Japanese companies very thinking about Bangladesh: envoy

Image collected

The Bangladesh government needs to take proper care of Japanese companies operating here to attract more foreign direct investment (FDI) from the island country as much business entities are waiting to bring in investment, said Japanese Ambassador to Bangladesh ITO Naoki yesterday.

Currently, 310 Japanese companies are operating in several sectors in Bangladesh. Very often they complain about not obtaining the same facilities provided to local companies by the federal government.

For instance, when the federal government disburses any loan facility or cash incentives on export, foreign companies usually do not benefit from the same benefits enjoyed by the neighborhood companies.

"We have a long set of Japanese companies which may have already invested in Bangladesh and several are waiting to get here," Naoki said.

He was addressing a virtual meeting on "Implications of COVID-19 on FDI inflow to Bangladesh: Challenges and Way Forward" organised by the Dhaka Chamber of Commerce and Industry (DCCI).

"The level of interests by Japanese companies to purchase Bangladesh is not changed. They will be ready to come to Bangladesh for investment."

The ambassador also said some 55 % of Japanese FDI was received by 10 members of the Association of South-East Asian Nations (ASEAN) while of the full total FDI, Bangladesh received only 0.09 % last year.

Easing the business terms and conditions for Japanese companies, causing regulatory reforms and taking good care of the existing Japanese companies are needed for attracting more Japanese investment here.

JAPAN envoy also said it is important to carefully turn the special economical zone (SEZ) for Japanese investors in Araihazar in Narayanganj into the number 1 zone in Asia and an important zone from among those in ASEAN countries.

Outward investment by Japanese investors declined 33 per cent year-on-year to $113 billion between January and June this season as a result of the coronavirus pandemic, said Yuji Ando, country chief of Japan External Trade Organisation.

That indicates that the firms are struggling to survive incurring losses in this situation, he said.

Japanese investors always complain about the tax and business environment issues in Bangladesh. Ando said motorcycle production is an extremely important sector for investment by Japanese investors in Bangladesh.

Currently, some 5,00,000 motorcycles are produced within Bangladesh, he said, adding that the number could be increased a whole lot as the demand is there.

Virtually all big US companies have their businesses in Bangladesh and much more were interested to invest here, said JoAnne Wagner, deputy chief of mission of the US Embassy in Bangladesh.

Agricultural food processing industries are incredibly interesting areas of investment in Bangladesh for American investors.

Labour rights improvement, safety and corruption are issues of concern for all of us investment in Bangladesh, she added.

Immediate reforms are needed in customs and transfer of gain the foreign companies and curbing corruption for bringing more FDI, said Paban Chowdhury, executive chairman of the Bangladesh Economic Zones Authority (BEZA).

Although China allowed duty-free usage of 97 per cent of Bangladeshi goods, the worthiness addition by Bangladesh would have to be 40 per cent.

"So it might not be very simple and simple to enjoy the full advantages from the Chinese duty exception offer."

The united states also needs more seaports, Chowdhury said, while citing Vietnam's 44 seaports to help expand his point.

"We need a congenial business environment," said Syed Ershad Ahmed, president of the American Chamber of Commerce in Bangladesh (AmCham).

Sometimes, the contradictory policies of industries and commerce ministries affect the business.

"Sometimes, we are harassed by the National Board of Revenue. Protection of intellectual property rights and port management are incredibly important issues for Bangladesh now," Ahmed added.

Vietnam received the best amount of FDI from Japan, said Abul Kasem Khan, chairman of the Business Initiative Leading Development (BUILD).

"China's duty-free offer could be a game-changer for Bangladesh in the event of attracting FDI."

Fast-tracking of the special economical zones is necessary and Bangladesh needs to invest $300 billion for bettering its infrastructure, he added.

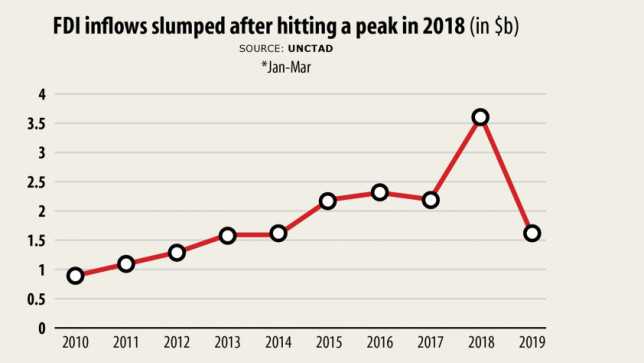

While presenting a keynote paper, M Masrur Reaz, chairman of Policy Exchange, said the global FDI, based on the United Nations Conference on Trade and Development, would plunge 40 % in 2020 and by another 5 % to 10 % in 2021.

Global FDI will flunk of the $1 trillion-mark for the very first time since 2005. Moreover, developing countries of Asia may face lower investment flows of up to 45 %, he said.

Bangladesh must improve in a few areas for gaining competitiveness like innovation, infrastructure, market efficiency, technological readiness and business sophistication.

"We've a $350 billion investment gap in infrastructure. Private investment to GDP ratio should be 26.6 %."

However, Bangladesh has been maintaining impressive economic performances and high potential to progress FDI inflow.

Bangladesh has many strengths for foreign investors to leverage like high growth rate, sound macro-economic management, demographic dividend, liberal policies, strategic geographic location, affordable and flexible labour market and preferential market access.

But to woo more FDI, some critical areas need focus such as compliance, skilled labour force, easy cross-border movement of goods and coherence between trade and investment policies.

To increase the investment climate, Reaz suggested policy actions and reforms like access to finance, regulatory reforms, a faster pace of mega infrastructure development, simplification of the tax regime, developing FDI policy and export diversification.

The FDI to GDP ratio in Bangladesh is 1.2 per cent, which is significantly less than that of India, Sri Lanka, Vietnam and Cambodia, said DCCI President Shams Mahmud, while moderating the discussion.

Out from the total FDI stock, the united states received the highest $3.8 billion FDI in gas and petroleum sector where in fact the US is the most significant investor with $3.6 billion, followed by the united kingdom, South Korea, holland, China and Japan.

Fast customs clearance facility is more important for investors, said Ruhul Alam Al Mahbub, managing director of Samsung-Fair Distribution.

Infrastructure development, building confidence among local investors, policy consistency, removal of bureaucracy and political stability were key to attracting FDI, he added.

Land registration is a crucial issue that needs to be addressed, said ASM Mainuddin Monem, deputy managing director of Abdul Monem.

He emphasised on better coordination among the BIDA, BEZA and land ministry and called for a congenial policy regime that ensures a level playing field for private monetary zone owners.

The pandemic would open up opportunities of foreign investment relocation, Monem added.

Investment should be encouraged in the energy and infrastructure sectors, said Asif Ibrahim, chairman of the Chittagong STOCK MARKET and a former DCCI president.

The government's plan of establishing 100 SEZs will boost FDI. Public-private partnerships and resolving the policy constraints will bring about a newer height.

The recent move by the federal government to permit non-resident Bangladeshis to invest in mutual funds is a part of the right direction.

Terming the Bangla Bond a great initiative, he said such innovative ideas would help entrepreneurs raise funds.

A reduction of tax for investors would ease their arrival, but alternatively, Bangladesh's tax to GDP ratio is the lowest in your community, said Salman Fazlur Rahman, private industry and investment adviser to the prime minister.

"We must widen our tax net to help ease the burden on the prevailing taxpayers. We will reform the bankruptcy law and companies act soon," he said.

The adviser said Japan has wanted to modernise the Kamalapur Railway station to bring about a multimodal transportation system.

Rahman admitted petty corruption in government mechanisms and corruption in the political parties at the mid-level.

For example, corruption has been occurring in land registration and while getting licences from different government offices, he said.

Source: https://www.thedailystar.net

Previous Story

- Bangladesh needs free trade agreement with the UK

- Factories moving from China: Possibilities for FDI in...

- Learn from Vietnam to offset export shocks

- UK envoy: Though badly damaged, fundamentals of Bangladesh...

- Bangladesh programs redesigned incentive package for post-pandemic FDI...

- Access to finance, corruption key issues for business...

- Economic diplomacy, governance essential to boost growth

- Investments into key Islamic economies Indonesia, Saudi Arabia...