How might the global monetary downturn have an impact on the Bangladesh economy?

Image collected

The Covid-19 pandemic has caused unprecedented monetary loss, that was more extreme in the first half of 2020 than was earlier anticipated. The International Monetary Fund (IMF) World Economic Outlook Revise (June 2020) offers projected negative global growth of an increased magnitude (-4.9 percent) in 2020. This is because of several factors. First, there's been a significant downturn in GDP development, particularly in the second quarter of 2020, specifically in the advanced economies (-8 percent), the oil-exporting countries such as for example Saudi Arabia (-6.8 percent), and the Middle East (-4.7 percent). China will grow at 1 percent simply, while India's expansion will contract by 4.5 percent. In 2021, great global growth is projected, nonetheless it it's still below the 2019 level.

Consumption and services have also declined sharply because of declines in output (20-25 percent), with customer expenditure declining by around one-third, in line with the Organisation for Economic Co-operation and Creation (OECD) in June 2020. Moreover, the pandemic has induced huge unemployment-around 305 million full-time jobs over the world-with the youth and girls being even more disproportionately affected.

According to the Globe Trade Organisation (WTO), global trade might experience considerable undesirable growth (-13 percent) as a result of pandemic, that will donate to the projected undesirable global growth aswell. Finally, prices of virtually all commodities have declined sharply, especially crude oil rates, declining by 50 percent, from USD 60 per barrel of oil in October to December 2019, to USD 30 per barrel of oil in May 2020.

How will this affect Bangladesh? Bangladesh's GDP expansion, which has averaged around 8 percent in the past few years, possesses been disrupted by the outbreak of Covid-19. The incidence of poverty has also raised, and over two million persons could be put into the ranks of the poor in 2020. The reported number of unemployed people now ranges from 10 million to 15 million, in comparison to 2.7 million in 2017.

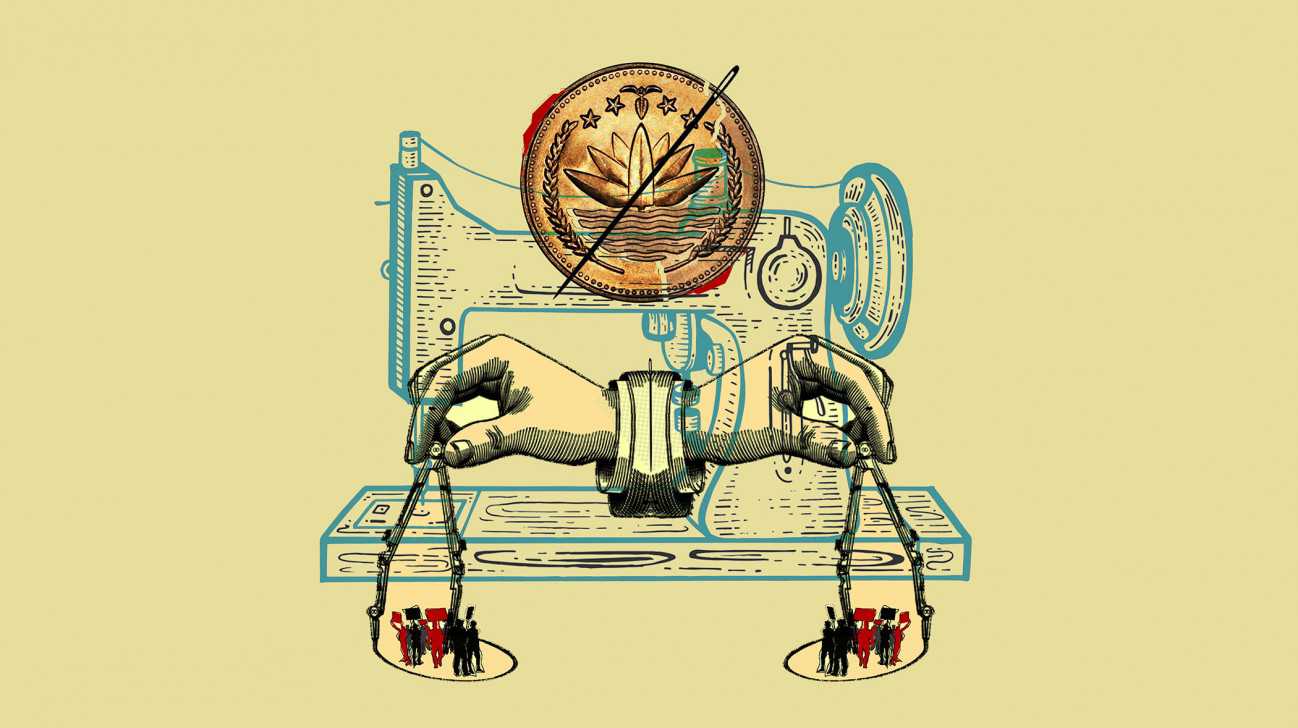

Economic growth on Bangladesh, until the start of the pandemic, has been helped largely by four key drivers of growth-export earnings, especially from the ready-built garments (RMG) industry, remittances directed by migrant workers, growth on the agricultural sector, and expansion on cottage, micro, little and moderate enterprises (CMSMEs). The primary two are largely influenced by external elements, although domestic factors may also play their part.

The RMG sector may be the biggest source of foreign currency earnings for Bangladesh. Manufacture and export of RMG makes up about 13 percent of the GDP, and employs around four million people. Alongside the knitwear sector, it contributed over 84 percent of total export earnings over the last financial season. Because of the global recession, growing trade tensions between your US and China and decline in oil rates, overall exports, including that of RMG items, have been declining. Total export earnings and export earnings from the RMG sector amounted to USD 30.18 billion and USD 25.71 billion respectively during July 2019 to Can 2020, which is 18 percent and 19 percent lower, respectively, compared to the same period during previous financial year.

The industry has been facing a extreme crisis, with mass cancellations of orders (around USD 3 billion), a virtual freeze on home based business, delayed shipments, and heavy reliance on import of fibres and other recycleables from China. Due to this fact, about one-quarter of the full total number of factories happen to be struggling to deal or survive, resulting in enormous unemployment (around two million), a projected decline in exports from March to May 2020 of around USD 5 billion and unsettled liability around USD 2 billion.

In the face of these challenges, the federal government has undertaken several measures to protect the sector. On the other hand, it is fairly unlikely that the sector should be able to create at its pre-pandemic levels within the next six months roughly. More critically, regardless if it does, will it be able to export at or near to the pre-pandemic level to the important countries of export- USA, UK, europe, India, Japan, Canada, Australia and China-which are hard hit by the global economical downturn and so are experiencing enormous unemployment and the resultant decline in usage? Under such unfavourable circumstances, it could not be reasonable to expect our exports will rebound to its pre-pandemic level and even close to it within the next six weeks or so.

Around 12 million Bangladeshis work overseas, including around 800,000 women. Annually, around 0.5 million look for jobs outside. Over time, there's been considerable increase in the volume of twelve-monthly remittance. The remittance, the next biggest income source for Bangladesh, offers helped the market by boosting foreign exchange reserves. It offers helped to lessen poverty at the national, household and individual levels as well.

Bangladesh received USD 18.20 billion remittances in the fiscal year (FY) of 2019-20, in comparison to USD 16.42 billion in FY 2018-19. However, because of the outbreak of the pandemic in significant places for Bangladeshi migrant employees (Middle Eastern countries, USA, UK, Malaysia and Singapore) and the drastic fall in global crude oil rates affecting the Middle East countries, progress in remittances will quite likely decelerate. The pandemic is pressing our migrant workers into unimaginable vulnerabilities. Thousands of workers have been completely repaid to Bangladesh. To handle the challenge of the returnee migrants, the government has undertaken more than a few measures to protect them.

The greatest challenge will be for countries, where Bangladeshi migrant staff were in employment prior to the pandemic, to regenerate their economies to the pre-pandemic level. It really is remarkably unlikely that, given reduced economic activity, the cost of crude oil will rebound to its pre-pandemic level later on. It isn't clear how prolonged it would have for such economies to rebound with their usual economic actions and build demand for migrant employees. Thus, until such period, the migrant workers will have to wait to receive jobs overseas.

Given the adverse influences of the global economic downturn on our export revenue and inward remittances, our foreign currency earnings are highly apt to be reduced, which can make it difficult for Bangladesh to achieve its desired degree of economic growth.

Source: https://www.thedailystar.net