Vaccine rollout cheers up stock investors

Image: Collected

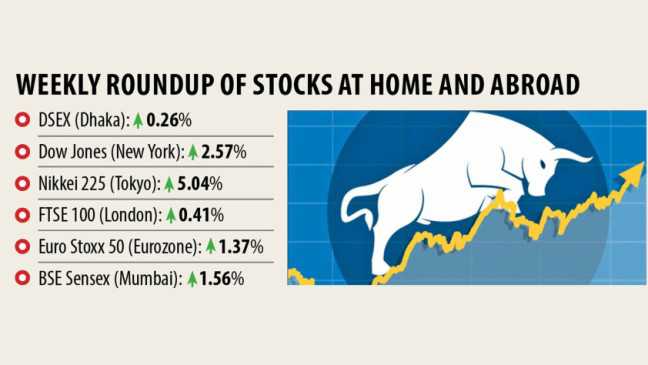

The start of the Covid-19 vaccine rollout in the UK and the US cheered institutional investors all over the world, allowing global stock markets to end higher last week and Bangladesh was no exception.

Institutional investors began taking part in the stock market and most importantly were choosing the manufacturing sector in the Dhaka STOCK MARKET.

As the vaccine arrived, the US and the UK already started administering it into the body, so investors worldwide are optimistic of the economy bouncing back, said Abdul Latif, a stock investor with around 20 years' experience.

The UK started to administer a Pfizer-BioNTech vaccine from December 8, and the mass immunization in the US commenced on December 14.

Pfizer and BioNTech announced that vaccine applicants against the pathogen achieved success in the first interim analysis on November 9.

The US's S&P 500 index rose around 1 %, and the Nasdaq edged up by 2.4 percent within the last five days.

The Dow Jones Index gained 2.57 %, the Eurozone's Euro Stoxx 50 added 1.37 percent, Japan's Nikkei 225 advanced 5 percent, and India's BSE Sensex went up 1.56 %.

Institutional investors in Bangladesh are also optimistic along with individual investors, and they also have begun to invest, Latif said.

The DSEX, the benchmark index of the DSE, rose 0.5 percent last week as the daily average turnover of the premier bourse went up around 10 percent to Tk 920 crore, DSE data showed.

Among the major sectors, the worthiness of stocks of the engineering sector rose the highest, 10.1 percent, last week followed by pharmaceuticals and cement stocks.

The manufacturing sector has been witnessing minimal investment for recent months amidst the pandemic as a result of peoples' apprehension over monetary trends.

When an economy fears any disruption, the manufacturing sector endures a big blow in the stock market since the demand for products falls fast, Latif said.

The positive movement of the global stock indexes is related to the vaccination since it will help big economies bounce back, said Prof Mohammad Musa, a currency markets analyst.

"Normally, we usually do not start to see the impact of the world market on Bangladesh's stock market, maybe because of its uniqueness," he said.

"However, our market is individual investor-based, so big economies' impact is less here," he said.

Now banks are investing funds in the currency markets as it has been considered lucrative and they may hopefully visit a turnaround of the economy, added Musa, a professor of business and economics.

Twenty-one banks informed the Bangladesh Bank that they would invest Tk 2,050 crore. More than Tk 700 crore was invested by December 10.

A top official of a merchant bank said they made a decision to invest in the currency markets because lending deemed risky now.

The pandemic might come out for the better as the vaccine is being administered worldwide, he said, adding that Bangladesh also would surely get the vaccine.

"We had made a decision to wait until the vaccine is invented before investing here," he added.

Source: https://www.thedailystar.net

Previous Story

- The UK Virgin Islands Reopened To Tourism This...

- Trade dialogue with the UK the following month

- UK PM outlines plan for green industrial revolution

- China issues non permanent travel bans for six...

- Bangladeshi, Pakistani economists under-represented at leading UK varsities

- UK FinTech firm Paymentology expands to the Middle...

- UK businesses finding more prospects for trade, investment...

- Partnerships will drive the economy