DSE mulls e-disclosure system for cos’ PSI

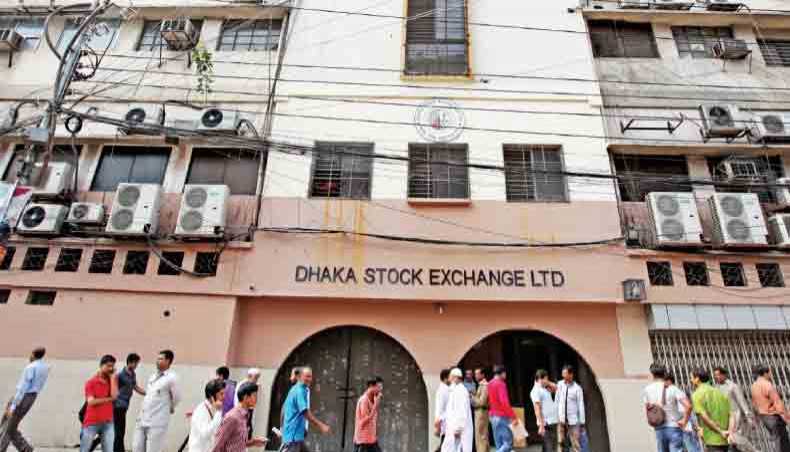

The Dhaka Stock Exchange is mulling over allowing the listed companies to publish price sensitive information directly on the bourse’s web site through eXtensible Business Reporting Language-based electronic disclosure system to check delay in publishing PSI by the firms.

XBRL is a global framework for exchanging business information, such as a financial statement. The system provides a complete electronic solution from corporate disclosure to fair speedy information access for investors.

All the companies will be linked with the DSE software and the companies pass the PSI directly to the web site without any intervention, DSE officials said.

The DSE board of directors has agreed in principle to run the system so that the companies can easily make their PSI public on their own responsibility, they said.

The bourse intends to run the system with support from its strategic partner of a Chinese consortium of Shenzhen and Shanghai stock exchanges as the system requires huge amount of money and efficient professionals, they said. The Chinese group joins the DSE board on Tuesday.

The consortium pledged to provide $37 million worth of technological supports to the bourse and the Shenzhen Stock Exchange has long-time experience of running XBRL system, DSE officials said.

However, there is no indication that the group alone would bear the expenditures for installing any technical system. The consortium said that it would provide consultancy and training services worth of $37 million, according to the book of share purchase agreement between the DSE and the Chinese consortium.

DSE officials said that listed companies often delayed providing PSI to the stock exchanges on the pretext of delay in postal services and procedures in the companies.

According to the DSE listing regulations, any listed company must disclose its price sensitive information within 30 minutes of making the decision on such information to the exchange and the Bangladesh Securities and Exchange Commission.

Once the new system is introduced, the company would not be able to show any excuse in regard to providing PSI on time.

Besides, the bourse also often makes delay in publishing the PSI provided by the companies. Therefore, the initiative is expected to resolve the problem from both sides.

DSE officials, however, said the bourse would have to face problems regarding what should be published and what should not as PSI covers a wide range of corporate information.

Any information and decision that the issuers of securities are obliged to disclose according to Bangladesh Securities and Exchange Commission Rules 1995 and have potentiality to have their impacts on share prices are called price sensitive information.

Currently, the DSE scrutinises PSI the companies provide to the bourse and publish applicable ones on its web site. The bourse is likely to limit PSI disclosures by the firms to some extent as there would be no intervention of the bourse in publishing PSI by the companies under the new system.

The bourse is trying to prevent asymmetrical access by people to unpublished information of any listed company, which when published would impact the price of securities in the market.

There is definitely a need for all listed entities to ensure its own control on PSI, DSE officials said.

Source: http://www.newagebd.net