Develop bond market to finance infrastructure projects: experts

Image collected

Bangladesh has to create a vibrant corporate bond market immediately if it wants to go to the next level of development, experts said yesterday.

Banks get deposits for short-term -- three months to 12 months -- but give loans for long-term, which is seven years or more. This is creating an asset-liability mismatch and liquidity crisis in the industry, they said.

The observations came at a roundtable organised by City Bank Capital Resources, a leading merchant bank, at the Pan Pacific Sonargaon hotel in Dhaka.

Ershad Hossain, chief executive officer of City Bank Capital, made a presentation on the current state of the bond market in Bangladesh and compared it with some other countries.

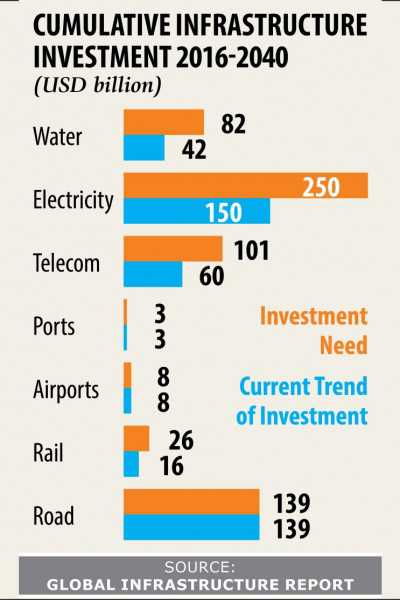

Bangladesh will need around $600 billion in investment only for infrastructure if it aspires to be a developed nation within 2041. But the current investment trend shows there will be a gap of about $200 billion, which can be raised by bonds, he said.

Hossain identified some bottlenecks -- lack of awareness among people, high issuance cost, no incentives, absence of a benchmark rate, lack of confidence on credit rating agencies, limited investor base, and poor knowledge of trustees -- behind the lacklustre bond market in the country.

Bangladesh’s bond market is dominated by the treasury bonds. The central bank data shows the government raised more than Tk 2 lakh crore by issuing bonds of different tenure.

On the other hand, the corporate bond market size is about Tk 25,000 crore, which is just 1 percent of Bangladesh’s GDP, Hossain said.

But the size of the corporate bond market in the US is nearly 150 percent of its GDP. It is 73 percent in South Korea, 60 percent in Thailand, 60 percent in Malaysia, and 16 percent in India.

Bangladesh will need huge amounts of funds to meet the government’s development target and banks will not be able to provide the sum, said Md Sirazul Islam, executive chairman of the Bangladesh Investment Development Authority.

“So, bonds could be one mechanism,” he said, adding that bonds can attract foreign direct investment and funds from non-resident Bangladeshis (NRBs).

Many NRBs are willing to participate in the development process of the country and they are always on the lookout for a sound channel for investment. “Bonds may be the way,” Islam said.

He went on to recommend forming a digital platform to make the bond market vibrant because it will reduce the cost of issuance.

“If we really want to meet the target of becoming a developed nation, we have to reduce regulations to facilitate the bond market,” he added.

Banks are facing liquidity pressure as they have a cash flow mismatch, said Mominul Islam, managing director and CEO of IPDC Finance.

The mismatch is the result of the banking sector’s long-term lending with short-term deposits, he said. “It’s the biggest risk for them.”

Non-bank financial institutions are also struggling because there is no vibrant bond market and they depend on banks for funds, Mominul said.

“So, steps should be taken immediately.”

Mominul recommended compliance-based bond issuance instead of approval-based as issuers need to take permission from the Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC) and it takes more than six months to get the consent.

However, Mohammad Rezaul Karim, a director of the BSEC, said if issuers submit application with all the required documents, they get approval within 15 days.

If they have no approval from the regulators, they will face problems in selling bonds because investors also want to see the permission, he said.

He said the central bank and the stock market regulator are working to make the bond market vibrant and reduce the cost of issuance.

The BSEC has approved the Alternative Trading Board and the Small-cap Board on the Dhaka Stock Exchange to facilitate the trading of bonds, Karim said.

AKM Abdullah, senior financial sector specialist of the World Bank, said they worked on the bond market and sought compliance-based bond issuance opportunity and the regulators nodded.

He said the government has formed three committees to make the bond market functional.

He said since banks are providing long-term loans, corporate houses are not interested in raising funds through bonds. “Banks will not do it willingly -- they should be forced,” he added.

Prashanta Kumar Banerjee, a director of the Bangladesh Institute of Bank Management, said all the related regulators should analyse the problems and solve them very fast because the economy needs the bond market.

“It is surprising to me how banks lend in the housing project for 20 years on the back of three years’ deposits,” he said.

Subhash Chandra Das, chief financial officer of Sonali Bank, said the bond issuance cost is too high and still bond investment is coming from banks only.

“We have to brighten our image at the international level,” he said.

Md Tabarak Hossain Bhuiyan, managing director and CEO of Prime Bank Investment, said the government would have to reduce regulatory barriers to promote the bond market.

“There is a potential for getting funds from NRBs through bonds, which will help the economy,” he added.

Abu Nur Rashed Ahmed, additional commissioner of the Customs Bond Commissionerate of Dhaka, said the money which is taxed but is not in the banking sector or in the stock market should be targeted for bonds.

Mohammed Shafiul Alam, deputy secretary of the financial institutions division, said: “The country’s stock market is going through turbulent times and the banking sector is suffering from non-performing loans, so we must be careful about the bond market.”

The government is working to make the bond market vibrant, so some policy support and good results are expected very soon, he added.

Sajjadur Rahman, business editor of The Daily Star, moderated the roundtable.

Source: https://www.thedailystar.net