Texas governor orders state agencies to sell China assets

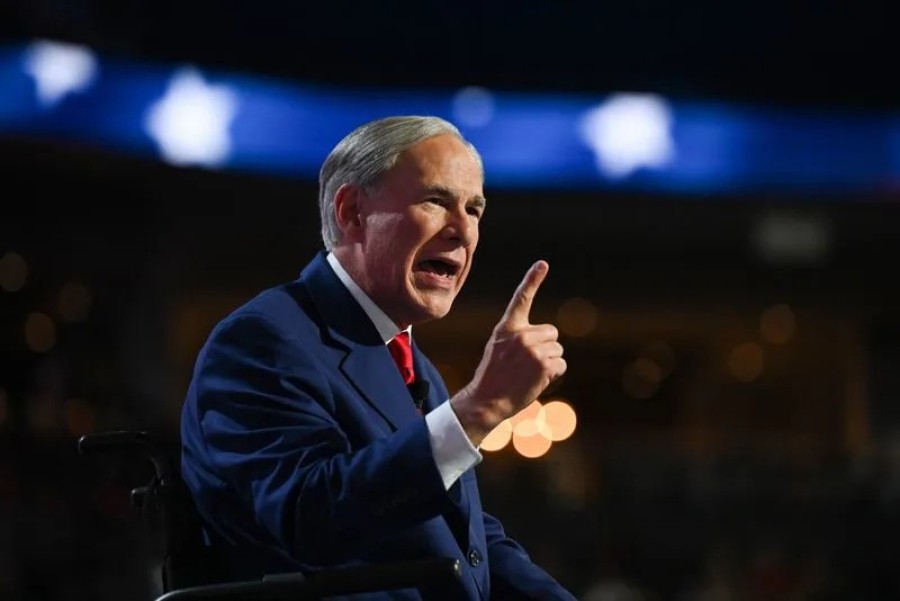

Day 3 of the Republican National Convention in Milwaukee, Wisconsin

The governor of Texas ordered state agencies to stop investing in China and sell assets there as soon as possible, citing financial and security risks, a sign of rising U.S.-China tensions starting to impact global capital flows.

Texas Governor Greg Abbott ordered state agencies to divest from China, citing financial and security risks. The move impacts major funds like TRS and UTIMCO, with billions in Chinese assets, reflecting escalating U.S.-China tensions in global capital flows.

In a letter to state agencies dated Nov. 21 and posted to his website, Republican Greg Abbott said "belligerent actions" of China's ruling Communist Party had increased risks to Texas' investments in China, and told investors to get out.

"I direct Texas investing entities that you are prohibited from making any new investments of state funds in China. To the extent you have any current investments in China, you are required

Its state agencies include the Teacher Retirement System of Texas, which had $210.5 billion under management at the end of August, according to its annual report.

The TRS has roughly $1.4 billion exposure to Chinese yuan and Hong Kong dollar assets, and listed Tencent Holdings as its 10th largest position, worth about $385 million at current prices.

Abbott's letter said he had told the University of Texas/Texas A&M Investment Management Company (UTIMCO), which manages nearly $80 billion, to divest from China earlier this year.

Neither Texas Teachers nor UTIMCO responded immediately to a request for comment outside business hours.

Markets in China fell sharply on Friday, with the Shanghai Composite down 3%. Tencent shares were about 2% lower in afternoon trade in Hong Kong, in line with the broader market.

Dealers said trade had been light in Hong Kong and sentiment already weak as Chinese authorities have disappointed expectations for economic stimulus, but that the news had added to the downbeat mood.

"Even though we all know that there will be more and more policies against China from the U.S.... whenever there's any news like this, it will hit the sentiment here," said Steven Leung, executive director at brokerage UOB Kay Hian in Hong Kong.

Source: https://www.yahoo.com

Previous Story

- Huawei's foldable smartphone sales nearly double in third...

- High-Quality Woodworking Tools and Machinery from China

- Headwinds in China and Asia travel retail impact...

- Congress Calls for Tougher China Sanctions to Thwart...

- EU to impose duties on electric vehicle imports...

- China Industrial Profits Extend Drop as Deflation Takes...

- China's exports miss forecasts as lone bright spot...

- China's deflationary pressures build in Sept, consumer inflation...