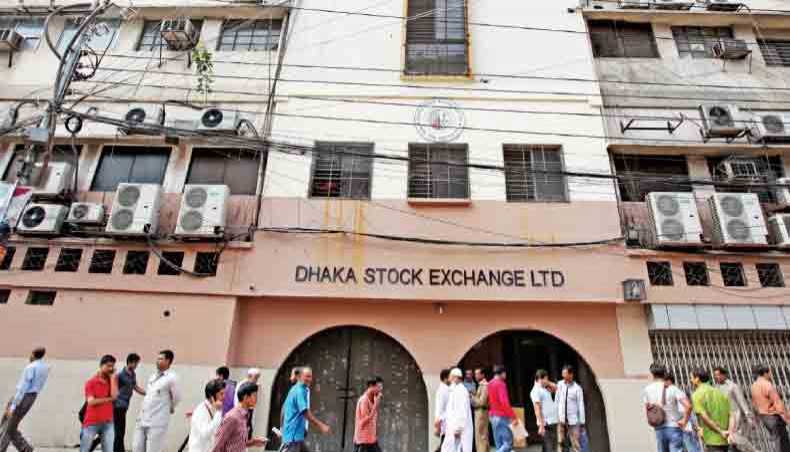

Dhaka stocks’ bear run stretches to 4th week

Image collected

Dhaka stocks’ bear run continued for the fourth week as a section of panicked investors kept selling shares and many others stayed on the side lines before the year end.

DSEX, the key index of the Dhaka Stock Exchange, lost 0.85 per cent, or 38.00 points, over the past week to close at 4,418.84 points on Thursday, the last trading session of the week.

The DSEX has lost 313 points in the last four weeks.

The week was shortened to four sessions as the market was closed on December 25 for Christmas.

In line with the trend seen in the week before, the DSEX dropped in the first three sessions as a section of investors continued selling shares in apprehension of further falls in share prices.

In the last four weeks, the DSEX saw only five positive days as the market was gripped by jittery sales.

Many investors rushed for exit on seeing no signs of the market recovering from its relentless plunge.

The investors remained nervous on seeing the government, the regulator and intermediaries sitting idle while the indices were kept hitting record lows every other day.

The market has been bearish for the last 11 months that caused DSEX to fall by 1,528 points and the DSE market capitalisation by Tk 80,412 crore.

Some investors preferred to stay on the side lines to see how the market fares ahead of the year end.

The daily average turnover on the DSE plunged to Tk 269.76 crore in the past week from Tk 279.73 crore in the week before.

Out of the 12 multinational companies, share prices of 10 dropped while those of just two gained over the past week.

The market gained during the last session of the week on Thursday after some institutional investors opted to go for bargain hunting, they said.

Besides, DSE officials said that finance minister AHM Mustafa Kamal would meet with the directors of the bourse on January 2 and the news had drawn attention of some investors.

Investors were assessing the Bangladesh Bank’s decision taken on Thursday to lower the interest rate for the export-oriented industrial manufacturing sector to 9 per cent from January 1, 2020.

The capital market has been entangled in issues including volatility in the financial sector, gloomy economic reports, selling of shares by the foreign investors and lack of confidence in the regulatory body.

Continued share sales by the foreign investors were making things worse for the ailing capital market. The foreign investors have withdrawn around Tk 970 crore from the capital market in the last 10 months.

EBL Securities in its weekly market commentary said that the Blue chip index, DS30, which comprises 30 prominent companies, hit almost a seven-year low on Sunday this week. ‘Trusted securities are also not spared from the restlessness in the market.’

‘Most of the large cap stock by capital shed points which dragged the market below psychological benchmark of 4,400 points. Meanwhile,’ the commentary said.

Average share prices of textiles, telecommunication, bank and non-bank financial institutions sectors dropped by 2.6 per cent, 2.2 per cent, 1.5 per cent and 0.9 per cent respectively.

Share prices of energy and engineering sectors advanced by 2.3 per cent and 0.2 per cent respectively.

Out of the 356 scrips traded last week, the prices of 229 declined, 90 advanced and 37 remained unchanged.

Shariah index of the bourse DSES shed 0.26 per cent, or 2.58 points, last week to close at 994.90 points.

DS30, the blue-chip index of the DSE, lost 0.30 per cent, or 4.52 points, and closed at 1,508.95 points.

Khulna Power Company led the turnover chart for the third consecutive week with shares worth Tk 35.96 crore traded over the past week.

Square Pharmaceuticals, Ring Shine Textiles, Beacon Pharmaceuticals, National Life Insurance Company, Paramount Textile, Sinobangla Industries, Standard Ceramic Industries, Golden Harvest Agro Industries and Genex Infosys were the other leaders on the turnover chart.

Anlima Yarn Dyeing performed the best during the past week with an 18.13 per cent increase in share prices while Aziz Pipes lost the most, shedding 12.76 per cent points.

Source: http://www.newagebd.net

Tags :

Previous Story

- Dhaka stocks sink for 2nd week on panic...

- Dhaka stocks fall on profit taking

- DSE election shareholder directors polls Dec 29

- Dhaka stocks dip for second week

- Dhaka stocks add 12 points in 3 days...

- Nine companies relegated to ‘Z’ category

- Treasury bond trading on DSE to be activated...

- Dhaka stocks rise amid continuous see-sawing