Economy to blast off again from Oct: IMF

Image collected

There appears to be glimmer of light towards the end of the tunnel following the International Monetary Fund yesterday projected that the Bangladesh economy would grab from the next quarter of next fiscal year from the coronavirus-induced downturn.

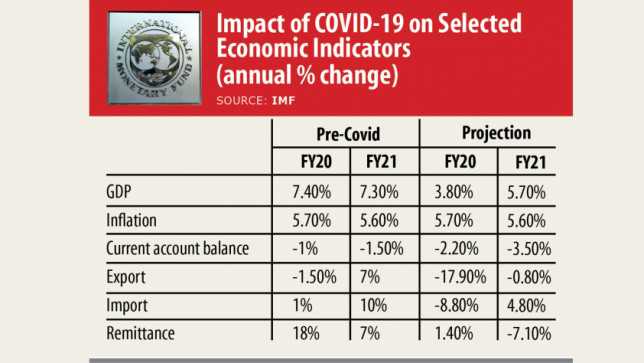

The Washington-based multilateral lender agency, however, said the country's GDP growth would stand at 3.8 per cent this fiscal year against the previous projection of 7.4 % as the coronavirus pandemic has severely damaged the economy.

This means, growth is projected to decline by about 4.50 percentage points fiscal 2018-19, in what would be the largest one-year decline within the last three decades.

Growth next fiscal year will be 5.7 %.

The organisation disclosed the projection in a written report, which includes prepared for the approval of $732 million in emergency funding to the country under its credit facility and the rapid financing instrument.

The credit support was approved on, may 29 to be able to mitigate the balance of payment crisis as a result of the ongoing economic recession.

A great number of stimulus packages amounting to close to Tk 100,000 crore taken by both the government and the central bank can help the economy to rebound.

In addition, the government reopened the economy on May 31.

CPI inflation 's been around the Bangladesh Bank (BB) target of 5.5 %, with increases in non-food inflation offset by a decline in food inflation.

Despite signs of disruptions in the domestic food supply chain, overall inflation is projected to remain broadly unchanged, owing partly to a bumper harvest in the agriculture sector.

But the IMF has also mentioned some downside risks for the economy in the days ahead.

"External risks add a prolonged COVID-19 outbreak that could delay and slow down recovery in exports and remittance inflows."

Oversupply in the oil market could continue steadily to slow down monetary activity in the centre East countries, which are the main resources of remittance for Bangladesh.

Remittance had soared 20 % in the first eight months of the fiscal year but have started to decline from March. In May, inflows dropped off 14 per cent year-on-year to $1.50 billion.

Some Bangladeshi diaspora employees have elected to come back, while those that remain are likely to experience job losses amid a stall in monetary activity.

After a modest decline in the first three quarters of fiscal 2019-20, exports in April contracted 83 per cent year-on-year.

COVID-19 has heavily afflicted the garment sector, with reports of more than $3 billion in orders already cancelled, resulting in many factories to turn off.

Around 3.5 million Bangladeshis work in the garment sector and about one million staff have reportedly been laid off.

A more substantial outbreak of COVID-19 may need longer containment measures by the authorities, that could increase social discontent, further weaken domestic demand, and disrupt the lives of Bangladeshi people, the IMF warned.

The multilateral lender has suggested the central bank to strengthen its monitoring on the banking sector through the ongoing pandemic.

The already-weak banking sector could face further challenges in maintaining its asset quality and providing necessary support to the private sector due to the ongoing economic fallout.

Controlling stressed assets of the banking sector will be imperative with banks bearing the entire credit risk for the stimulus package routed through banks.

Effective supervision by the Bangladesh Bank needs to continue while strengthening the organization governance of commercial banks.

Loans beneath the stimulus package ought to be effectively targeted and monitored by the authorities with necessary homework and risk assessment considerations by banks to preserve banking soundness while providing support where most needed.

Banks can be encouraged to undertake prudent re-negotiations for loans which may have deteriorated due to the shock.

But loan reporting, classification and provisioning standards shouldn't be eased.

Before the pandemic, towards the end of 2019, reported default loans approached 9 %, with state-owned commercial banks' classified loans reaching 24 %.

The authorities have already started amending several laws to enforce more discipline, but repeated loan rescheduling, regulatory forbearance and failure to deal with weak and insolvent banks hindered progress.

To strengthen the banking sector, the authorities should give attention to introducing effective and risk-based supervision and steer clear of regulatory forbearance.

An archive Tk 50,186 crore was rescheduled this past year, often by breaching banking norms, yet defaulted loans hit Tk 94,313 crore at the end of 2019, up 0.42 % year-on-year, according to data from the central bank.

In the event of further deterioration of the monetary situation or declining inflation, the BB could consider further cuts in the repurchase agreement rate or ease liquidity through decrease in the money reserve ratio (CRR).

Since March, the central bank has recently slashed Repo and CRR rates in times to 5.25 per cent and 4 per cent respectively since March to tackle the ongoing pandemic.

The central bank should continue steadily to gradually permit more exchange rate flexibility, which would help buffer the economy against external shocks and preserve the amount of reserves.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Biggest Storm in twenty years Spurs South Asia...

- 8.5pc GDP growth set for fiscal 2020-21 on...

- ADB now forecasts economic losses of $13.3 billion

- Making SMEs more vigorous and vibrant

- Nimble-footed Reserve Bank of India shows Bangladesh Bank...

- China’s economy to rebound in Q2, hopes IMF...

- GDP growth to plunge to 33-year low this...

- Navigating the socioeconomic perils of Covid-19 in Bangladesh