Time for MFS providers to shine

Collected

The coronavirus pandemic has proved a stroke of luck for mobile financial service providers as people are increasingly choosing digital payment during a bid to steer beyond the health risks the lethal pathogen poses, experts said.

The expansion of MFS in recent times also will help the govt advance a step closer to a cashless society, they said at a virtual discussion on 'Digital Payment Solutions during Coronavirus Pandemic', organised by The Daily Star yesterday.

"The coronavirus pandemic has given a robust message to all or any that there remains scope to embrace the digital financial tools to run the economy under any circumstances," said Mustafa Jabbar, posts and telecommunication minister.

Banks hardly run their financial activities in rural backwaters, but the MFS providers have brought the underprivileged people of those territories to the formal financial sector, he said.

"A difficult situation would are created if we had not taken adequate preparations to widen the bottom of the mobile financial services on time."

The strong foundation of MFS will now make the government's fight against coronavirus easier.

"We have already brought the workers of the garment sector under the MFS platform. the need of traditional banking has already diminished as we've entered a digital era."

The banks' cash counters won't be required soon thanks to the rapid expansion of digital banking and therefore the strong base of the MFS, Jabbar added.

"Economic activities should remain vibrant during the continued shutdown such the wheel of the economy keeps moving," said Tanvir A Mishuk, director of Nagad, an MFS provider of the Bangladesh Post Office and a personal entity.

The benefits of the stimulus package offered by the govt should reach the marginalised people, including farmers, and little entrepreneurs, he said.

Half the country's population has been benefitted by financial inclusion and efforts should remain underway to bring the remainder on board, he said, adding that the continued measures taken by the MFS providers will deepen financial inclusion further.

The popularity of MFS has increased significantly within the last one month because the pandemic has forced people from all walks of life to require the service, said Kamal Quadir, chief military officer of bKash, a number one MFS provider.

But the quantity of transaction plunged 28 per cent at one point because the financial institution reduced the extent of banking operations.

The Bangladesh Bank has recently increased the banking hours to four hours from two/three hours, which has helped boost MFS transactions gradually.

If the MFS agents cannot deposit or withdraw money from banks smoothly, they're going to be unable to run the service properly, Quadir added.

bKash, the country's largest MFS provider, has 225,000 agents and 60,000 digital e-KYC centres across the country.

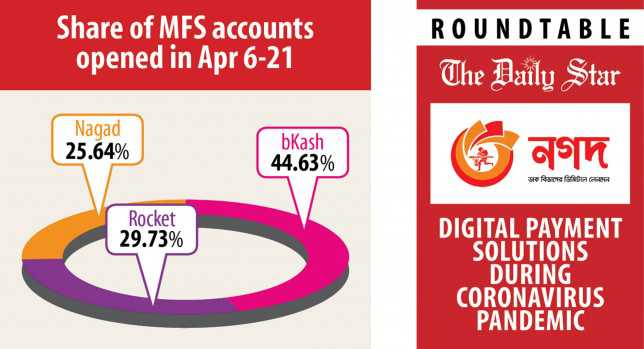

MFS operators opened 30 lakh new accounts from April 6 to April 25 to assist disburse funds from the government's stimulus package of Tk 5,000 crore for export-oriented industries, said Abul Kashem Md Shirin, director of Dutch-Bangla Bank.

Some 16 lakh MFS accountholders within the garment sector wont to receive their wages through the digital platform earlier, but the pandemic has played a task in expanding the service further.

Clients usually withdraw Tk 7,000 crore via cash machines of DBBL per month, but Rocket, the bank's MFS platform, witnesses a complete transaction of Tk 10,000 crore a month.

"This may be a excellent sign. But we should always make sure that clients also can use the cash to get goods and pay their house rents through the MFS platform."

The government should take measures to the present end, Shirin added.

"Social distancing can't be maintained among the economically vulnerable people if we fail to offer them social protection," said Zahid Hussain, a former lead economist of the planet Bank's Dhaka office.

The government should prepare an inventory of vulnerable people to supply them the specified support with cash and food.

As distributing food among them will create a risk of viral infection , the govt could start a programme to supply cash support to them during the continued lockdown, and MFS providers offers support during this regard, Hussain added.

Previously, only 5 per cent of the electricity bills were paid through digital platforms, but the ratio has now reached 60 per cent, said Abul Kalam Azad, former principal coordinator for SDG affairs at the Prime Minister's Office.

"We need to play a much bigger role within the post-coronavirus period. MFS cash-out should be brought down as a part of our journey towards a cashless society."

Initiatives should be taken to supply trade licences to small businesses through the digital tools, Azad added.

The coronavirus pandemic is leaving a positive impact on widening the digital payment services as people now attempt to avoid cash transaction as a health precaution, said Rahel Ahmed, director of Prime Bank.

Nagad can open 1-2 million accounts each day , said Mohammad Aminul Haque, the MFS provider's chief treasurer .

"So, we will help disburse funds quickly from the government's stimulus package."

Nagad also can support in developing an eco-system for e-money to market the country's digital financial programme because it has the adequate technical capability also because the experience of handling an enormous amount of transactions a day , Haque added.

Many workers in several sectors, also as an honest number of general people, have just started using MFS to settle their transactions as a part of the social distancing measure to fight the coronavirus, said Sheikh Monirul Islam, chief operating officer of bKash.

"We also are taking awareness campaigns to guard our users from fraudulence."

As the owners of the export-oriented industrial units will soon start paying salaries from the government's stimulus package, the enforcement agencies should help the MFS agents run their outlets within the areas anesthetize lockdown.

If the owners of grocery shops, who are yet to manage trade licences, are allowed to use the purpose of sale (PoS) terminals, transaction through e-money will increase manifold.

"The authorities concerned should take measures to the present end as getting trade licences is tough in our country," Islam added.

SSL Wireless had taken an initiative to deliver groceries to clients even before the lockdown was imposed, said its Chief Operating Officer Ashish Chakraborty.

"There has been a trust deficit for the settlement of e-commerce transactions. In most cases, clients make payments after receiving their products. this suggests delivery persons need to receive cash."

The MFS providers will play an enormous role during this regard such clients can settle the transactions through their MFS accounts, which can help create a full-fledged cashless society, Chakraborty added.

Source: https://www.thedailystar.net

Tags :

Previous Story

- COVID-19 trajectory for Bangladesh RMG

- Bangladesh’s garment industry unravelling

- Bangladesh loses Tk 33b a day during lockdown:...

- High Commission of India in Bangladesh holds webinar...

- Apple, Google say users to regulate virus 'tracing'...

- Bangladesh to consider easing age restrictions for jobs...

- Tourism sector for specific incentive combating coronavirus crisis

- Coronavirus in Bangladesh: Experts for prudent monetary recovery...