How coronavirus burst California’s tourism bubble

Image collected

California’s tourism bubble possesses burst, an monetary victim of the coronavirus outbreak.

It’s hard to chat about commerce when the main element issue is the largely unidentified scope and impact of a killer virus. But when financial market segments are tanking, because they did again on Monday, and travelling is normally slowing to a crawl, the monetary fallout seems fair game.

Look at what’s at stake: A globe’s value of folks arrive to California for pleasure and do the job. The rush created amazing and outsized business opportunities in and around tourism, a business that was hammered by the fantastic Recession.

Tourism, both statewide and globally, made an instant and good rebound from the financial debacle of the past due 2000s. Industry insiders and analysts as well certainly didn’t see the new consumer fervor for travel “encounters” coming. Also overlooked by the gurus was a good revival in business travel, corporate expenditures once regarded as a dinosaur at risk in today's age of communications.

This gorgeous tourism turnabout flooded the industry with opportunities that were met with income: Billions were allocated to from new hotels and theme park expansions to a big hiring spree. People that had been impatient bought their way in, most notably with an acquisition wave that pushed hotel values to record heights.

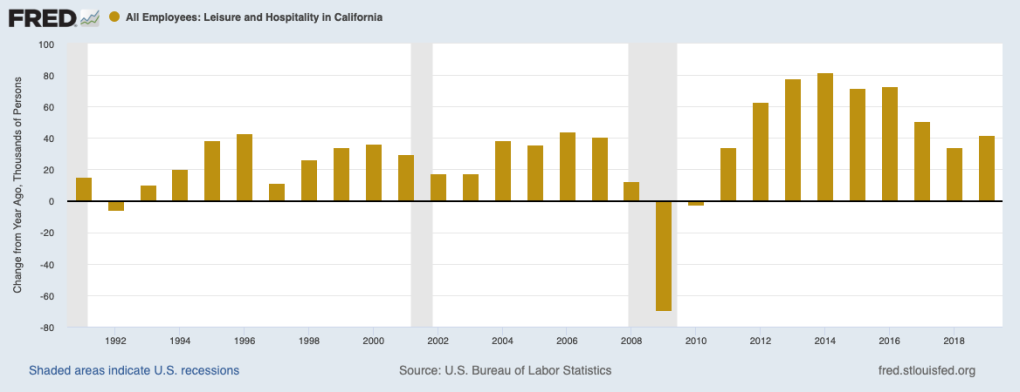

But tourism have been cooling, not crashing, prior to anyone knew of a novel virus quietly stirring on China. For example, selecting in California leisure and hospitality businesses possesses been halved in the past two years. Disneyland’s billion-dollar gamble on a Superstar Wars attraction wasn’t exactly achieved with a rabid response. And hotel buyers have pulled again on property acquisitions.

But today, most of tourism’s sizzle is fully gone. The U.S. federal government has basically warned individuals in order to avoid most non-essential travel.

Trade shows, like a massive foodstuff conference set for Anaheim the other day, have already been “postponed.” Events, such as a tennis tournament placed for the Coachella Valley this week, have already been canceled. Cruises? Dead.

And this can be the norm for the foreseeable future.

Big bucks

It results in a huge monetary blow as the travelling business has become a lot more than just dollars in the tourism traps.

I’m rarely a supporter of industry made “economic impact” reports, since the self-defined math often overstates the clout. Still, the VisitCalifornia trade group’s latest analysis, for 2018, gives us a glimpse into what kind of dollars are in being lost statewide.

The industry’s big number is California’s “total direct travel spending,” a tally of all cash tourists spend within the state. In 2018, it was $140.6 billion, up 42% in eight years.

Tourism looks mostly modest by this math, as California’s non-inflation adjusted gross domestic production, a key way of measuring total business creation, rose 50% found in the same period to $3 trillion.

But then, look at careers. Tourism employed 1.16 million Californians in 2018 when you accumulate a variety of work directly associated with tourism. That was up 32% in 2010-18. Do a comparison of that hiring with 20% job growth in all California industries.

Ponder this task boom in this manner: Tourism added 281,000 jobs in eight years as California work grew by 2.9 million. That’s almost 10% of most statewide hires for an industry that employs significantly less than 7% of most California workers.

And remember tourism’s awkward issue: It doesn’t pay such as a boom organization. The common annualized pay of all California leisure and hospitality employees (a government work grouping bigger than tourism) was $36,700 at year-end 2018, approximately half the normal statewide wage.

Now, if that amount of tourism spending in risk doesn’t cause you to gulp enough, economically speaking, here’s what VisitCalifornia detailed simply because “secondary impacts.” The re-spending of travel industry funds by businesses and workers - some 795,000 extra Californians.

Hotel hotness

Nowhere in tourism did the boom transformation thinking more than in the hotel organization as building and purchasing took off.

Between 2017 and 2019, California resort owners added 29,000 new areas, according to Atlas Hospitality. In the previous seven years? Just 23,000.

Those that bought, not built, acquired 297 California accommodations worth $6 billion this past year, Atlas reported. Now that’s straight down by one-third, in offers and dollars spent, from the 2014-15 peak. But 2019 was triple the buying tempo of 2010.

This building and buying binge looks poorly timed today. The Dow Jones index of hotel-owning property trusts shows these stock rates slashed by one-third previously month.

Alan Reay, Atlas’ president, says we’ll now find which operators had sound business plans that may withstand turmoil and which ones had no bedroom for error. Yes, Reay says there are several panic responses heading on. But serious business has been lost.

Reay mentioned that a single 300-bedroom Orange County resort was initially overbooked the other day. When the food expo was postponed, simply 16 rooms were payed for.

Reay says many businesses beyond tourism will you need to be sitting down on unexpected inventory in this economic disruption, goods they can later offer. In tourism, “after the day is over, that business is fully gone forever,” he said.

Taxing proposition

Roughly 60% of California tourism comes from people that live either somewhere else in the country or internationally, according to VisitCalifornia. So even if consumers or corporations continue to travel and leisure locally - and the collapse of global crude oil prices should make gasoline finally much cheaper - statewide tourism losses will be significant.

And if all this tourism tumult isn’t even economical wallop, the industry’s tumble won’t just hit the sector, its workers and those folks loosely linked with it.

Let’s remember statewide tourism-related tax selections for state and municipality, mainly because calculated by VisitCalifornia. Tourism corporations, employees and tourists paid everything from income taxes to sales taxes to hotel levies totaling $11.8 billion in 2018. That was up 42% in eight years

Source: https://www.mercurynews.com