PLFS liquidation move keeps hammering stocks

Image collected

Dhaka stocks slumped on Wednesday to extend the bear run to four sessions as investors continued selling shares following the government’s decision to wind up struggling People’s Leasing and Financial Services.

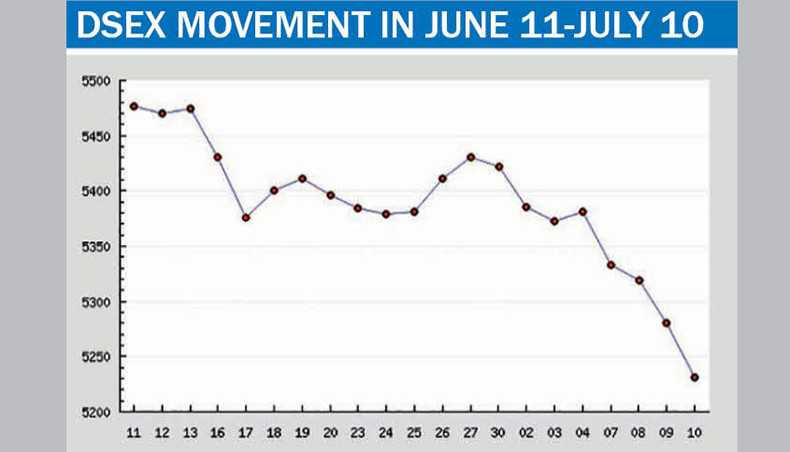

DSEX, the key index of Dhaka Stock Exchange, dropped by 0.93 per cent, or 49.41 points, to close at 5,230.63 points on Wednesday.

The DSEX lost 150 points in last four sessions.

In line with the previous day, the market started falling from the very beginning on Wednesday and descended firmly as the time passed to end the session deep into the negative territory as liquidation news of People’s Leasing and Financial Services dampened the investors’ mood, market operators said.

With investors already on the edge over the penalty tax on listed companies, gas price hike and Grameenphone woes, the PLFSL wind-up decision sparked panic sell-offs at the market, they said.

The media reported on Tuesday that the government had approved a Bangladesh Bank proposal to liquidate PLFS considering fragile state of the non-bank financial institution.

If performed, the liquidation would be the first of its kind in the country. The fragile situation in the financial sector became evident following the move from the government.

Market operators said that unnerved investors continued selling shares as they were assessing the impact of the decision on the financial sector.

Investors feared that more financial companies might face liquidation as some companies in the financial sector are plagued with various scams, numerous bad loans and poor corporate governance that became risky for the depositors and investors.

PLFS has failed to repay its depositors’ money and more than 60 per cent of loans and leases of the company have already become non-performing, the media reported.

On Wednesday, there was no buyer for the shares of PLFS for the second day. The shares of the company were traded at its lowest possible prices under circuit breaker for the second day to finish at Tk 3.3 per share on Wednesday.

The market fell eight out of nine trading sessions since the budget passage. Investors were disappointed as the government passed finance bill on June 29 imposing 10 per cent tax on listed cos’ stock dividend if it exceeds cash dividend.

It also levied 10 per cent tax on the amount of profits transferred to reserve by a listed company if the amount exceeds 70 per cent of the company’s net profits for the year.

The Bangladesh Energy Regulatory Commission on June 30 increased gas prices by 32.8 per cent on an average for all consumers with an effect from July 1 that also hit investors’ sentiment.

The Bangladesh Telecommunication Regulatory Commission on July 4 reduced the bandwidth for Grameenphone by 30 per cent, which triggered share sales of the company and it lost 7.40 per cent in last four sessions.

The average share prices of telecommunication, NBFI, textile and bank sectors plunged by 1.95 per cent, 1.84 per cent, 1.63 per cent and 1.51 per cent respectively.

Mutual funds plummeted by 3.44 per cent after recent surges. Out of the 353 scrips traded on the day, 279 declined, 51 increased and 23 remained unchanged.

Turnover on the bourse plunged to Tk 408.88 crore on the day from Tk 512.91 crore in the previous session. DS30, the blue-chip index of DSE, dropped by 0.77 per cent, or 14.61 points, to close at 1,860.90 points.

DSE’s Shariah index DSES decreased by 0.76 per cent, or 9.22 points, to close at 1,198.26 points. National Life Insurance led the turnover chart with its shares worth Tk 15.77 crore changing hands.

Rupali Insurance Company, Runner Automobiles, Sino Bangla Industries, Pioneer Insurance, Singer Bangladesh, Asian Tiger Sandhani Life Growth Fund, Dhaka Insurance, Paramount Insurance Company and Prime Insurance were the other turnover leaders.

Nitol Insurance Company gained the most on the day with a 10-per cent increase in its share while Imam Button Industries was the worst loser, shedding 9.96 per cent.

Source: http://www.newagebd.net

Tags :

Previous Story

- Stocks fall in 5 out of 6 days...

- Stocks slump on new tax measures, GP woes

- Stocks in red again as revised tax, gas...

- Delisting of dud cos hits snag as BSEC...

- Tk. 27 crore disappeared from stock market in...

- Stocks drop for 3rd day on tax measures

- Stocks drop for 2nd day on revised taxes

- Stock stakeholders hail changes in taxes on retained...