Will the chip shortage create a nightmare before Christmas?

Santa’s sleigh is skidding to a halt this Christmas. Thanks to the global chip shortage, coupled with a lack of HGV drivers, gaps on shelves and items out of stock have become a common sight in the lead up to the festive period.

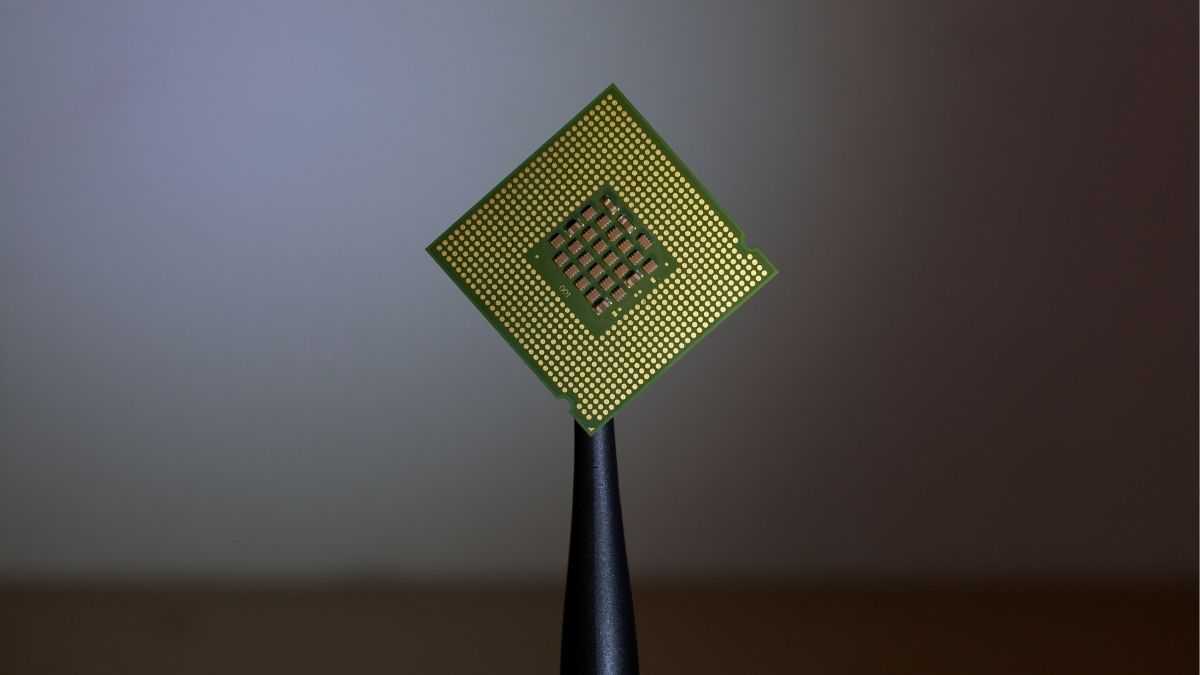

Chips are the brains behind products like electric toothbrushes, smart fridges and consoles, so the shortage has been squeezing supply from electronics to white goods to toys. The situation is compounded by competition for the limited supply between electronics manufacturers and automakers.

“This is having some impact on retailers in terms of the overall range of offers,” says Emile Naus, partner at BearingPoint, a management and technology consulting firm.

“We’ve seen this with the reduced supply seeming to limit traditional Black Friday offers to older products and models.”

Sainsbury’s, which owns Argos, was forced to delay its pre-Christmas toy sale by a week due to such problems. CEO Simon Roberts admitted to reporters in November that customers will be seeing fewer electronics products on offer than usual in the weeks before Christmas.

Shoppers usually hunt for bargains at this time of year, but a number of electronics manufacturers have even been hinting at price rises for consumers since the early part of 2021. Laptop and TV maker Asus said on an earnings call in March that a components shortage would mean “price hikes further upstream”. In September, Apple warned of “noticeable” rises for its products. Meanwhile, Sony expects the PlayStation 5 to be in short supply through 2022 as production problems continue to bite.

Toy manufacturers will likely be at the back of the queue when it comes to sourcing chips, with foundries focused on supplying the technology giants first, long-term clients that can afford to pay the rising prices. The world’s biggest chipmaker – Taiwan Semiconductor Manufacturing Company – has prioritised Apple and cars.

According to Naus, manufacturers in all industries are facing long lead times. It’s entirely possible that some lower priority products are being modified to remove chips and certain smart features just to ensure there is at least some stock available, he says.

Bright spots

As demand for chips outstrips supply, what impact is the shortage having on bottom lines? It’s probably not as negative as you’d expect.

Take consoles, for example. They’re usually priced using what’s known as a loss leader strategy – products are sold at a lower cost than what they were bought for in the expectation that it will encourage shoppers to spend more.

A Microsoft executive revealed earlier in the year that the company never makes a profit on the Xbox. Instead, it makes its money through sales of digital and physical copies of games, which have a significantly higher mark-up, as well as subscriptions and passes.

For retailers, that means consoles are usually low margin items. They can even afford to sell the hardware at a discount because they expect to recoup any loss easily, including through sales of higher margin product lines.

“Some of the biggest retailers have always come to cosy arrangements with Nintendo and Sony, selling each unit at a loss and recouping their money via marketing deals,” says Ian Finch, founder of Click Europe, a UK seller and distributor of toys, games and gadgets.

Unlike the big retailers, small specialists aren’t in a position to cut the price of consoles. But the current shortage can actually benefit the smaller players, as Finch explains.

“Under normal circumstances, these large chains never run out of stock and will always outprice us,” he says. “But these days, when hardware is like gold dust and the big stores have empty shelves, customers are prepared to pay the recommended retail price. This obviously works in our favour.”

Hardware is like gold dust and the big stores have empty shelves – customers are prepared to pay the recommended retail price

In general, Click Europe doesn’t stock many new generation console units, because “they represent a high layout for their relatively small profit margin.” The company does, however, sell plenty of games for old generation consoles. This too can work in its favour, especially if some of these titles are no longer offered by the big retailers.

“Those customers that can’t get hold of the Playstation 5 or Xbox Series X are choosing instead to buy games for their existing systems [Playstation 4 or Xbox One],” says Finch. “We’re able to offer really attractive prices on these because with games we have a decent margin to play with.”

While Finch doesn’t go into specifics on how the chip shortage is impacting Click Europe’s pre-Christmas sales, he’s keen to point out that there’s been an “upside to the disruption in the market”.

Consumer appetite

The shortages that have been blighting the retail industry are set to continue beyond the festive period, with no guarantees on when the chip crisis will end.

“Based on the typical cycles in the chip industry – and the planned new [production] capacity coming online – it’s likely that the situation will get better through 2022,” says Naus. However, he doesn’t expect the industry to return to oversupply until 2023 or 2024.

What this means for retailers depends on the products they sell and how much of a priority they are for chip manufacturers. While some retailers may not be enjoying the usual seasonal boost in sales of consoles and toys given the lack of availability and products on offer, consumer appetite won’t wane and pent-up demand will be high. Shoppers will be eager to get their hands on a bargain once stock levels return to some level of normality.

Previous Story

- Carmakers accelerate creativeness to make up for global...

- Chip maker TSMC, Sony partner on new plant...

- South Korean chipmakers will submit semiconductor data to...

- Tencent launches three new chips as China’s tech...

- Why Qualcomm’s supply issues are ‘in the rear...

- Chip crisis: Christmas shoppers face disappointment, Arm boss...

- Chip maker backed by Mubadala set for new...

- Decentralised finance can increase economic freedom, Bitcoin.com chief...