Investment in Bangladesh govt securities fetches record profit for Commercial Bank of Ceylon

Image: Collected

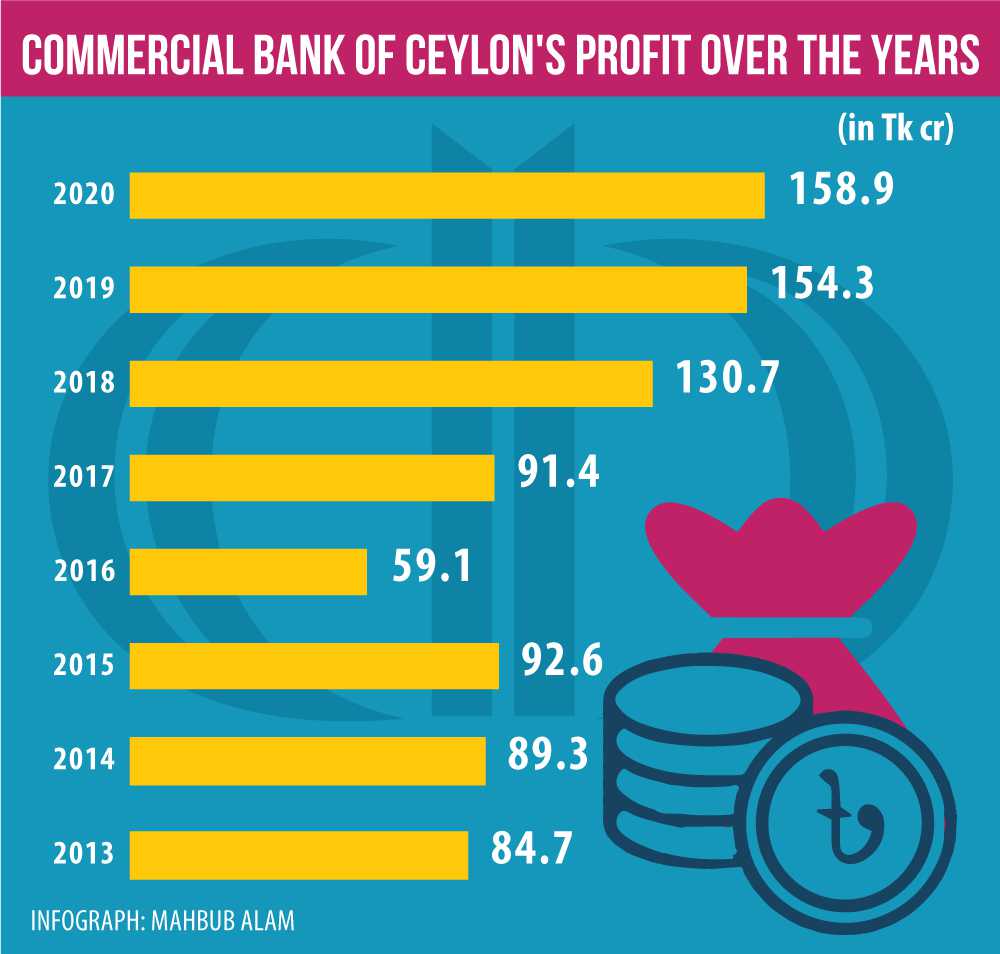

The lender logged in a profit of Tk 158.9 crore for 2020, which is its highest yet in 17 years of its procedures in Bangladesh.

The Bangladesh subsidiary of Commercial Bank of Ceylon edge up 3 % in 2020, in a mirror image to its parent company, which saw its profit shrink 3.8 per cent on higher provisioning requirement of the pandemic.

The bank, which gives full-fledged retail banking, logged in a profit of Tk 158.9 crore for the entire year, which is its highest yet in 17 years of its procedures in Bangladesh.

The profit was because of higher investment income, which offset losing from reduced lending opportunities for the pandemic.

Its investment income soared 2.8 times to Tk 136.5 crore as the bank poured in money generously on Treasury bills and bonds.

Its net interest income contracted about 25 % to Tk 143.6 crore on reduced lending opportunities for the pandemic.

Towards the end of 2020, its loans and advances stood at Tk 5,539.5 crore, up 15.4 per cent from a year earlier.

Its default loan ratio is 0.6 %, down from 0.75 % in 2019 -- exceptional as the banking sector’s average is 7.7 %.

It kept a provisioning of Tk 14.2 crore in 2020, which is more than double that from a year earlier, although the Bangladesh Bank had put a bar on loan classification for 2020.

Its deposits swelled 12.4 % to Tk 5,100 crore.

The bank, which includes 11 branches, two offshore banking units and 6 SME centres, has a loan-deposit ratio of 77.48 per cent at the end of 2020, up from 75.33 per cent a year earlier.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- Women entrepreneurs need particular financial support: experts

- Bank of America to attain net-zero emissions before...

- 'Bangladesh has the virtually all complicated LC opening...

- BB brings changes in MPS for FY21

- Monetary policy issue of Bangladesh Bank

- Rules need further reforms for steady global trade...

- The future of mobile financial services in Bangladesh

- Pandemic kills appetite for credit among businesses