Gas-starved Bangladesh, one of the fastest-growing LNG markets in Asia

Image: Collected

ICIS is expanding its LNG demand forecast to rising markets in South Asia and the center East. The most recent addition is Bangladesh.

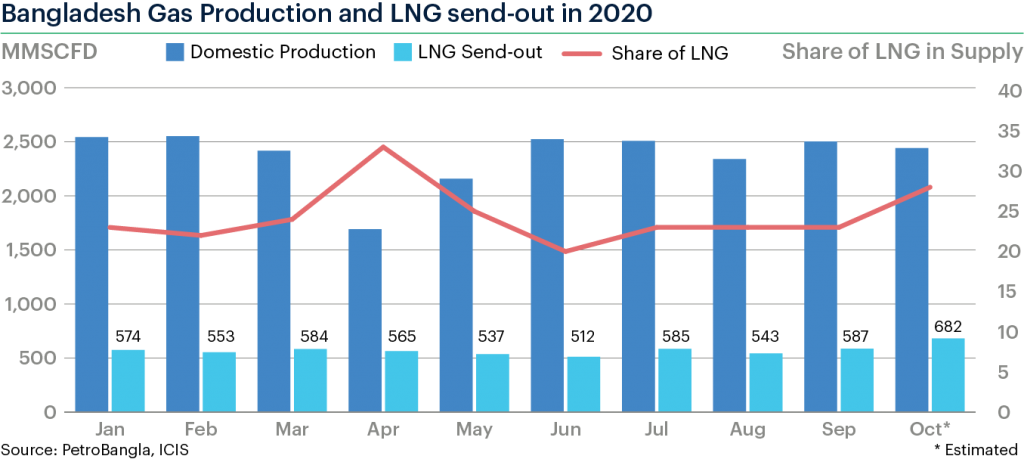

A new-comer to the LNG market, Bangladesh added 7.5mtpa in import capacity between August 2018 and April 2019. It rose fast to be the next biggest growth market in Asia in 2019, second and then China, absorbing near 4m tonnes in its first year as LNG importer.

The country is currently getting into its second stage of LNG imports, taking its first spot cargo in September and likely to take two additional cargoes every month from December 2020.

With domestic gas production getting into decline in the coming years, Bangladesh is likely to continue steadily to increase LNG imports to cover supply shortages amid rising gas demand.

The government is also putting the brakes on plans to build coal-fired power plants and calling instead for LNG-based projects. The 800MW Rupsha Combined Cycle Power Plant is definitely the first to be built on the basis of LNG imports, with several other projects in the offing. ICIS expects coal to create a small dent in gas-to-power demand in the fiscal year ending 30 June 2021, but with gas-fired generation time for a rising path in subsequent years.

There is also significant latent demand in the market and fertilizer, with ICIS projecting LNG imports to permit double-digit percentage growth in these sectors.

Bangladesh has the eighth major population and is the most densely populated country on the globe. Its fast-growing economy can be shifting from agriculture to manufacturing and services, with energy security a focal point in the government’s ambition to sustain growth.

Longer-term, the united states is planning to double its LNG import capacity with a 7.5mtpa onshore terminal, though progress was unclear during writing.

Source: https://www.icis.com

Tags :

Previous Story

- 'Bangladesh needs to address the widening monetary gap...

- Why building financial bridges in the neighbourhood matters

- Bangladesh’s growth stems from political stability

- Asian Economies Set to Dominate 7% Growth Club...

- Economy key to ease Indo-Pak ties: South Asian...

- Juniper Networks to bring comprehensive digital security system...

- Govt conducts 5G trial run

- Stronger investment in children sought