Pandemic kills appetite for credit among businesses

Image: Collected

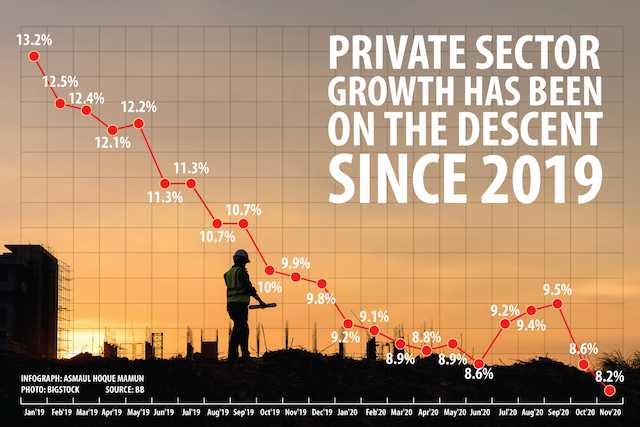

As the year started with the demand tapering for a bunch of reasons, the pandemic simply killed the demand.

By the end of November, individual sector credit growth stood at 8.2 %, the lowest recently and 6.6 percentage factors less than the 14.8 % target set for fiscal 2020-21.

Between February and June, personal sector credit growth constantly dropped when the global pandemic was in its ominous form.

From 9.2 % in January it arrived right down to 8.6 % in June as lenders refrained from disbursing credit during the countrywide shutdown from March 26 to May 30.

“Loan disbursement by banking institutions was first halted amid the shutdown period, which was the reason for the slow credit expansion,” said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Even so, the private sector credit rating growth has found from July to September because of stimulus packages implementation, he added.

September’s growth was 9.5 per cent.

The country’s banks were disbursing loans from several stimulus packages through the period, which caused the uptick, said Rahman.

But from October, progress decelerated as many of the stimulus deals have already been implemented.

The fear of the next wave of coronavirus cases has kept businesses putting a pause on their investment plans.

“This was another reason behind slow credit growth,” said Rahman, also a former chairman of the Association of Bankers, Bangladesh, a platform of banks’ MDs.

The entrepreneurs and industries didn't head to business expansion for want of confidence, said Asif Ibrahim, a former president of Dhaka Chamber of Commerce and Industry, the largest SME trade body of Bangladesh.

The deadly virus is very much indeed alive and kicking.

“It is extremely tough to make fresh investment and business expansion decisions when the community is witnessing a brand new wave of coronavirus situations.”

The require for credit from the private sector increase after the pandemic has been doused forever, Ibrahim said.

“The growth figure isn't a true picture of the true situation,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The real situation could very well be worse.

The adjustment of interest and rescheduling of the existing loans might be the reason why behind the uptick in private sector credit growth at night 8 per cent-mark, he said.

The real growth wouldn't normally become more than 6 %, said Mansur, also a former economist of the International Monetary Fund.

“The lower imports will be the reflection of slow investment situation prevailing in Bangladesh.”

In the 1st four several months of fiscal 2020-21, imports dropped about 13 % year-on-year to $15.8 billion, according to data from the Bangladesh Bank.

The undesirable import growth in the current situation indicates the stagnated economical activities, said Zahid Hussain, a former business lead economist of the World Bank’s Dhaka office.

Investment-related imports just like capital machinery and industrial raw materials have dropped significantly owing to the pandemic.

“There will never be any sustainable economic restoration from the recession for another six months,” Hussain added.

Banks though are actually sitting down on an enormous pile of surplus liquidity.

By the end of September, excess liquidity in the banking sector stood at Tk 169,658 crore, according to data from the BB.

“The private sector credit growth would not increase substantially until March following year as our economy and businesses have not fully recovered,” Rahman said.

The growth would hover around the 9 per cent-tag in the upcoming days, he added.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- Bangladesh banks on preferential trade terms to improve...

- Citizens Lender gets the ultimate nod from Bangladesh...

- ADB felicitates City Bank as 'leading part bank...

- Remittances continue steadily to paint Bangladesh's monetary resilience

- India must contend with Bangladesh first before competing...

- World Bank, BRAC Join Hands to boost Road...

- US rush to Bangladesh revs up economic race...

- Geriatric infants in the professional sector