Electronic scrap processors see profits, despite decline in precious metals

The consumer electronics market was valued at $1 trillion in 2020 and is expected to grow by a compound annual growth rate of 8 percent between 2021 and 2027, according to a report done by Global Market Insights, a market research and management consulting company based in Selbyville, Delaware.

According to Global Markets, a few things are driving this growth. This includes the proliferation of smartphones, growing demand for technology-integrated televisions and advancements in headphones and audio equipment.

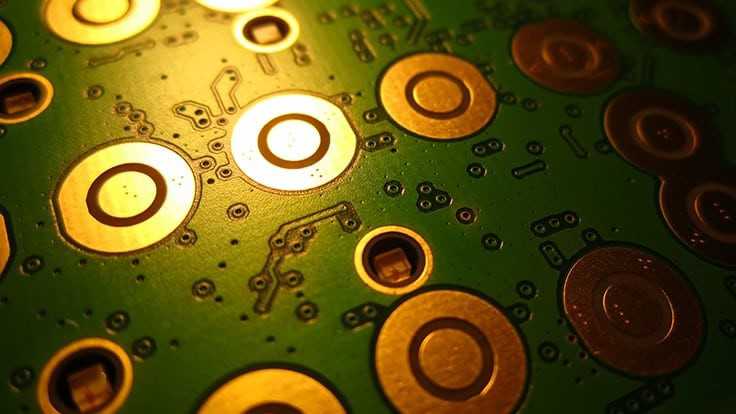

As the market grows, original equipment manufacturers (OEMs) continue to find more ways to increase production while making their devices smaller and lighter. Manufacturers also are looking at ways to make their production more cost-effective. The main way OEMs have done this is by making circuit boards lighter and by removing the volume of precious metals (PMs) they use during production.

“Technology has gotten more sophisticated and need for precious metals has been reduced,” says Walter Alcorn, the Consumer Technology Association vice president for environmental affairs and industry sustainability. “Manufacturers have come up with new technologies that don’t rely as much on precious metals like electronics used to.”

An increase in value

While this might seem like a bad thing for electronics recyclers, processors like Dave Farrow, director of trading at Dynamic Lifecycle Innovations Inc., an electronics recycler based in Onalaska, Wisconsin, say the market has seen a boost and is now more profitable than the last 10 years.

“The use in precious metals has been declining for a long time,” says Craig Boswell, the president of Hobi International, a mobile, information technology and data center asset management provider based in Batavia, Illinois. “However, because prices for precious metals have been steadily increasing, it offsets the loss in the amount we harvest from electronic devices.”

According to data taken from Goldline, a precious metals dealer based in Los Angeles, prices for precious metals such as gold, silver and palladium have increased. Right now, the spot price for gold is $1,783.07 per troy ounce, silver is being sold at $26.20 per troy ounce and palladium is being sold at $2,646.32 per troy ounce. While the prices fluctuate, Farrow says these are the highest prices precious metals have sold for in 10 years.

Another factor driving recycler’s profitability is the increased focus on end-of-life electronics. According to the United Nations University’s “Global E-waste Monitor 2020,” around 50 million metric tons of electronic products are discarded globally every year. In 2021, that amount is estimated to increase to 52.2 million metric tons.

According to the Environmental Protection Agency, every million cellphones recycled yields 35,000pounds of copper, 772 pounds of silver, 75 pounds of gold and 33 pounds of palladium.

“Everybody has their opinions of the market, but it seems like there’s strong worldwide demand” for the precious metals recovered from e-scrap, Farrow says. “As long as that demand is there, prices will be more elevated than they have been in the last 10 years, and that’s where we’re at now.”

Obstacles and innovations in recycling

While recycling PMs has proven to be profitable, recyclers say the addition of lithium-ion batteries has made recycling costlier. Because of the risk of fires caused by shredding these batteries, recyclers have taken the extra step of separating them by hand before processing the electronics, Farrow says.

“It’s one of the biggest issues facing the industry because a lot of electronics contain lithium batteries. You can’t just throw them into a shredder,” he says. “It is costlier because it’s a change in the material stream, and you have to make sure you’re charging the right value for when that material is coming in. It consumes a lot more effort when taking them apart.”

Farrow says the decrease in PMs and increase in batteries has made companies examine how they recycle in an effort to increase profits. Things like making improvements to the extraction process to make it more cost-effective and improving how materials are acquired and transported have helped increase profitability.

“For the industry to be viable, there has to be a return,” he says. “The consumer does not want to pay for recycling, so it drives companies in this industry to be innovative. You have to be constantly remaking yourself. How can we extract in different ways economically? How do we improve the management of our supply chain?”

John Shegerian, the co-founder and CEO of ERI, which is headquartered in Fresno, California, says innovation and investment also help companies stay ahead of the curve and maximize PM extraction. By creating direct partnerships with smelters, Shegerian says his company was able to maximize profitability.

While innovation and investment play an important role in maximizing profits in the industry, Farrow says the most important thing contributing to a recycler’s profits is knowing the precious metals market and what has increased in value.