Looking towards better external sector management

Image: Collected

A trade deficit might not exactly be too undesirable even amidst the coronavirus issues when you have a healthy forex reserve, strong remittance inflow, foreign direct purchase, and aid flow. Moreover, when capital machinery or professional raw materials import may be the cause of this feasible trade deficit.

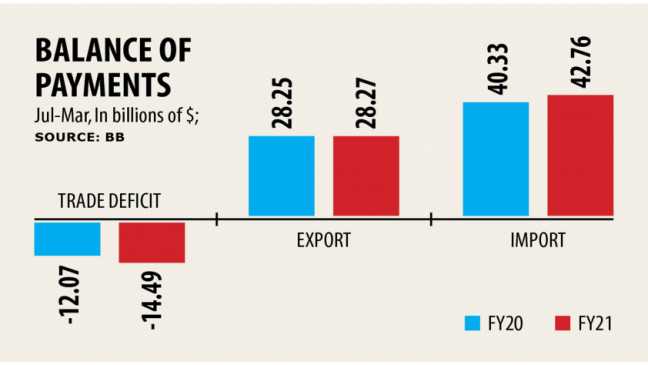

Bangladesh's trade deficit widened by 20.02 % in the first nine months of the current fiscal year as import obligations rose. But export revenue stagnated, which can often be being displayed as the sluggish overall economy by the conventional approach in economics.

The deficit stood at $14.49 billion through the July-March period of the 2021 fiscal year, up by $12.07 billion from the same period a year ago.

Bangladesh Bank info showed imports rose by 6.04 per cent to $42.76 billion in the July-March period, from $40.33 billion in the same period previous fiscal year.

Alternatively, exports rose by only 0.06 % to $28.27 billion in the nine-month period from $28.25 billion in the same amount of the previous fiscal year.

The exports and imports have already been declining noticeably since this past year. However, the overall economy started to get over the lacklustre situation designed by the deadly virus since December, which probably provides been reflected in the import expansion.

However, a lot of things rely upon how deep the onslaught of the next wave in our external trade is definitely. If we can not control the infection amount of Covid-19, chances are to be a major concern for future years of the country's trade and market.

It's been mostly construed that the foreign traders would not be more comfortable with investment if Bangladesh does not manage the ongoing coronavirus situation.

The existing account surplus stood at $125 million, that was a $2.65 billion deficit in the same period within the last fiscal year. The surplus number was $1.36 billion just a month ago.

Net foreign immediate investment (FDI) dropped 7.96 per cent during the period.

Bangladesh received $948 million net FDI in the first nine a few months of the outgoing fiscal season, straight down from $1.03 billion a year earlier, central bank info showed.

Economists across the developing world are also talking of healthy imports to create higher exports in the future. With our number 2 posture in the global clothing trade and good inward remittance, I don't think we have much to worry about, provided our coverage support to the nationwide exports remains despite some noises occasionally, and people are encouraged to choose further investments.

However, FDI and foreign aid disbursement rely upon how Bangladesh positions itself among the global investment community and how many quality open public fascination or export facilitation assignments we are able to put up on the table convincingly for the development companions.

While talking of export facilitation, economists were, therefore, focusing on import liberalisation too, to be able to garner support for an improved trade regime. While the Bangladesh Investment Production Authority (Bida) is quite focused on bringing in positive changes to our conducting business index, we also need to go for further liberalisation of the international trade and foreign exchange policy regime.

The interesting part is Covid-19 has put most of the countries on earth in financial doldrums, forcing them to invest or divert extra public money for the general public interest and putting the reforms agenda in the backyard, at least temporarily. Hence, any focused function in this way will ensure greater results in the future.

Bangladesh's trade deficit widened by 20.02 % in the first nine months of the current fiscal year as import obligations rose. But export revenue stagnated, which can often be being displayed as the sluggish overall economy by the conventional approach in economics.

The deficit stood at $14.49 billion through the July-March period of the 2021 fiscal year, up by $12.07 billion from the same period a year ago.

Bangladesh Bank info showed imports rose by 6.04 per cent to $42.76 billion in the July-March period, from $40.33 billion in the same period previous fiscal year.

Alternatively, exports rose by only 0.06 % to $28.27 billion in the nine-month period from $28.25 billion in the same amount of the previous fiscal year.

The exports and imports have already been declining noticeably since this past year. However, the overall economy started to get over the lacklustre situation designed by the deadly virus since December, which probably provides been reflected in the import expansion.

However, a lot of things rely upon how deep the onslaught of the next wave in our external trade is definitely. If we can not control the infection amount of Covid-19, chances are to be a major concern for future years of the country's trade and market.

It's been mostly construed that the foreign traders would not be more comfortable with investment if Bangladesh does not manage the ongoing coronavirus situation.

The existing account surplus stood at $125 million, that was a $2.65 billion deficit in the same period within the last fiscal year. The surplus number was $1.36 billion just a month ago.

Net foreign immediate investment (FDI) dropped 7.96 per cent during the period.

Bangladesh received $948 million net FDI in the first nine a few months of the outgoing fiscal season, straight down from $1.03 billion a year earlier, central bank info showed.

Economists across the developing world are also talking of healthy imports to create higher exports in the future. With our number 2 posture in the global clothing trade and good inward remittance, I don't think we have much to worry about, provided our coverage support to the nationwide exports remains despite some noises occasionally, and people are encouraged to choose further investments.

However, FDI and foreign aid disbursement rely upon how Bangladesh positions itself among the global investment community and how many quality open public fascination or export facilitation assignments we are able to put up on the table convincingly for the development companions.

While talking of export facilitation, economists were, therefore, focusing on import liberalisation too, to be able to garner support for an improved trade regime. While the Bangladesh Investment Production Authority (Bida) is quite focused on bringing in positive changes to our conducting business index, we also need to go for further liberalisation of the international trade and foreign exchange policy regime.

The interesting part is Covid-19 has put most of the countries on earth in financial doldrums, forcing them to invest or divert extra public money for the general public interest and putting the reforms agenda in the backyard, at least temporarily. Hence, any focused function in this way will ensure greater results in the future.

Source: https://www.thedailystar.net

Previous Story

- Surgical equipment makers in South Asia search for...

- Blow for Bangladesh's feminine crab farmers due to...

- Merchandise export earnings in August up 4.32%: EPB

- How three financial impacts of Covid-19 could spell...

- Bangladesh features some readymade lessons for India

- Exports slump by 17pc, hit five-year lower in...

- Bangladesh plans to revive jute sector in PPP....

- Supply chain to greatly help revive battered economy