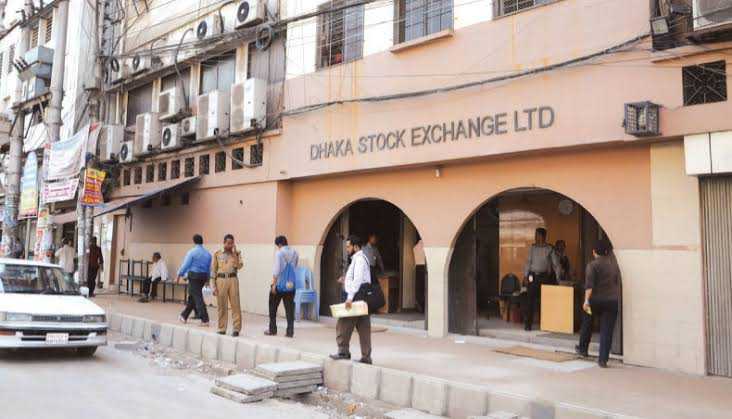

Dhaka stocks dip for second week

Image collected

Dhaka stocks inched down in the past week, stretching the losses to second week, as investors remained cautious following poor financial disclosures by major companies.

DSEX, the key index of Dhaka Stock Exchange, shed 0.08 per cent, or 3.70 points, over the week to close at 4,706.67 points on the last trading session of the week on Thursday, after losing 61.55 points in the previous week.

In the past week, a 30-point loss of DSEX on Wednesday alone eroded all marginal gains during four other sessions as many investors were confused over the movement in the market while some institutional investors continued to go for bargain hunting, market operators said.

They said that poor quarterly financial disclosures by many of the companies that had dragged down the index in the week before also affected the investors’ psyche in the past week, resulting in cautious trading.

Poor financial disclosures by major companies, including the state-run Investment Corporation of Bangladesh, ACI Limited, Shahjibazar Power Company, BSRM Steel, Titas Gas and Premier Cement, for the July-September period worried investors about their business prospects.

Share prices of most of the companies came down to lucrative levels that also provoked some opportunity hunters to make investment moves, they said.

Share prices of heavyweight Grameenphone soared by 7.2 per cent over the week as investors hoped that the tussle between the company and the telecom regulator over an audit claim might be settled soon.

Some institutional investors were also injecting funds to restore confidence of retail investors, who dominated the capital market.

Most of the investors, however, remained edgy in the aftermath of 10 straight months of market doldrums that had wiped off significant amounts of investor funds.

Market experts said that the confidence and trust of the investors would gradually be regained if the regulators could unite to eradicate the loopholes and lapses.

EBL Securities, in its weekly market commentary, said, ‘The negative earnings declaration outnumbered the positive earnings declaration; so, index did not move in a positive direction despite increased investors’ participation.’

The ailing capital market had been struggling with issues like the volatility of the financial sector, poor corporate governance, lack of regulatory measures to improve the state of the market and approvals of weak initial public offerings.

Share prices of telecommunication, life insurance, general insurance and non-bank financial institution sectors advanced by 7.2 per cent, 4.5 per cent, 3.0 per cent and 1.8 per cent respectively.

Share prices of food, energy and bank sectors dropped by 1.6 per cent, 1.1 per cent and 0.9 per cent respectively.

Out of 355 companies whose shares were traded in the past week, prices of 172 advanced, 148 declined and 35 remained unchanged.

The daily average turnover on the DSE increased to Tk 396.29 crore over the past week from Tk 349.54 crore in the week before.

DS30, the blue-chip index of the DSE, however, gained 0.76 per cent, or 12.39 points, to close at 1,650.63 points.

Shariah index of the bourse, DSES, also saw addition of 0.08 per cent, or 0.85 points, in the past week to close at 1,081.77 points.

National Tubes led the turnover chart for the third consecutive week with shares worth Tk 78.39 crore traded during the week.

Grameenphone, Sonar Bangla Insurance, Beacon Pharmaceuticals, Asia Insurance Company, WATA Chemicals, Bangladesh Submarine Cable Company, Square Pharmaceuticals and Stylecraft and National Polymer Industries were the other leaders of the turnover charts.

BD Autocars performed the best during the week with a 38.92-per cent increase in its share price while Far East Knitting performed the worst, losing 22.76 per cent.

Source: http://www.newagebd.net

Tags :

Previous Story

- Nine companies relegated to ‘Z’ category

- Stocks inch up for 2nd day on recovery...

- Dhaka stocks maintain upbeat

- Premier Cement takes up Tk 1,300cr expansion despite...

- Dhaka stocks inch up after 3-day fall

- Stocks back to red zone on poor reports

- Income of numerous material cos down: 10 downsized...

- Treasury bond trading on DSE to be activated...