Despite bleak real-estate industry, signs and symptoms of hope are building

Image: Collected

New York City’s pandemic-battered house world resembles a nerve-wracking “seesaw” of “flights and drops,” as Henry James wrote of his neurotic protagonist’s mood in “The Flip of the Screw.” With any luck, Gotham should come through in better form than James’ tragic heroine.

On the dark side, office towers hit a near-historic high vacancy amount of 15 percent, and continue to be 85 percent physically unoccupied. Investment product sales have grounded to a halt. The Partnership for New York City, in a new report, says that companies are so wanting to leave that claims including Florida, Texas, NEW YORK and Maryland “established aggressive programs to recruit talent and attract careers from New York . . . literally every New York employer has been courted.”

Retail’s a disaster and may worsen. Ominously, 90 percent of restaurants didn’t give their December rent, based on the New York City Hospitality Alliance - raising the chance that thousands extra dark eateries will soon swell the vacancy plague.

And yet . . . and yet. Indications of underlying balance and renewed strength are increasingly common. House sales are up, specifically in Brooklyn. Stimulated by decreased rents, more Manhattan local rental leases had been signed in December than for the month in a dozen years, regarding to Douglas Elliman and analyst Jonathan Miller - although vacant devices stay at a near all-time high.

Investment and residential revenue of $6 billion in January 2021 saw a good 38 percent jump above January 2020, the Real Estate Board of New York found - yielding the city and talk about $190 million found in badly needed transfer-tax earnings, 31 percent a lot more than in the previous January.

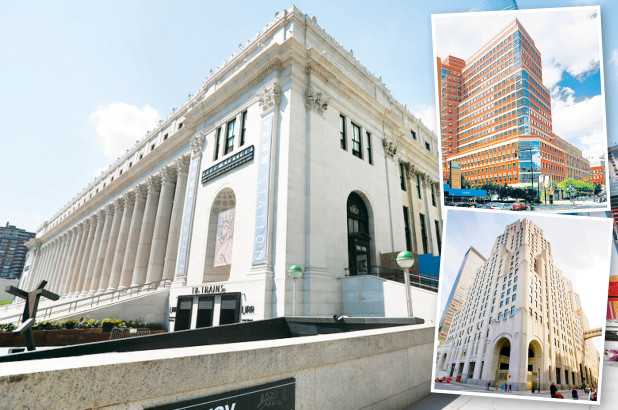

Downtown Brooklyn’s MetroTech has clocked renewals totaling 132,000 square feet since the start of fourth quarter of 2020. The signings - incorporating for SoulCycle and HeartShare Human being Services of New York - reflect the complex’s evolution under different owner Brookfield from usually a banking back-office right into a vacation spot for tenants as various as Slate and Wonder! Architecture and Design. MetroTech’s 5.5 million square feet are actually 91 percent leased.

Concrete evidence of total market stability also permeates Vornado Realty Trust’s just-released 10-K annual SEC filing for 2020 and its fourth-quarter earnings call the other day.

The giant programmer/landlord saw a net lack of $209 million for the quarter, weighed against net gain of $193 million the year before. But it’s typical of outcomes for publicly-traded REITS through the pandemic.

CEO Steve Roth noted in the call that Vornado closed on $1 billion of apartments at 220 Central Recreation area South - “a big amount which was put into our dollars balances and improved our financial durability.” His provider is spending a lot more than $1 billion to redevelop the Farley building - where Facebook signed the most significant office lease of 2020 at 750,000 square toes - and the Penn 1 office tower “off our balance sheet without debt.”

Vornado CFO Michael Franco said on the decision that even “with post-COVID leasing activity down dramatically, we still leased 2.2 million square feet and 54 separate leasing transactions in New York” in 2020.

Starting rents remained solid in $89.33 per square foot, and the common lease term was for 14.4 years, Franco said.

The entire year ended with Vornado’s Manhattan office occupancy at 93.4 percent. Despite anecdotal tales of widespread rent holdouts, Vornado collected 95 percent of owed rents in the fourth one fourth - 97 percent including hire deferrals from office tenants and 88 percent from retail tenants, based on the 10-K.

Meanwhile, SL Green, the city’s most significant commercial landlord with interests in 29 million sq . feet of offices, reported similar strength in its fourth-quarter benefits.

The REIT collected 97.9 percent of office rent and 80.8 percent of retail lease for the complete year of 2020.

Actually in a low-demand industry, SL Green properties found 464,000 square ft of bargains in the fourth one fourth and 1.25 million square feet for the full year. The most recent major dedication was Beam Suntory’s lease for 100,000 square toes at 11 Madison Ave., with a starting rent of around $90 per square ft ..

Beam Suntory will approach its US headquarters to New York from Chicago while keeping some space found in the Windy City - an indicator that companies still find value in getting here.

There might possibly be hope that workplace workers will go back to their desks this season. The broadly followed Kastle Back-to-Function Barometer reviews an uptick in physical office occupancy last week from 13.3 to 14.7 percent. The needle’s been stuck for months but could start to move with increased vaccinations and a renewed impression of public safety.

Source: https://nypost.com

Tags :

Previous Story

- JetBlue reveals new all-suite Mint cabins for flights...

- DRiViLL seeks ride-posting licence in Bangladesh

- How to Travel Car-Free With a Family

- NY State senators keen to boost investment in...

- US squares progressively Chinese tech firms

- The Future Of Travel: Hotel Game-Changers

- 8 Innovative Travel-Sized Beauty Essentials To Pack On...

- On the move: Why secondary cities aren't always...