Most of mutual funds suffer profit fall in FY18

Profits of most of the closed-end mutual funds declined in the financial year of 2018 compared with that in the previous financial year due to a bearish trend at the market.

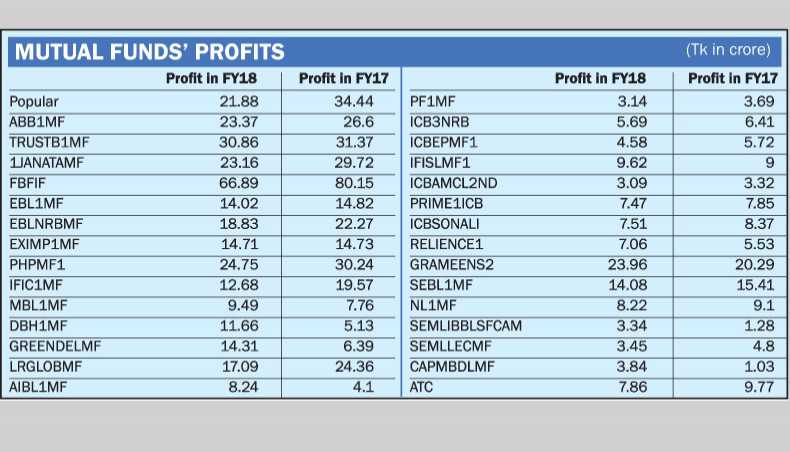

Out of the 30 mutual funds, earnings per unit of 21 mutual funds declined while EPU of nine mutual funds advanced in the year of 2018.

Experts said the capital market was mostly bearish in the second half (January-June) of FY 2017-18 that affected the mutual funds’ profits.

The key index of Dhaka Stock Exchange, DSEX, lost 4.43 per cent or 250.59 points in FY18 compared with that in FY17.

The average turnover at the bourse declined to Tk 646.6 crore in last financial year compared with that of Tk 755.3 crore in the previous financial year.

The returns of mutual funds depend on the movement of the capital market as most of their assets under management must be invested in the capital market as per securities rules, experts said.

Besides, the asset managers were not capable enough to manage the funds effectively, they said, adding that effective management was the key to making the mutual funds attractive and profitable.

Stockbrokers said investors had remained depressed about the mutual funds since the market crash in 2010-2011 as most of the mutual funds failed to perform up to the investors’ expectation.

Market experts blamed regulator Bangladesh Securities and Exchange Commission for the situation saying that it was not seen taking any fruitful initiative to make the sector lucrative to both the investors and asset managers.

On September 16, BSEC allowed extension of tenure of all the existing closed-end mutual funds by up to 10 years despite knowing the legal complexities over such extension.

According to the BSEC mutual fund rules, a mutual fund is required to distribute its profit by way of dividend either in cash or re-investment units or both to the holders of the units after the closing of the annual accounts an amount that must not be less than 70 per cent of annual profit earned in that year.

Therefore, making lower profits for a year ultimately affects the investors.

Of the 29 listed mutual funds which maintain the July-June accounting year, just six declared higher dividends, 16 announced lower dividends, six mutual funds declared the same rates what they had given in the previous year and one mutual fund was yet to announce dividend.

Profits of all the 10 mutual funds under RACE Asset Management Company declined in the financial year 2017-18.

Profits of seven out of eight mutual funds under ICB Asset Management Company declined in 2018.

Due to the investors’ decreased attention, most of the mutual funds witnessed decline in their unit prices after dividend declaration and have been traded below their net asset value per unit.

The units of 30 mutual funds have been trading far below their issue prices, reflecting investors’ lack of interest for the MFs, experts said.

Source: http://www.newagebd.net

Tags :

Previous Story

- Summit to invest $8m in India to improve...

- ISN, Kay & Que declare dividends after 5...

- Bangladesh’s burgeoning pharmaceutical sector: Ruling local market, stock...

- Stocks close week down

- 90 more DSE members receive sales proceeds

- Banks' earnings per share saw fall in Q3

- Power sector shares dominates DSE turnover chart

- Stocks gain for 3rd day on regulator’s move