation.

The probabilities that Ant can revive its significant stock listing subsequent year want increasingly slim as China overhauls tips governing the FinTech industry, which in past years has boomed instead of traditional state-backed lending.

China is said to have separately create a joint task force to oversee Ant, led by the Financial Stability and Expansion Committee, a financial system regulator, along with various departments of the central lender and other regulators. The group is usually in regular connection with Ant to collect data and other elements, studying its restructuring as well as drafting other guidelines for the FinTech market.

“China has streamlined a lot of the bureaucracy, thus it’s easier for the various regulatory bodies to interact now,” said Mark Tanner, managing director of Shanghai-based consultancy China Skinny. “Of all regulatory hurdles, this can be the biggest by an extended shot.”

Source: https://www.thenationalnews.com

Previous Story

- How Bangladesh can benefit from China’s economic recovery

- What the brand new trade bloc opportunity for...

- China, Saudi, Turkey like to create international standard...

- Is Bangladesh stuck on the periphery of Asia...

- India must contend with Bangladesh initial before competing...

- Bangladesh among nations at bottom in greenfield FDI...

- Formulate well-coordinated roadmap to face Covid crisis: PM...

- Formally approached embassy for rail, road links between...