Remittance to nosedive 22pc in 2020: World Bank

Collected

Remittance circulation to Bangladesh might plunge by as a good deal as 22 per cent in 2020 due to the fallout of the global coronavirus pandemic, found in a significant blow to the market, said the World Lender yesterday.

Money sent by the migrant personnel is projected to fall to $14 billion this year, said the multilateral loan company in its Migration and Development Brief.

Remittance is Bangladesh's second-largest source of foreign earnings after the garment industry.

The inflows from the migrant workers, which rose 21.49 % to $11.05 billion in the first seven months of the fiscal year on the trunk of the 2 2 % cash incentive, had kept the growth momentum until January this season.

However the momentum came crashing in the next months as the effect of the deadly bug began to become evident. In March, remittance fell 12 % year-on-year to $1.28 billion, the cheapest in 15 months.

Coronavirus, which started in China found in December last year, has affected both international and internal migration found in South Asia.

As the first phases of the crisis unfolded, many international migrants, specifically from the Gulf countries, came back to countries such as for example India, Pakistan and Bangladesh, the WB said.

Gulf countries, such as Saudi Arabia, the UAE and Kuwait, are residence to 75 % around 1 crore Bangladeshis living abroad.

Because the middle of February, about 2 lakh migrant personnel returned home, with virtually all arriving from Saudi Arabia, the UAE and Malaysia, according to Shariful Islam Hasan, head of BRAC's migration programme.

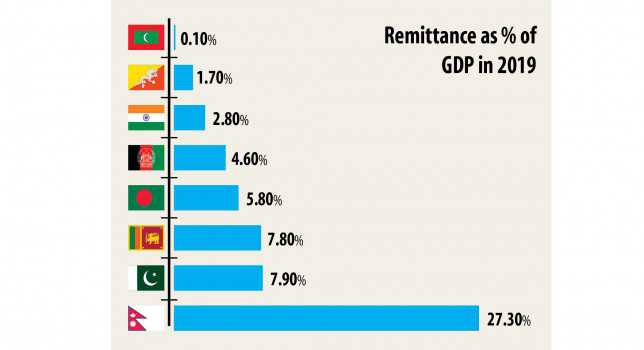

Remittances to South Asia are actually projected to decline 22 per cent to $109 billion found in 2020, following growth of 6.1 % in 2019.

Falling oil rates will influence remittance outflows from the GCC countries and Malaysia and the coronavirus-induced economic slowdown from the united states, the united kingdom and the EU to Southern Asia.

Apart from the GCC countries, a significant chunk of Bangladesh's migrant personnel lives and work in Malaysia and Singapore, as the US and the united kingdom are respectively residence to 5 lakh and 10 lakh expatriate professionals.

"The ongoing financial recession due to COVID-19 is going for a severe toll on the capability to send money residence and helps it be all the more essential that we shorten the time to recovery for advanced economies," said World Bank Group President David Malpass in a press release.

The coronavirus-related global slowdown and travel restrictions may also affect migratory motions, and this is likely to keep remittances subdued even in 2021, the simple said.

During the past, remittances have been counter-cyclical, where personnel send additional money home in times of crisis and hardship back. This time, nevertheless, the pandemic has damaged all countries, creating further uncertainties.

"Effective social protection systems are crucial to safeguarding the indegent and vulnerable during this crisis in both developing countries together with advanced countries. In web host countries, social cover interventions also needs to support migrant populations," explained Michal Rutkowski, global director of the social coverage and careers global practice at the WB.

So far, the WB said, authorities insurance plan responses to the coronavirus crisis have generally excluded migrants and their own families back home.

But you will find a strong case for including migrants in the near-term health approaches of most countries, given the externalities linked to the health position of a whole population when confronted with an extremely contagious pandemic.

"Quick actions that make it less complicated to receive and send remittances can offer much-desired support to the lives of migrants and their own families," explained Dilip Ratha, lead writer of the Brief.

Financing Minister AHM Mustafa Kamal has urged the Asian Production Bank to supply another $150 million, which will be used to create jobs for the local Bangladeshis and migrant employees who have lost jobs together with rehabilitate the micro, cottage, small and medium entrepreneurs.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Govt seeks $1b from IMF, World Bank

- World bank approves $170M Bangladesh sanitation project

- IFC launches web portal to monitor resource use...

- Online business exchange still poor BD: WB report

- Bangladesh Can Boost its Exports with Better Logistics

- Bangladesh exports robust: World Bank

- Remote guide getting costlier for Bangladesh

- Bangladesh Economy Continues Robust Growth with Rising Exports...