Dhaka stocks kept afloat amid regulatory intervention

Dhaka stocks gained slightly on Wednesday after a plunge in the previous day as some institutional investors including Investment Corporation of Bangladesh bought shares to revive the investors’ confidence shattered by the relentless fall at the market in recent months.

DSEX, the key index of Dhaka Stock Exchange, increased by 0.19 per cent, or 10.49 points, to close at 5,259.41 points on Wednesday after losing 76 points in the previous session. After an early-trading surge, the market began to fall sharply before finishing in the positive territory amid regulatory intervention, market operators said.

They also said that some institutional investors continued buying shares to revive the market sentiment and state-run ICB contributed most to the move. ICB officials said that ICB had been trying to keep the market afloat, but it alone could not make that happen. ICB managing director Kazi Sanaul Hoq on Wednesday met Bangladesh Securities and Exchange Commission chairman M Khairul Hossain and discussed the market situation.

The average share prices of general insurance sector gained 3.36 per cent, bank 0.37 per cent, telecommunication 0.33 per cent and pharmaceutical 0.28 per cent. Some of the low-profile and non-performing companies including Standard Ceramics, Jute Spinners, Fine Foods, Savar Refractories and Imam Button soared at the bearish market.

National Board of Revenue chairman Mosharraf Hossain Bhuiyan on Tuesday clarified that taxpayer identification number would not be required to open beneficiary owners’ account for investment in the capital market. Market operators said the clarification might ease the investors’ nerve as a rumour in this connection had made investors worried.

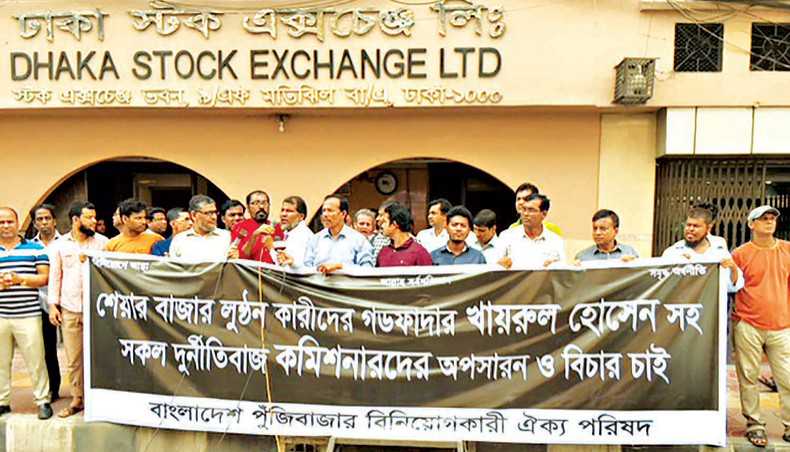

Despite the positive ending on Wednesday, the bearish sentiment remained as investors felt that the rise was ‘engineered’, they said. Some affected investors on Wednesday staged demonstration in front of the DSE building at Motijheel in the capital against the continuous fall in share prices and ‘index engineering’.

They also sought the prime minister Sheikh Hasina’s intervention in the issue and demanded immediate resignation of BSEC chief Khairul due to his failure in his 8-year tenure to revive investors’ trust and confidence over the market. On Tuesday, investors took to the streets with the same demands. The downward trend resulted in a 700-point decline in last three and a half months.

Market experts said that investors lost their trust in the regulator as it continuously failed to address manipulation and wrongdoings and introduce new products, and it approved ‘filthy’ IPOs with huge amount of placement shares. The average share prices of energy, non-bank financial institution and food sectors dropped by 1.95 per cent, 0.74 per cent and 0.51 per cent respectively.

The volatility at the market began with the liquidity shortage in the financial sector, which was worsened by the Grameenphone’s tussle with the telecom regulator over Tk 12,500 crore in dues. EBL Securities in its daily market commentary said, ‘Mixed sentiment among investors regarding the capital market outlook following the earnings declaration from the listed companies has been creating indecisiveness.’

‘The market opened with a positive vibe but within an hour shaky investors started to sell off and finally active presence of the opportunist investors who opted to take fresh position in the later part of the session eventually helped the market close at marginally higher,’ it said. Of the 345 issues traded at DSE on Wednesday, 127 declined, 160 advanced and 58 remained unchanged.

The turnover on the bourse increased to Tk 314 crore on Wednesday from that of Tk 269.91 crore in the previous trading session.

DSE blue-chip index DS30 also added 0.19 per cent, or 3.69 points, to close at 1,880.50 points. Shariah index DSES gained 0.38 per cent, or 4.67 points, to finish at 1,217.03 points. Bangladesh Submarine Cable Company led the chart of turnover leaders with its shares worth Tk 26.10 crore changing hands on the day.

United Power Generation Company, Monno Ceramic Industries, Fortune Shoes, Sonar Bangla Insurance, Shurwid Investors, Monno Jute Stafflers, SK Trims Industries, Alif Industries and BBS Cables were the other turnover leaders. Standard Ceramic Industries gained the most on the day with a 9.97-per cent increase in its share prices while Monno Ceramic Industries was the worst loser, shedding 8.29 per cent.

Source: http://www.newagebd.net

Tags :

Previous Story

- Stocks return to negative zone as investors resume...

- Stocks gain for 2nd day as bargain hunting...

- Colombo and Dhaka Stock Exchanges accelerate collaborative efforts

- Dhaka stocks hit 3-month low as sell-offs resume

- CSE and GRI to host a forum on...

- Dhaka stocks fall again amid lacklustre trading

- BSEC to amend private placement, book building method...

- Market in distress amid jump in share sales...