BB move brings stocks back on track: DSEX returns to its 5,000 points level

Image collected

On Monday, DSEX gained 79.26 points or 1.61% to settle at 5,000.23. Turnover rose to Tk517 crore, which was 70% higher than the previous day’s Tk305 crore. It was also the highest turnover in more than one month since August 21, when turnover was Tk542 crore

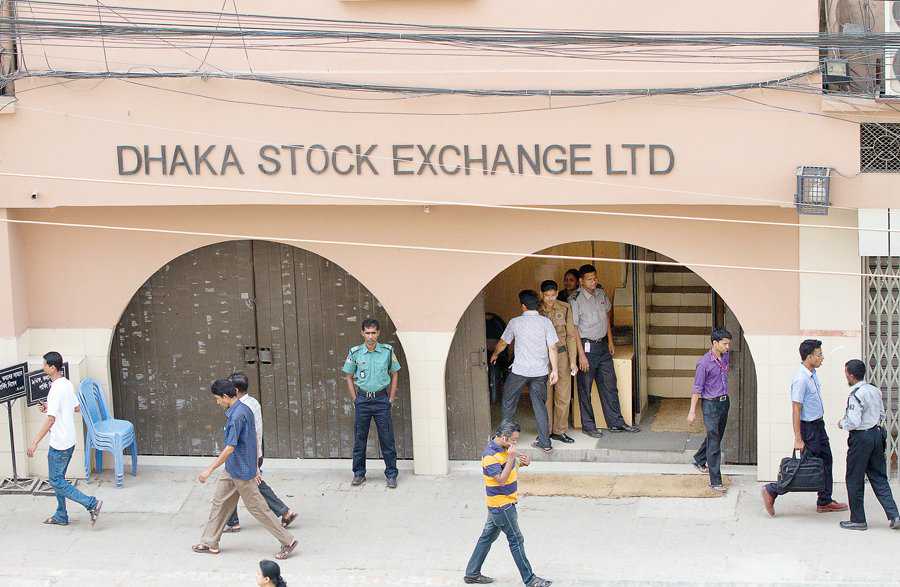

DSEX, the key index of Dhaka Stock Exchange (DSE), is back at its 5,000 points level as the market, after months of downtrend, now feels upbeat by the central bank announcement that it will extend liquidity support to banks for investment in stock market.

On Monday, DSEX gained 79.26 points or 1.61% to settle at 5,000.23. Turnover rose to Tk517 crore, which was 70% higher than the previous day’s Tk305 crore. It was also the highest turnover in more than one month since August 21, when turnover was Tk542 crore.

At the end of the day, market-cap of the DSE also rose to Tk 3,79,000 crore from Tk 3,74,000 crore of the previous session.

Bangladesh Bank's decision to provide liquidity support to the scheduled banks for investment in capital market has given investors the badly required confidence, which was dwindling for a long time, market operators have said.

As a result, they say, market participation from investors has seen a significant upsurge which carried the DSEX upwards.

EBL Securities in its daily market commentary said that investors exerted buying pressure on the bank, food and allied, and the financial institution sectors.

Earlier on Sunday, the central bank announced in a circular that fresh liquidity support would be given to banks to raise their respective portfolios in the capital market up to the regulatory limit directly or through subsidiaries.

According to the circular, issued by the Department of Offsite Supervision (DOS), banks will get the liquidity support through special repo (repurchase agreement) facility at a rate of 6% interest for a 28-day period, which may be extended in rotation up to maximum six months.

About the BB move, DSE Director Rakibur Rahman told Dhaka Tribune that this was a good initiative to make the capital market vibrant. The initiative impacted the market positively today (Monday), he said.

“Now is the perfect time to buy shares of fundamental companies,” said Rakibur Rahman.

Talking to this correspondent, a top official of stock brokerage said that the government and largest listed company, in terms of paid-up capital, Grameenphone have reached a consensus over settling the long disputed audit claims amicably which made investors optimistic.

As many as 5, 57,365 shares in GP were traded yesterday at the DSE. The market value of the traded shares was Tk20 crore. The GP closed the day at Tk362.8 per share, up from Tk360.5 per share in the previous session. The stock gained by 0.92% or Tk 3.3.

Earlier on Wednesday, Finance Minister AHM Mustafa Kamal said the dispute over the telecom regulator’s audit claim of around Tk12,500 crore against GP was likely to be settled within the next two to three weeks through discussions.

According to the DSE data, in a span of five months, GP’s share sank 30.70% to Tk289 on September 4, the lowest ever of the mobile phone operator.

The share price of the company was Tk472 on January 1 last year and it finished the year at Tk367.3 per share. GP’s share price was Tk364 on June 30 this year.

Market operators have said the continued fall in price of GP affected the overall market and market capitalization. The price of shares in GP in the DSE leapt as investors felt assured of Wednesday’s announcement of amicable solution.

Requesting anonymity, a stock broker said the recent operations against casinos also drove many people to invest their money in the stock market.

Former chairman of Bangladesh Securities and Exchanges Commission (BSEC) Faruq Ahmed Siddiqi told Dhaka Tribune that BB’s circular positively impacted the market but it would not last long.

“Ensuring good governance in the stock market is now the vital thing for sustainable stock market,” he added.

Meanwhile, the port city’s bourse, the Chittagong Stock Exchange, yesterday also ended higher with its All Shares Price Index (CAPSI) – CASPI- soaring 272 points to close at 15,218 and the Selective Categories Index - CSCX –advancing 165 points to finish at 9,241.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- BB offers fresh liquidity for banks to prop...

- ADB lifts growth estimate to 8.1pc

- Sugar price rises makeshift in port city

- Stocks rise riding on insurance sector

- Stocks rise after 2-day plunge on tax proposal...

- Bangladesh garment manufacturers seek higher export subsidies

- Long on promises, short on specifics

- The Update on the FY20 Budget Stated by...