An expansionary monetary policy or nothing

Image collected

At times of recession, it really is all too tempting to axe jobs or go for pay cuts for self-preservation.

If all companies think in this manner, then it puts the financial locomotive that could pull the nation out from the crisis grind to a halt, and actually, give rise to a chicken and egg situation.

It includes a fierce reverse-hit to the professional production as staff usually buy the most products from the market given that they outnumber the other segments in society.

The demand for products declines as a result of purchasing power of staff when they lose jobs or saw a earnings cut.

Factory owners are finally forced to squeeze the production when goods are stuck in the market that contracts their profit further.

German philosopher Karl Marx depicted the problem in his essay titled "Wage, Labour and Capital" in 1849.

The ongoing financial recession due to the coronavirus pandemic in addition has created the same consequence for the economy.

Bangladesh hasn't faced such an financial fallout, meaning the central bank in a good spot since it draws up the monetary policy statement (MPS) for fiscal 2020-21.

The MPS is scheduled to be unveiled in the last week of July.

"We are in a difficult situation due to the twists and turns of the pandemic," said a central bank official.

Probably, the Bangladesh Bank will need on an expansionary monetary policy stance that the other nations have previously adopted, he said.

The new MPS should give all-out effort to boost the dwindling demand, which includes been hit hard by the financial meltdown.

The federal government has set a GDP growth target of 8.2 % and an inflationary target of 5.4 per cent because of this fiscal year.

The central bank will attempt to achieve both the targets by implementing the brand new monetary policy, the state said.

Ensuring the mark of the private sector credit growth is very important for another fiscal year as it can be a driving force in generating jobs and demand.

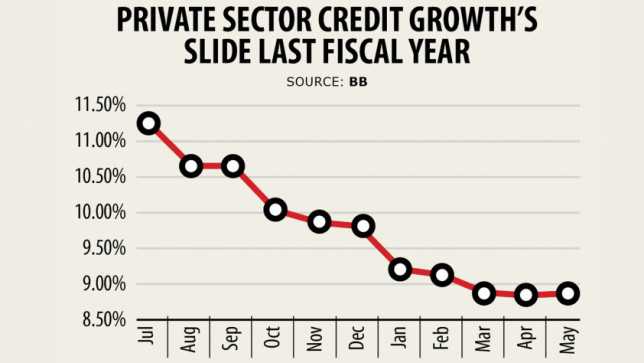

The credit growth stood at 8.86 % in May, which is a lot lower than the mark of 14.8 % for fiscal 2019-20.

Although the central bank has yet release a the data of the credit growth for June, the prevailing trend has given an indication that the BB is far away from the target.

The central bank won't set a target for the private sector credit growth that's lower than in the just-concluded fiscal year, as a way to noticeably raise the confidence of businesspeople.

"Setting private sector credit growth won't create anything. Rather, the central bank should target implementing the stimulus packages properly to revive the economy," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The BB will need to inject a sizable amount of reserve money (RM), or high-powered money, in to the financial market to handle the ongoing crisis, he said.

The RM may be the base level for money supply in fact it is also the high-powered element of the money supply. The broad money, which is multiple of RM, depends on the quantity of the RM as well.

Both government and the central bank have announced several stimulus packages involving a lot more than Tk 103,117 crore, which is 3.7 per cent of the country's gross domestic product, to greatly help industries, exporters, farmers and SMEs ride out the crisis.

Nearly all stimulus packages will be implemented by the central bank.

"It has added extra pressure for the central bank and banks as the federal government has taken little fiscal measures to mitigate the recession," said Mansur, a former senior official of the International Monetary Fund.

In addition, the federal government has set a borrowing target of Tk 84,980 crore from the banking source for the existing fiscal year.

The federal government should borrow more from the central bank to provide an area to the private sector, Mansur said.

The central bank had fixed 12 per cent RM target and 13 % broad money for fiscal 2019-20. Both targets may be widened to a big extent because of this fiscal year.

Inflation will not increase alarmingly in the days to come in the wake of the demand fall. However the food inflation may rise as the ongoing floods have previously beaten up many paddy fields, Mansur said.

"The cost of the staple is maintaining an upward trend. So, the federal government should immediately take an initiative to import one million to two million tonnes of rice as a way to control inflation."

There is uncertainty about when the global economy can make a turnaround, therefore the central bank should concentrate on the local economy.

The industries dedicated to manufacturing goods for the neighborhood market ought to be given importance. The SME sector will play a crucial role in boosting the economy where a sizable number of workers are employed.

If SMEs reunite its tempo, the economy will be able to enjoy its momentum.

But Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said lenders would not feel encouraged to provide out loans to the SME sector at 9 %.

Banks can make little profit against their SME lending as the operational cost is high, he said.

The central bank should rethink about the interest cap on all lending products as operational cost and risk vary predicated on the characteristics of different sectors, he said.

Hussain also criticised the government, saying it had almost completed all the tasks of the central bank while unveiling the cover fiscal 2020-21.

The targets on inflation, GDP and credit to the general public sector usually are set by the government through the budget sessions.

But this time, in addition, it unveiled a credit growth target for the private sector, which is highly unusual, he said.

According to the medium-term macroeconomic policy statement of the federal government, the credit growth in the private sector was set at 16.7 %.

"If all works are done by the finance division, then your central bank could have nothing to do," Hussain said.

The BB might not exactly follow the mark set by the finance division, said a central banker requesting anonymity to speak candidly on the problem.

Source: https://www.thedailystar.net

Tags :

Previous Story

- New law more likely to cut Bangladeshi jobs...

- Outcomes of 38th BCS exams out: 2,204 to...

- Steps had a need to develop skills for...

- Bangladesh to consider easing age restrictions for jobs...

- Rohas Tecnic bags power line jobs worthwhile RM192m...

- CSE, IT graduates getting more jobs

- Economic Slowdown: Tirupur Garment Industry Gasps for Survival

- High growth, fewer jobs