Rumours fuel junk stocks

Most of the junk stocks outperformed the market in the first 16 days of trading in 2019 as rumours and gamblers ran amok.

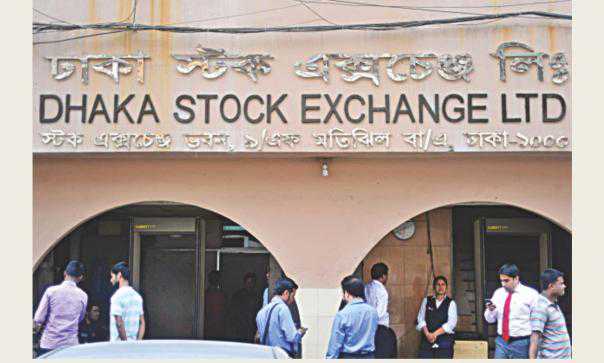

Of the 43 junk shares, 23 shot up between 10 percent and 76 percent. In contrast, DSEX, the benchmark index of the Dhaka Stock Exchange, gained 8.91 percent. Only five junk stocks fell during the time.

“This looks like a suicidal decision by the investors,” said AB Mirza Azizul Islam, a former chairman of the Bangladesh Securities and Exchange Commission.

The market though will not be significantly affected if the investors who poured money into the junk stocks suffer as their market capitalisation is relatively low.

“But a lot of innocent poeple may suffer,” said Islam, also a former finance adviser to a caretaker government, however. Of the junk stocks, Emerald Oil soared the most during the period: 76.16 percent.

The other notable gains were of Fareast Finance, First Finance and BD Welding, whose stocks soared 43.39 percent, 36.84 percent and 31.25 percent respectively.

“There is absolutely no reason behind the junk stocks' gaining streak other than unsubstantiated rumours,” said a top official of a leading brokerage house seeking anonymity.

A vested interest group is spreading rumours about junk stocks, luring in unsuspecting people to buy them.

“The investors saw these stocks' prices rocket, so they took the risk,” he added.

A high official of the DSE says the bourse has taken some measures against the junk stocks, but still investors are buying the shares.

The bourse de-listed two junk stocks and has put another 14 under review to find out whether they have any potential to return to profitability.

If they are found to have no bright future, they might be de-listed, the official said.

“What can we do if investors themselves do not become cautious?”

Source: https://www.thedailystar.net

Tags :

Previous Story

- Finance stocks thrive on low prices

- Study: Shares in pharma, food, banks sought most...

- Stockbrokers seek liquidation rules for delisted firms

- Dhaka stocks’ rally extends to 5th week

- Stocks soar for 4th week as banks, GP...

- MFs post 16pc portfolio loss in 2018

- Stocks advance further as buying mood sets in

- Dhaka stocks on fire, cos linked with cabinet...