The economy could have caved within pandemic gust. Migrant staff propped it up

Image: Collected

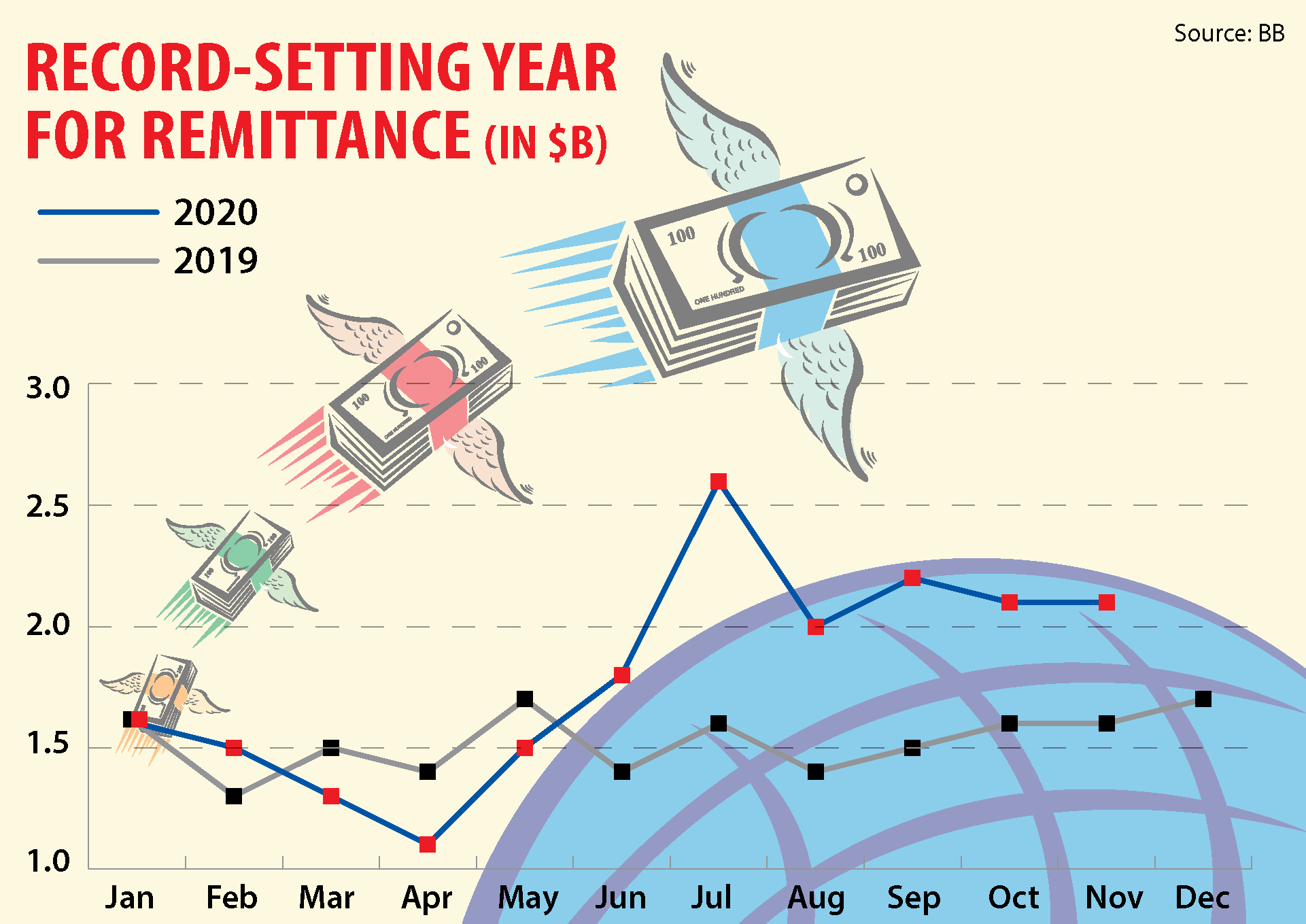

The global coronavirus pandemic brought a major blow to the country’s economy and businesses together with people’s livelihood in 2020 nonetheless it was a year of track record for remittance inflows and forex reserves.

The united states continues to visit a robust inflow of remittance amid the ongoing pandemic despite the authorities and international organisations’ initial projections that the receipts could decline significantly due to the impact of COVID-19.

In April, the World Bank had forecasted that remittance inflows to Bangladesh may plunge as much as 22 per cent in 2020 to about $14 billion.

And in July, the Asian Development Bank had made an identical grim forecast: Bangladesh will be among the five worst-hit growing Asian economies in terms of remittance inflows.

In the worst-case scenario, Bangladesh's remittance will decline 27.8 % from its 2018 level.

But, it was surprising that the country’s remittance earning struck a new record in today's year.

Bangladesh received $19.6 billion as remittance during January to November of the existing year, surpassing keep going year’s full-year receipts of $18.3 billion, which was a record, in line with the info from the central bank.

The remittance had hit the new record mainly as a result of 2 per cent cash incentive on inflows through the state channel, said Md. Serajul Islam, spokesperson of the Bangladesh Lender.

The objectives of the incentive, when introduced in July this past year, were to mitigate the responsibility of increased expenses in sending foreign remittance and also to encourage the Bangladeshi diaspora to remit more money through the legal channels, said Islam, also an executive director of the BB.

However, remittance declined somewhere between February and April when the pandemic was putting down its roots worldwide.

From May onwards, the inflows started to increase as countries worldwide gradually began to ease their movement control orders to flatten the curve on coronavirus.

The inflow of remittance hit the single-month record in July as migrant personnel sent home $2.6 billion.

July's inflows were up 62.5 percent from a year earlier and 42.1 percent from the prior month.

Remittance inflows rose 35.9 percent in August, 45.6 percent in September, 28.1 percent in October and 33.7 percent in November from a year earlier.

The collapse in the hundi system, an illicit cross-border transaction network, because of the travel ban brought on by the raging coronavirus could make clear the gush of remittance, said Zahid Hussain, a former lead economist of the World Bank’s Dhaka office.

The hundi network was moored on international travel, import business and medical tourism. All have been in the gradual lane because the pandemic began in February.

“But the expatriate Bangladeshis still need to send in money home plus they turned to the legal channel,” Hussain added.

Although the Bangladeshi expatriates are facing various disruptions as a result of struggling economies they have a home in, they did not stop sending money to their relatives in the united states, said Zaid Bakht, chairman of Agrani Bank.

Consequently, the inflow of remittance has increased in today's year possibly amid the pandemic.

The inflow of remittance would maintain a typical flow in the upcoming days and nights as migrant workers already are used to the legal channels and getting benefits because of the incentives, said Bakht, also the research director of the Bangladesh Institute of Development Studies.

Ahsan H Mansur, executive of the Policy Research Institute of Bangladesh, echoed the same.

“There will never be much progress in remittance in the upcoming days and nights but it would not decline.”

The technological transformation seen in recent times that has made receiving remittance within a few minutes via cellular financial services may have posed itself as a viable option to hundi amid the pandemic, said Mansur, also the chairman of BRAC Lender.

Another reason behind the spike, particularly from the US, could be the higher returns on savings in Bangladesh.

In a lot of the developed world, the interest rates are near zero and even negative in some instances.

“A portfolio reallocation could possibly be happening here,” Mansur added.

The country’s forex (forex) reserve crossed the $42 billion-tag for the first time on December 15 following a higher growth of inward remittance and lower import payment.

In the initial four several months of fiscal 2020-21, imports dropped about 13 % year-on-year to $15.8 billion, according to info from the BB.

Forex reserve was about $41 billion on October 29 and $40 billion on October 8.

Earlier on September 1, forex reserves exceeded the $39 billion-mark.

With the reserve tally, it could be possible to meet the import payment of 10 a few months, according to BB officials.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- Priorities in the post-Covid-19 era

- Bangladesh seeks better global support for migrant workers

- Covid-19 impacts on life cycle deficit in Bangladesh

- Ushio launches world's 1st UV lamp that may...

- Holding on to hope amid drawn-out adversity

- On Bangladesh GDP in the time of coronavirus

- 92 per cent plainland ethnic minorities in Bangladesh...

- The world's most popular tourist cities may have...