Narrowing trade deficit not wholly good

Image collected

Trade deficit narrowed heavily in the first 8 weeks of the fiscal year in the wake of falling imports as a result of the ongoing economic slowdown, an indicator of depressed demand and consumption.

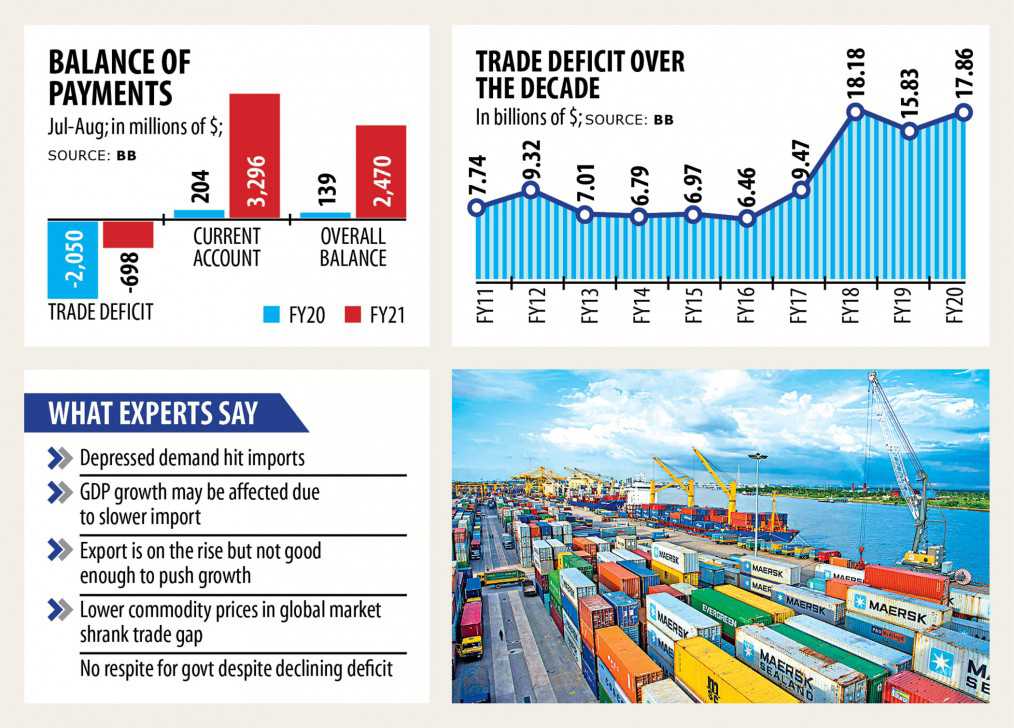

Between July and August, trade deficit, which occurs when imports outweigh exports, stood at $698 million, down 66 per cent year-on-year, according to data from the Bangladesh Bank.

Through the period, imports declined 13.85 per cent from that a year earlier to $7.43 billion and exports rose 2.39 % to $6.73 billion.

All indicators of the total amount of payments (BoP) have posted a shining mark, but these won't have a remarkable positive effect on the GDP growth, specialists said.

Current account balance, among the major indicators of the BoP, stood at $3.29 billion in the first 8 weeks as opposed to $204 million during the same period this past year.

The existing account, the record of a country's international transactions with all of those other world, was in surplus riding on the large level of remittance sent by expatriate Bangladeshis and the dwindling import payments.

The current account includes all the transactions (apart from those in financial items) that involve financial values and occur between resident and non-resident entities.

"The ongoing monetary meltdown brought on by the coronavirus pandemic has adversely affected the domestic demand, heavily decreasing import payments," said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

Also, the commodity price in the global market has declined massively. The cost of petroleum products also fell. Import of capital machinery has almost come to a halt amid the ongoing slowdown in businesses.

"Rising export earnings is a positive sign for the economy. But, we have still quite a distance to go as the country will need additional time to achieve the benchmark of the export which it enjoyed prior to the pandemic," Rahman said.

The government will not get any rest from the improvement in the indicators of the BoP immediately as robust domestic demand and consumption are very important to help make the economy vibrant.

"Depressed demand is not an excellent sign for the GDP growth under any circumstance. The federal government should address the health issues to push the economy," Rahman said.

Between July and August, the entire balance stood at $2.47 billion as opposed to $139 million a year earlier.

The strong position of the existing account and foreign loans from multilateral lenders helped raise the overall balance of the BoP.

"There is absolutely no scope to feel happy watching the indicators of the BoP. The export sector has been around a weak situation taking into consideration the pre-Covid-19 level," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The country is steadily recovering from the meltdown but additional time will be needed as a result of weak domestic demand, he said, adding that the economical recovery is also reliant on the global situation.

"It really is predicted that THE UNITED STATES and Europe will require at least five to six months to enjoy recovery from the prevailing economical hardship," said Mansur, also a former senior official of the International Monetary Fund.

"However the western nations are now in a panic because they think that a second wave of the coronavirus pandemic will hit them," he said.

The government has recently warned a similar situation may occur in Bangladesh in the coming winter.

"This will impede the healing process of the economy. We are far away from the economic revival. And the government should take cautious steps to tackle the ongoing crisis," Mansur said.

Lower imports and a higher level of remittances have played a great role in widening the forex reserve.

The reserve stood at $39.04 billion by August, up 19.11 % year-on-year. The quantity is good enough to stay import payments of 8.4 months, way higher than the typical limit of 90 days. The reserve was $39.11 billion on Wednesday, BB data showed.

Remittance inflow jumped 50 % year-on-year to $4.56 billion in the first two months of the fiscal year.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Bangladesh economy shows early signs of recovery, GDP...

- On Bangladesh GDP in the time of coronavirus

- Just how do we ensure food security in...

- The world's most popular tourist cities may have...

- There are lots of kings and emperors of...

- Bangladesh’s GDP growth number will not hold water

- GDP growth data not credible, says CPD

- The federal government stimulus packages must reach those...