Chinese recovery slows down: Retail sales disappointment hits global markets

Image: Collected

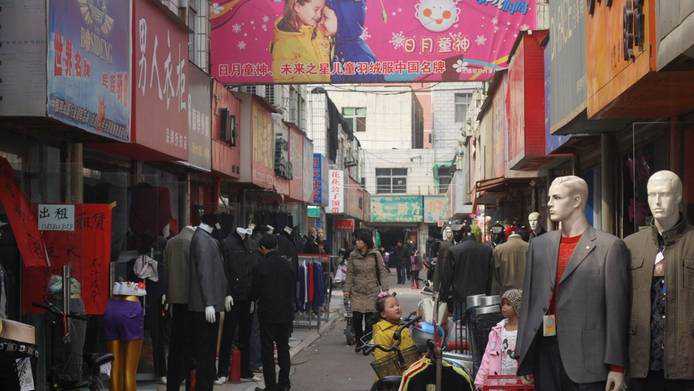

While still on the uptrend, China’s economy’s recovery slowed down in July. National retail sales in China grew 8.5 percent compared to a year ago, falling short of expectations and signaling a potential new dip as the Delta variant virus outbreak takes force.

Even if the Asian giant’s retail sales missed the consensus analysts’ forecast for July (11.4 percent growth) the numbers were still above 2019 levels, per Yahoo Finance data. Indeed, total sales of consumer goods in July were up by 7.2 percent compared to the same period two years ago.

In July, apparel sales in China grew by 7.5 percent, while jewellery sales improved by 14.3 percent. Online retail sales, which account for 23.6 percent of total retail sales, increased by 17.6 percent year-on-year. For the first seven months of the year, total sales increased 20.7 percent year-over-year.

Commenting the figures in a market note, ING Bank’s greater China chief economist Iris Pang, warned that “We see few positive factors for the economy, instead, we see more risk factors.” She detailed some of the most pressing threats to the Chinese economy’s recovery: “There have been more floods in China. The Delta COVID-19 variant is spreading in the Mainland, although the number of cases remains fewer than 200 per day. Strict social distancing measures have affected the ports in Ningbo and Shanghai, which are close to each other…Strict social distancing measures also limit people flows around the Mainland, which limits domestic leisure travel and spending during the summer holidays.”

China’s factory output and retail sales fell sharply in July

The impact of new coronavirus variants and extreme weather dented China’s factory output and retail sales growth earlier in the summer. As a result, those indicators fell sharply and missed expectations in July, hinting that the country’s economic recovery is stalling.

The Chinese industrial production increased 6.4 percent year-on-year in July, as shown by data from the National Bureau of Statistics. This increment missed analysts’ expectations for a 7.8 percent increase in July. Meanwhile, retail sales increased 8.5 percent year-on-year, again behind the estimated 11.5 percent rise.

Chinese economy’s slowdown drags stock trading worldwide

On a related note, online sales of physical consumer goods rose by 4.4 percent in July, far below an average of about 21 percent for the past five years, per CNBC’s calculations of official data. This acute dip was partially due to massive shopping promotions in June, which were followed by logistics disruptions amid Covid-19 travel restrictions, floods and typhoons in July, explained Bruce Pang, head of macro and strategy research at China Renaissance. Back in June, Alibaba and JD.com handled a record 136.51 billion dollars of combined sales during the major June 18 shopping event known as “618.”

On the back of China’s economic update, weaker stock trading worldwide highlight a growing unease in the market over slowing growth in the Asian country, the second largest world’s economy. “Asia’s low vaccination rates and low tolerance for community spread suggest it is the region most at risk economically from the Delta variant,” said to Reuters JPMorgan economist Bruce Kasman. He added that “China is in the midst of removing policy supports, which looks likely to restrain domestic demand growth and weigh on regional performance through the rest of this year. With these drags building in recent weeks we have been lowering 2H21 regional growth forecasts.”

Even if the Asian giant’s retail sales missed the consensus analysts’ forecast for July (11.4 percent growth) the numbers were still above 2019 levels, per Yahoo Finance data. Indeed, total sales of consumer goods in July were up by 7.2 percent compared to the same period two years ago.

In July, apparel sales in China grew by 7.5 percent, while jewellery sales improved by 14.3 percent. Online retail sales, which account for 23.6 percent of total retail sales, increased by 17.6 percent year-on-year. For the first seven months of the year, total sales increased 20.7 percent year-over-year.

Commenting the figures in a market note, ING Bank’s greater China chief economist Iris Pang, warned that “We see few positive factors for the economy, instead, we see more risk factors.” She detailed some of the most pressing threats to the Chinese economy’s recovery: “There have been more floods in China. The Delta COVID-19 variant is spreading in the Mainland, although the number of cases remains fewer than 200 per day. Strict social distancing measures have affected the ports in Ningbo and Shanghai, which are close to each other…Strict social distancing measures also limit people flows around the Mainland, which limits domestic leisure travel and spending during the summer holidays.”

China’s factory output and retail sales fell sharply in July

The impact of new coronavirus variants and extreme weather dented China’s factory output and retail sales growth earlier in the summer. As a result, those indicators fell sharply and missed expectations in July, hinting that the country’s economic recovery is stalling.

The Chinese industrial production increased 6.4 percent year-on-year in July, as shown by data from the National Bureau of Statistics. This increment missed analysts’ expectations for a 7.8 percent increase in July. Meanwhile, retail sales increased 8.5 percent year-on-year, again behind the estimated 11.5 percent rise.

Chinese economy’s slowdown drags stock trading worldwide

On a related note, online sales of physical consumer goods rose by 4.4 percent in July, far below an average of about 21 percent for the past five years, per CNBC’s calculations of official data. This acute dip was partially due to massive shopping promotions in June, which were followed by logistics disruptions amid Covid-19 travel restrictions, floods and typhoons in July, explained Bruce Pang, head of macro and strategy research at China Renaissance. Back in June, Alibaba and JD.com handled a record 136.51 billion dollars of combined sales during the major June 18 shopping event known as “618.”

On the back of China’s economic update, weaker stock trading worldwide highlight a growing unease in the market over slowing growth in the Asian country, the second largest world’s economy. “Asia’s low vaccination rates and low tolerance for community spread suggest it is the region most at risk economically from the Delta variant,” said to Reuters JPMorgan economist Bruce Kasman. He added that “China is in the midst of removing policy supports, which looks likely to restrain domestic demand growth and weigh on regional performance through the rest of this year. With these drags building in recent weeks we have been lowering 2H21 regional growth forecasts.”

Source: https://fashionunited.uk

Previous Story

- Chinese regulators meet with developer Evergrande as scrutiny...

- Hugo Boss aims to double sales to 4...

- Marcolin boosts presence in China with new subsidiary

- China's online regulator orders removal of 25 Didi...

- Syngenta looks to China's farmers for growth ahead...

- Seizing the opportunities of a circular economy in...

- Swiss Textile Machinery Companies Report Successful ITMA Asia...

- Cargill CEO says plant-based will 'cannibalize' protein business