Double whammy for apparel exporters for the second wave, lessen price

Image: Collected

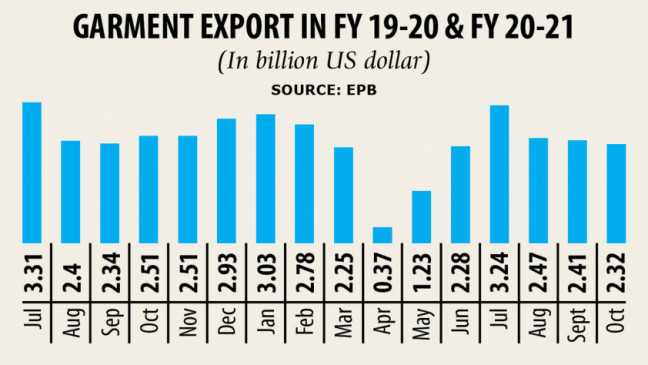

The garment sector fared well in the first quarter of the existing fiscal year because of the reopening of western shops after a pause for some months because the Covid-19 outbreak.

But now the risk of a possible second wave of the deadly virus and a price cut from the buyers in an excuse of low demand from the end-customers are holding back the recovery of the multi-billion-dollar industry.

The neighborhood exporters are fearing a slow recovery of apparel shipments as many buyers are planning twice before putting work orders taking into consideration the second wave.

With the havoc in the supply chain, the perennial shock of offering lower prices by the buyers has been emerging as a double whammy for the exporters.

Between January and October this season, the common price of garment items shipped from Bangladesh declined by 2.43 per cent, according to data from the National Board of Revenue, Eurostat and OTEXA.

Of the decline, 1.04 % happened in EU markets and 3.28 % in the US markets during this time period, in line with the data.

Now, the exporters are simply trying to remain afloat amid the shock of order cancellation and abnormal deferment of payment.

Many international retailers and brands have demanded even 220 days of deferred payment, although they signed contracts for 3 months in the letters of credit.

"We didn't cancel work orders for the next wave. We are just adjusting our stocks," said a European buyer wanting to remain unnamed.

"Where needed we are placing late. But in 90 % cases we are positioning orders. There is a rumour that we are not placing orders, which isn't true."

Everyone has been facing the same challenge -- a minimal level of work orders and low prices, said Anwar-ul-Alam Chowdhury Parvez, managing director of Evince Group, a respected garment exporter.

Buyers have grown to be very cautious about inserting work orders, he said.

So, a lot of local suppliers have missed the annual sales bonanza centring the Christmas to some extent, as many important export destinations have previously announced partial lockdowns to keep the virus away, he said.

The demand for woven garment mainly declined although the demand for knitwear items is still there. Food items have now replaced apparels in the customers' priority list, he said.

Moreover, the western retailers are actually concentrating more on saving capital rather than choosing new orders, he added.

Parvez hoped the arrival of vaccines available in the market may bring back confidence.

The export of health safety related clothing items has been increasing, he said.

"So, while the industry struggles to retain 1-2 % as income, and before pandemic there is absolutely no question of earning a profit, such decline in prices is very frightening, especially if we make an effort to draw a generalised knowledge of the financial health of the industry and its own resilience to turn around," said Rubana Huq, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

A business playing on a thin margin isn't supposed to bear out such an enormous blow for years, she said.

The decline in prices is a long-drawn-out trend and the Covid-19 has only worsened the problem, she said.

Although garment export declined by 1.79 per cent despite an over 30 % rise in the cost of production within the last five years, the price has fallen by 5.23 % in September and by 4.15 % in October, she added.

"If we analyse our major export markets, it reveals the same story."

The US apparel import price from Bangladesh has declined by 1.84 % and the EU's by 1.64 per cent during 2014-2019, Huq said in a WhatsApp message to The Daily Star.

"We started losing unit values in the US since February which reached 9.77 % in the negative in July. That is probably unprecedented and can't be explained by any logic of business."

A similar picture was observed in the case of the EU earlier this season where in fact the price decline was recorded as high as 4.49 % in one month.

In Bangladesh, the wages have hiked, vast amounts of dollars have already been invested under factory safety remediation programme since 2013 and factories 're going green according to the prescription of the US Green Building Council, which requires huge capital investments, she said.

"So, such a drop in prices can't be justified at the same time when companies are spending big on maintaining hygiene and social distancing with their ongoing fight to recover the losses due to the coronavirus."

"Buyers have not yet cancelled payments in this second wave."

But shipment is being deferred for per month as buyers are reviewing their market situation, said the BGMEA chief.

"We are observing this with caution as further deferment is feared that will affect the money flow of factories."

Huq also said new order placements are completely on hold, this means very soon factories will have a whole lot of idle capacity to cope with.

"And due to this, a financial meltdown in the sector looks imminent."

As much as 39 per cent of the Bangladeshi garment exporters accept prices below their production costs for the sake of business relations with international retailers, according to a research paper.

Mark Anner, a professor at the University of Pennsylvania, conducted the study on "Squeezing workers' rights in global supply chains: purchasing practices in the Bangladesh garment export sector in comparative perspective".

Source: https://www.thedailystar.net

Previous Story

- The EU should never let Bangladesh’s personnel down

- EU trade benefits may continue even after LDC...

- EU travel ban on 15 nations goes

- Bangladesh no longer eligible for Schengen visa

- Signing of FTAs with trading partners essential

- Service charge on export consignments likely

- Member of European Parliament praises Bangladesh economic process

- Shahriar Alam discusses trade issues with member of...