Most listed banks' profits tumble in Q3

As many as 60 percent of the banks listed on the stock exchanges have seen their profits tumble in the third quarter of the year because of higher provisioning requirement against default loans, lower interest rates and slow credit growth.

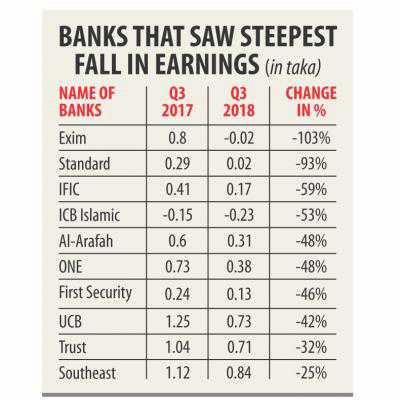

Of the 30 banks listed, 18 saw their earnings per share (EPS)—an indicator of profitability—plummet between the months of July and September. EPS informs how much money shareholders would receive for each share of stock they own if the company distributed all of its net income for the period.

Al-Arafah, Brac Bank, Dhaka, Exim, First Security, IFIC, Islami, Mercantile, One, Premier, Prime, Rupali, SIBL, Southeast, Standard, Trust and UCB saw their EPS to decline, according to the data from the Dhaka Stock Exchange.

ICB Islamic Bank posted higher losses this quarter.

“Bad performance, bad management and bad governance led the profits to tumble,” said Salehuddin Ahmed, former governor of Bangladesh Bank.

All the banks are saddled with large amounts of bad loans, so they have to keep provisioning against them.

“This ate into the profits.”

Some banks are averse to providing loans ahead of the national election fearing political tension, which has slowed down credit growth.

“As credit growth rate has lowered, so has the banks' income. On the other hand, their operating costs have not declined, so profits fell,” Ahmed added. Exim Bank's EPS declined the most this quarter: by 103 percent year-on-year to Tk 0.02 in the negative.

The shariah-based bank incurred losses this quarter, in contrast to profits a year earlier.

“Exim Bank's income was mostly hit by the sector's decision to lower the interest rates,” said its Managing Director Mohammed Haider Ali Miah, adding that most of the banks' profits were impacted by the decision.

From July 1, both public and private banks decided to lower the interest rate on lending to 9 percent and that on deposits to 6 percent.

Syed Mahbubur Rahman, chairman of the board of governors of the Association of Bankers, Bangladesh, said the main hit came from the provisioning on bad loans.

“As the loan quality in the banking sector falls their costs rose.” As of June, total default loans, including non-performing and written-off ones, is Tk 131,666 crore, which is equivalent to 73 percent of the country's development budget this fiscal year and more than double the government's borrowing target from external sources.

More importantly, private banks' default loans soared 32.58 percent to Tk 38,975 crore in the first six months of 2018.

“Some banks do not get deposits at 6 percent interest but they have to give out loans at 9 percent, so the interest income declined in the quarter. Credit growth also fell during this time, so interest income was hit by the lower growth rate too,” said Rahman, also the managing director of Dhaka Bank.

Credit growth stood at 14.67 percent in September, the lowest since December 2015 when the growth was 14.19 percent, according to data from the central bank.

This growth was more than two percentage points less than the central bank's target of 16.8 percent for the first half of the fiscal year. On the other hand, 12 banks saw their EPS to grow.

Dutch-Bangla Bank posted the highest EPS this quarter among the banks (Tk 5.17), while Mutual Trust Bank's EPS soared the most (345 percent).

Source: https://www.thedailystar.net

Tags :

Previous Story

- Bangladesh comes last in South Asia

- Bangladesh, World Bank sign deal for cash transfer

- Submarine Cable Company records lowest profit

- ISFD to lead solar energy revolution in Bangladesh

- Banking loopholes limit potential of stockmarket

- Cyber criminals steal bank card details of 380,000...

- AIIB keen to invest in water management, communication...

- Canada: Expect Strong Growth As Tariff Bruises Are...