Moody’s sees minimal affect of China virus outbreak about Bangladesh growth

Image collected

Global rating agency Moody’s Investors Service on Tuesday reported that the impact of China’s economic slowdown because of the coronavirus outbreak in Bangladesh economic growth will be minimal.

But, it warned that the source chain disruption because of virus outbreak would have a substantial repercussion for intra-regional trade in Asia Pacific incorporating Bangladesh.

Moody’s in its most up-to-date report titled ‘Sovereigns-Asia Pacific: regional growth revise following coronavirus outbreak’ retained the gross domestic product expansion projection for Bangladesh in 7.8 per cent for the existing fiscal year 2019-2020.

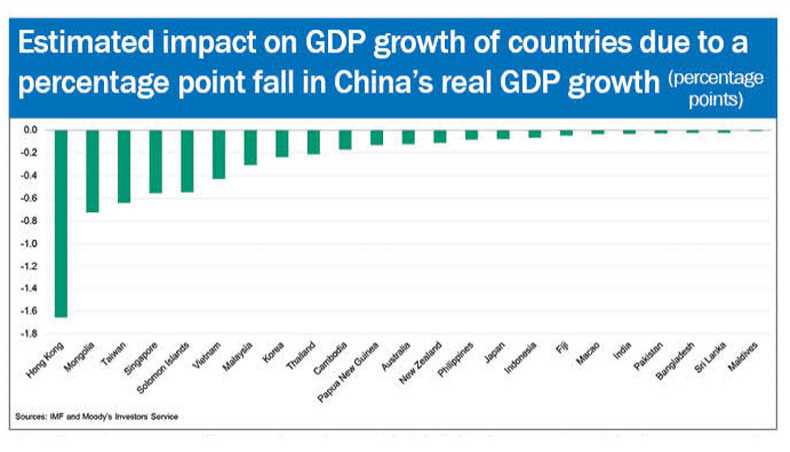

It showed that Bangladesh’s monetary expansion would decline by incredibly insignificantly, significantly less than 0.1 percentage items, if the GDP growth of China fell by 1 percentage points due to the coronavirus outbreak.

The primary reason for insignificant effect on Bangladesh is lower exports from the country to China.

Hong Kong would face the highest impact as its economy would shrink by more than 1.6 percentage points.

Taiwan, Singapore and Vietnam market will also face a substantial negative effect, said the report.

Moody’s showed supplying chain disruption could have significant repercussions for intra-regional trade seeing that Bangladesh imports more than 30 % of its products from China.

Bangladeshi businesses, including readymade garment exporters who bring raw materials from China for generating goods for export market, have already been expressing their concern about getting their raw materials in time because of the outbreak.

Import from China has recently witnessed a substantial drop in recent times following the outbreak.

Some companies are also looking for alternative markets for sourcing recycleables fearing the prolonged outbreak would affect their export.

Chinese ambassador to Bangladesh Li Jiming, however, within the last few days assured the business enterprise community many times that his country would overcome the problem and the disruption was temporary.

The Moody’s report said that the outbreak would cause disruption in regional monetary activity in the first quarter and growth across countries in Asia Pacific would slow to varying degrees, reliant on economic contact with China.

Prolonged outbreak would trigger significant second-round effects, including extreme supply chain disruption, that said.

‘We assume that the economical impression of the coronavirus outbreak will end up being largely limited by Q1 if the outbreak grew to pandemic proportions and lasted almost a year into the calendar year, downside risks to the global economy would be more severe and amplified beyond China through a variety of channels,’ it said.

The report lowered growth forecast for China to 5.2 per cent for FY2020, reflecting a serious but short-lived financial impact.

Regional impact will be felt through trade and tourism, and for a few sectors through supply-chain disruptions, it added.

Source: https://www.newagebd.net

Previous Story

- 7.5 lakh Bangladeshi workers in KSA fear deportation

- Light engineering to greatly help diversify export basket

- Roaring Bangladesh economy a boost to Asian dry...

- Country backpedals on growth goal

- Implementation of 8th Plan towards achieving SDGs: Building...

- IATA warns against Bangladesh VAT plans for aeronautical...

- Sustainability of the growth matters most

- Leading the financing for development agenda in Asia-Pacific