What will happen when overseas employment and remittance dip?

Image collected

Among all the news about the fallout of the pandemic due to COVID-19, two pieces of news didn't escape my attention.

The foremost is an announcement by the foreign minister that more than 28,000 employees who were employed in several countries outside Bangladesh were more likely to return soon. The next little bit of news was a dip in remittances.

In the journey of Bangladesh from a "basket case" or "test case of development" to a lower-middle-income developing country, one factor which has played a crucial role is overseas employment.

From a paltry 6,000 in 1976 the quantity going abroad for employment recently has soared for some 7-10 lakh. These, of course, are gross outflows and do not represent the web outflow because nobody knows just how many return every year.

The government appears to assume that even taking returnees into consideration, about five lakh people find employment abroad each year.

There are in least three ways where overseas employment contributed to the success story of Bangladesh's development. The clear one is really as a source of employment and as a way of relieving strain on the domestic labour market.

The figure of five lakh could be devote perspective by noting that the brand new addition to the labour force recently has been about 16 lakh.

Second, the majority of the employees are from relatively lower-income groups (though not from really poor households), and their own families usually remain home.

Remittances sent by the personnel usually are the major -- if not the only -- source of income of such households, and thus play a crucial role in meeting their expenditures.

And that, subsequently, plays a part in the growth of GDP through the consumption route.

Household expenditure on a range of goods and services generates demand for them, which, subsequently, creates the impetus for output growth.

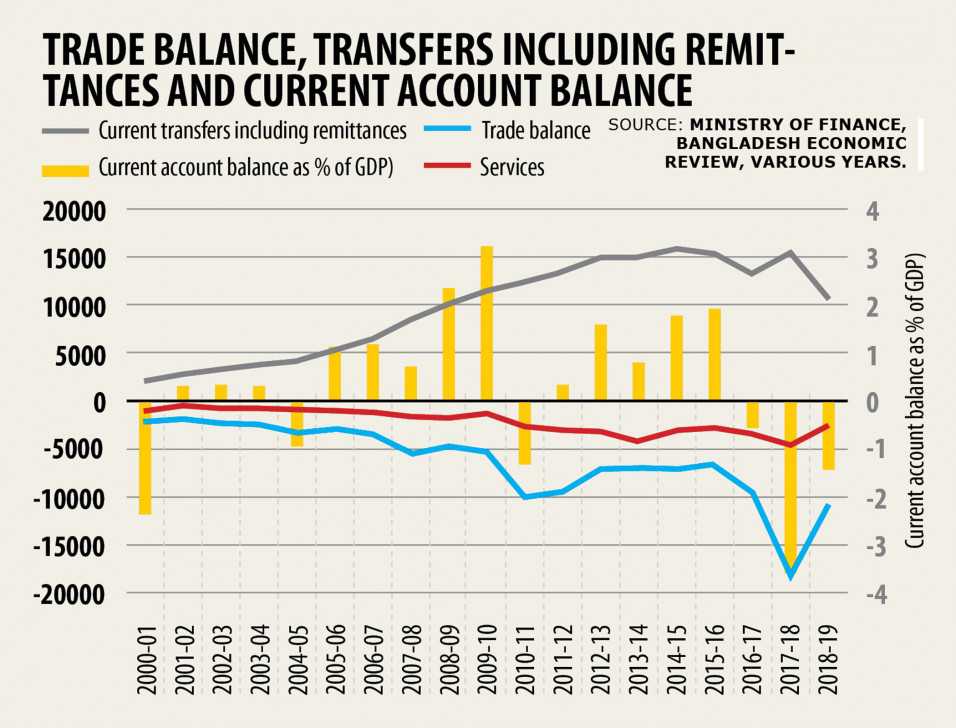

Third, remittances have played a significant role in accumulating the forex reserves to an extraordinary level and in supporting the existing account balance of the country.

The trade balance (i.e., the balance of exports and imports) of the country is nearly always negative. It's the current transfers -- where remittances are by far the major component -- that help accocunts for for the negative trade balance.

As a result, the existing balance has been positive in almost all of the years in the past couple of decades.

However in fiscal 2017-18, there is a sudden steep upsurge in imports; and consequently of this spike in imports, the existing account balance had an enormous deficit that year.

Then there is a decline in the inflow of remittances during fiscal 2018-19, which resulted in a continuation of this deficit.

In the kind of situation mentioned previously, what may be the consequences of a sharp decline in overseas employment and the flow of remittances?

On the employment front, it really is simple to see that additional pressure will be created on the already fragile domestic labour market.

As pointed out by myself in an earlier article in this newspaper (May 1 2020), about one crore persons may have lost their jobs in March-April as a result of shutdown of public life and economy.

In addition, one would have to add the quantity of workers who'll be losing their jobs abroad and can return and perhaps join the labour force.

Although there is no data on overseas employment after February this year, you can surmise that hardly any could actually get such jobs. And the situation will probably continue until at least economical recovery starts in the labour-receiving countries.

If the existing forecasts of global monetary growth created by the International Monetary Fund and the World Bank are any guide, it really is assumed that the tap of overseas jobs is unlikely to reopen until about the last quarter of this year.

In that scenario, the number of such jobs for your of 2020 is unlikely to become more than three lakhs (the full total for January and February was 129,127).

If one takes into account the number that's likely to return as a result of loss of jobs, the net outflow may turn out to be insignificant.

So, the current year is likely to be a lost year as far as overseas employment can be involved.

That which was once a reliever of pressure on the domestic labour market will turn back and play the opposite role.

Arriving at remittances, a survey on the use carried out by the Bangladesh Bureau of Statistics in 2013 showed that practically 39 % of the amounts received by households is allocated to food and clothing alone.

Education and health together take into account another 9 % or so. The others is spent on purchasing land or constructing house and repaying debt.

Although it isn't known how households would change to a sharp decline in the flow of money, you can conjecture that adjustment may take place mainly in the things of consumption outside food.

To the extent that occurs, the demand for non-agricultural products (e.g., clothing, furniture, etc.) may decline, which, subsequently, may have a dampening influence on their production.

The fallout of the dip in remittances may thus extend to make a negative impact on output and financial growth all together.

The possible negative impact of a fall in remittances on the total amount of payments of the united states was already indicated earlier.

With the sharp decline in exports that the economy happens to be experiencing, unless imports also fall simultaneously, trade balance may worsen further.

In fact, during the July-April amount of this fiscal year, exports declined 19.09 % from a year earlier. Not unexpectedly, imports also declined.

But if projections created by the WB of a 22 % decline in remittances turn out to be true, the impact on the current balance is likely to be quite severe.

What policy measures could be undertaken when confronted with the situation mentioned above?

On the employment front, the issue is associated with that of overall employment strategy that the country should be pursuing; and this is not the destination to get into that.

However, a word could be said about the large number of workers who already are returning and are more likely to do so in the coming weeks and months.

A full-fledged strategy must extend assist with them in getting re-integrated into the economy.

Given the precarious situation of the economy, it could be more practical to believe regarding helping them start their own enterprises.

Probashi Kalyan (Expatriate Welfare) Bank must come forward and play its due role, especially by giving credit support to those enthusiastic about starting enterprises.

However, speed and ease with which credit is made available will be key to the success of such a programme.

Such an effort may very well be a win-win proposition for the economy and the individuals concerned.

If properly integrated, the returning workers will be able to contribute to the economy by creating their own enterprises and by making some employment for others aswell.

To minimise the possible adverse aftereffect of a fall in remittance on the total amount of payment, the measures that are needed include: (i) all-out effort to put exports back on the right track; (ii) frugality in imports while maintaining a smooth and speedy way to obtain intermediate and capital goods needed for reinvigorating production; and (iii) keeping a close eye on payments to ensure that leakage and capital flight do not happen in the guise of imports.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Is Southeast Asia's drug trade too large to...

- Rescue package needed to salvage aviation industry

- COVID-19: Tripura resumes border trade with Bangladesh amid...

- Bangladesh garment factories reopen despite coronavirus threat to...

- Robots on hand to greet coronavirus patients in...

- Int'l brands' business practice questioned; staff interest ignored

- Bangladesh economy awaits a bigger blow: Economists

- One million IT staff will continue work-from-home post-lockdown:...