JP Morgan sues Tesla for $162m citing contract breach

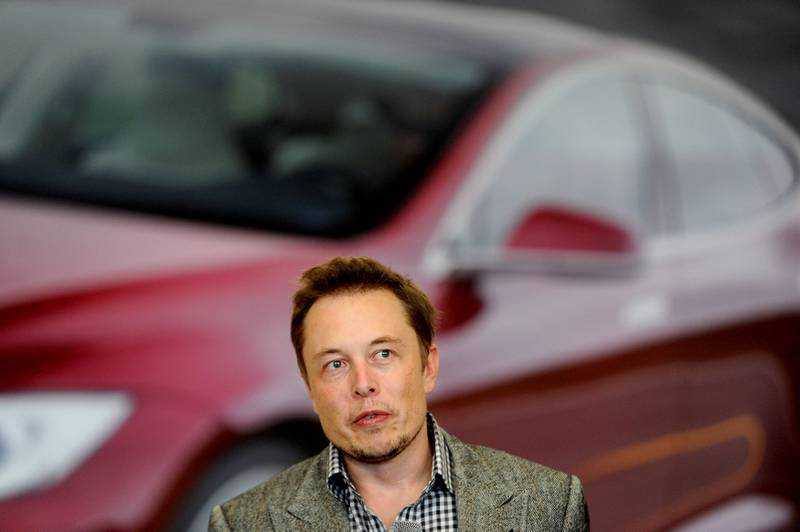

JP Morgan has sued Tesla for $162.2 million, accusing Elon Musk's electric car company of "flagrantly" breaching a contract the two corporate giants agreed in 2014 relating to warrants Tesla sold to the bank.

Warrants give the holder the right to buy a company's stock at a set "strike" price and date. The suit, filed in a Manhattan federal court, centres on a dispute over how JP Morgan re-priced its Tesla warrants as a result of Mr Musk's notorious 2018 tweet that he was considering taking the car maker private.

It is unusual for a major Wall Street bank to sue such a high-profile client, although JP Morgan has done relatively little business with the electric car maker over the past seven years, according to Tesla's filings and Refinitiv data.

"We have provided Tesla multiple opportunities to fulfill its contractual obligations, so it is unfortunate that they have forced this issue into litigation," JPMorgan said in a statement. Tesla did not respond to requests for comment.

According to the complaint, Tesla in 2014 sold warrants to JP Morgan that would pay off if their "strike" price was below Tesla's share price when the warrants expired in June and July 2021.

JP Morgan said the warrants contained standard provisions that allowed it to adjust their price to protect both parties against the economic effects of "significant corporate transactions involving Tesla", such as an announcement the company was going private.

Mr Musk's August 7, 2018 tweet that he might take Tesla private at $420 per share and had "funding secured", and his subsequent announcement 17 days later that he was abandoning the plan, created significant volatility in the share price, the bank said. On both occasions, JP Morgan adjusted the strike price "to maintain the same fair market value" as before.

Tesla's share price rose by about 10-fold by the time the warrants expired this year, and JP Morgan said this required Tesla under its contract to hand over shares of its stock or cash. The bank said Tesla's failure to do that amounted to a default.

"Though JP Morgan's adjustments were appropriate and contractually required," the complaint said, "Tesla has flagrantly ignored its clear contractual obligation to pay JP Morgan in full," the bank said.

Tesla in February 2019 complained that the bank's adjustments were "an opportunistic attempt to take advantage of changes in volatility in Tesla's stock", but did not challenge the underlying calculations, JP Morgan said.

Mr Musk's tweets resulted in the US Securities and Exchange Commission bringing civil charges and $20 million fines against both him and Tesla.

Previous Story

- Emirates Development Bank teams up with National Bank...

- ECB member says inflation could be nearing the...

- India central bank chief gets 3-year term amid...

- FII: SoftBank investing in blockchain assets but steers...

- HSBC's third-quarter profit surges 76% as outlook improves

- Investcorp introduces investment management service for insurers

- Saudi National Bank’s third-quarter profit jumps 20% on...

- GFH to buy 100% of Khaleeji Commercial Bank...