Elon Musk Makes $82 Billion Gambit to Silence Tesla Critics

The wild tweet hit Wall Street at precisely 12:48 p.m. Tuesday -- and things just keep getting wilder.

Seemingly out of the blue, Elon Musk proclaimed that he might pull his money-losing Tesla Inc. off the market. Taking the electric-car company private at the price he touted would amount to an $82 billion valuation, a monumental sum that left many investors wondering: Is this a joke?

It wasn’t.

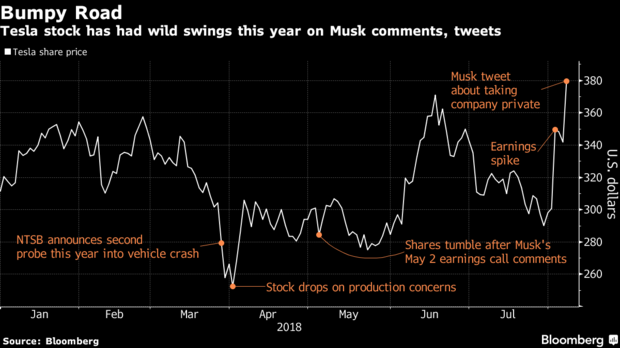

Musk, the enfant terrible of Tesla and SpaceX, has defied the odds before. But Tuesday’s gambit -- unleashed in tweet after tweet over the next 2 hours and 40 minutes -- opened a new chapter in one of the most tempestuous business stories of our time.

Even fans seemed unsure whether Musk could pull this off -- or, if he does, where that will leave Tesla. Only a week ago, the company with a seemingly unshakable base of firm believers and equally fierce legion of detractors recorded another huge loss after burning through hundreds of millions of dollars.

‘Better Environment’

Indeed, Musk’s initial tweet, sent roughly half an hour after news emerged that Saudi Arabia’s sovereign wealth fund had built a stake in Tesla worth about $2 billion, was the latest in a series of unusual maneuvers that have thrust the executive into the public spotlight.

He’s made no secret that he has little patience for his naysayers. In a May conference call, the CEO blithely said that if investors were concerned about the volatility of Tesla’s stock, they shouldn’t own the shares.

“The reason for doing this is all about creating the environment for Tesla to operate best,” Musk, 47, wrote Tuesday in an email to employees. He said wild swings in the carmaker’s stock price are a “major distraction” to Tesla workers, who are all shareholders. And he said that being public “puts enormous pressure on Tesla to make decisions that may be right for a given quarter, but not necessarily right for the long-term.”

To take Tesla private, Musk would have to pull off the largest leveraged buyout in history, surpassing Texas electric utility TXU’s in 2007. And Tesla doesn’t fit the typical profile of a company that can raise tens of billions of dollars of debt to fund such a deal.

The carmaker has lost money on an operating basis every year since going public and has been burning through billions of dollars amid the struggle to iron out production issues with its Model 3 sedan. Neither Musk’s tweets nor his blog post make mention of how the company would pay for it.

Tesla surged 11 percent Monday on the plan, closing at $379.57, or about 10 percent below the $420 a share Musk said he’d pay to take the company private, highlighting the doubts traders have about his ability to pull the deal off. The stock declined 0.6 percent at 10:58 a.m. on Frankfurt’s Tradegate before the U.S. market open.

Source: https://www.bloomberg.com