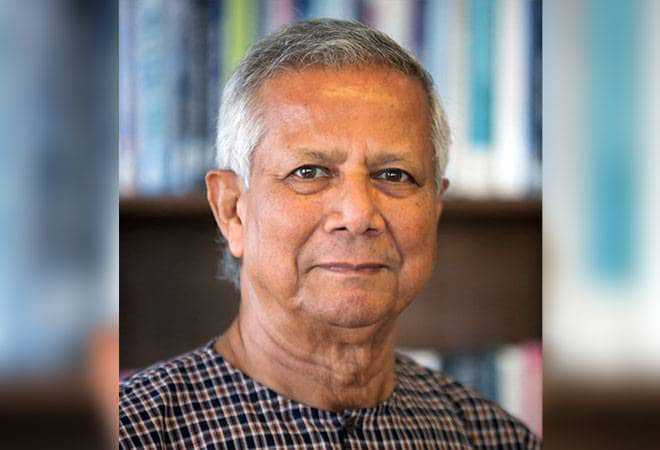

India's slowdown due to uncertainty, says Nobel laureate Muhammad Yunus

Image collected

Nobel laureate Muhammad Yunus, the founder of world's pioneering microfinance network Grameen Bank in Bangladesh, says India's economic slowdown could be due to uncertainty. "When there is uncertainty, people are reluctant to invest," says Yunus in an interview to Business Today. Besides, India's vulnerability to economic slowdown could be due to its economic inequality, according to Yunus.

"I don't know what is happening in India, but theoretically, when there is uncertainty people are reluctant to invest. Or, (if) some policy changes (are) coming, people wait to see. That's where it (slowdown in economy) happens. When people are not taking decisions, they will not invest and they will not take advantage of things that are happening. It happens when investment decisions are limited to the hands of such a few people," he says.

But, what uncertainty? Reminded about the huge mandate with a vast majority in the past 2 General Elections in 2014 and 2019, Yunus says there need not be a direct correlation between political certainty and investors' uncertainty.

Perhaps, the investor community is reading it differently. "You are seeing stability; maybe they are seeing some problem. I don't know. The business people have to (decide) how to play their cards. They are hesitant, that is the only way you can explain. Maybe they are waiting for a much better opportunity tomorrow. They see a time coming, where they are given these privileges, and they jump in," he says.

At the same time, Indians at the bottom of the pyramid may not be feeling the pinch of economic slowdown as much as those on the top, Yunus says. "For the people at the bottom, they couldn't care less. They are busy with their own things. Even when the 2008 collapse happened, everything was closing down, everything (was) falling, collapsing, and people were asking about what is happening to microcredit. I said this is flourishing," he points out.

Yunus preferred entrepreneurship over self-employment as a means to trigger growth. "Self-employment is still an employment. You didn't get a job, so you are doing it yourself. But if you say I am not interested in a job, I am an entrepreneur; I do things I want to do. You belong to a completely new category. The moment you see it, there will be growth".

According to Yunus, on what needs to be done next is purely a textbook exercise. "I am not an expert on that. The textbook thing will say come back; build confidence in people, those kinds of things. It will say bring back what is missing".

Yunus, who is in Delhi to participate in the 20th annual meeting of Sa-Dhan, the association of Indian microfinance enterprises, says Bangladesh's economic resilience is based on the transformation that happened at the bottom of the country (economy). "One reason is micro-credit, its deep penetration. Every single poor family gets micro-credit in Bangladesh. So, imagine, India having a similar situation. Every poor family who is considered as below poverty line is connected with micro-credit. The second is the (economic empowerment of) women (through micro-credit), they completely transformed the society. The third is the amount of remittance money that is flowing in. It is about $28 billion. Every year it is a massive amount coming in, and it is not coming to the rich. This transforms families. And it gives a tremendous boost to consumption, investments etc", he says. The growth of the garment industry and technology advancement in agriculture also helped Bangladesh economy in a big way, he added.

Source: https://www.businesstoday.in

Tags :

Previous Story

- Oil prices surge, stock futures slip after Saudi...

- Stocks rise for 3rd day amid Kamal’s brainstorming...

- Apple iPhone 11 has this one unexpectedly surprising...

- Stocks inch up ahead of Mustafa’s meeting with...

- Redmi K20 Pro review- Still the Pro in...

- Who’s listening?

- Bangladesh witnesses unrest in Ready Made Garments sector

- Mercedes, BMW in talks to open assembling plants...