Nanotechnology in Medicine: Regulatory trends

Collected Image

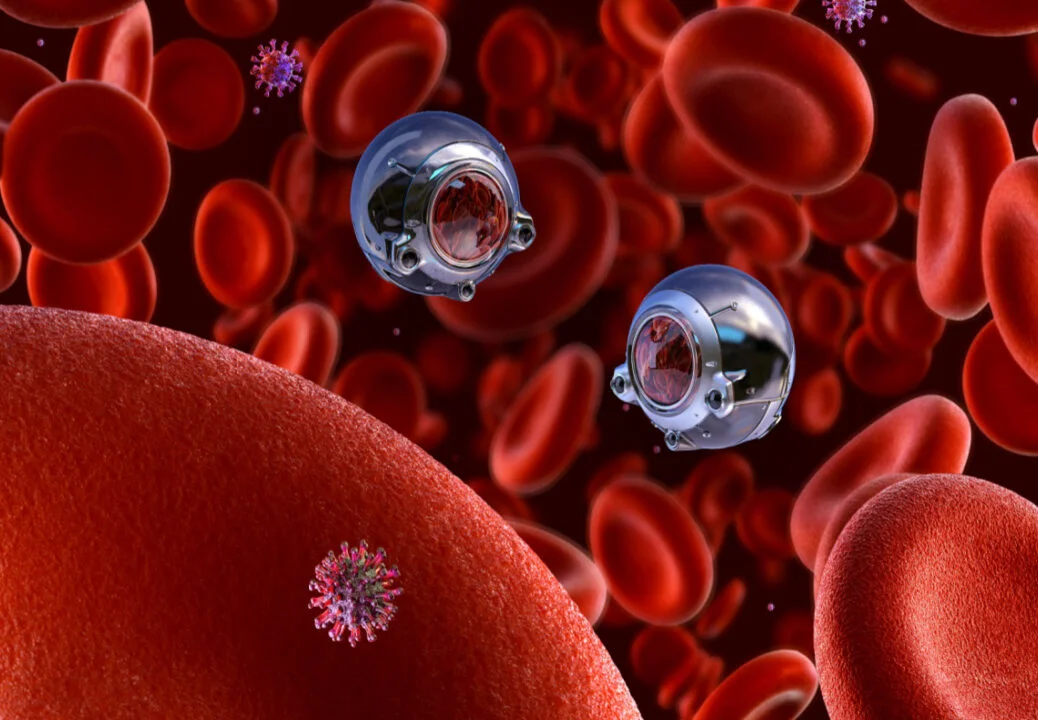

Listed below are the regulatory trends impacting the nanotechnology in medicine theme, as identified by GlobalData.

Unlike most MedTech industries, the nanomedicine market remained relatively unscathed by the Covid-19 pandemic, primarily due to the severity of health conditions for which nanomedicines are used. GlobalData expects the market to continue to grow until at least 2026, with regulatory bodies continuing to approve any repurposing of microbubbles for the delivery of therapeutic compounds adding to the momentum.

Sponsored Article

AI in the energy sector: Middle East must leverage machine learning to better track and reduce emissions

Amid increased pressure and urgency around climate change, how can energy operators in the Middle East better measure emissions and help lead the decarbonization agenda? Given the scale of global greenhouse emissions and the intractability of fossil fuel use from industry performance, businesses within the oil and gas sector must collate and pinpoint exact areas for improvement, building a bridge between intention and action.

The oil and gas industry is responsible for approximately 10% of direct and 40% of indirect global greenhouse gas emissions, according to a report from McKinsey & Company. At COP26, more than 450 businesses from across the finance sector, collectively worth $130trn, committed to pledge funds to reach net-zero carbon emissions by 2050, putting increased pressure on the energy sector to improve performance, as investors increasingly seek to divest from fossil fuel assets.

FDA regulation of nanotechnology

Historically, nanotechnologies in medicine have followed the 510(k) US Food and Drug Administration (FDA) regulatory pathway in a manner similar to other medical devices. However, this pathway led to complications when trying to gain approval, since there was no specific category for these types of products. In 2018, the FDA announced that it would expand the 510(k) programme to take into consideration the opinion of other organisations, such as the Nanotechnology Characterisation Lab and the Nano Task Force.

While this change has the potential to streamline the approval pathway for nanotechnologies in medicine, GlobalData expects the approval of new nanomedicines in 2020 to slow down as the FDA shifts its focus to the approval of diagnostics and therapies for the SARS-CoV-2 virus.

Government and regulatory agencies

While North America dominated the market in 2020, accounting for the largest share, GlobalData expects that government funding for new nanomedicines will increase again in 2022, as national budgets and economies recover from the Covid-19 pandemic

Patents and intellectual property (IP)

The design of new nanomedicines sometimes involves the use of a previously existing nanotechnology or drug. This can potentially result in ambiguity when determining if a new nanomedicine is indeed novel. In some cases, licensing agreements might be required between companies for the approval of nanomedicines to occur. As such, clear definitions on what satisfies the requirements for a new patent are required. This industry is unique, as it combines the fields of medical devices and pharmaceuticals.

Therefore, patent officers with expertise in these fields would be a benefit to the industry and improve rates of commercialization. GlobalData expects the number of new patents and IP for nanomedicines in 2021 to rise, while patents and IP for Covid-19-related therapies decrease, as companies divert resources away from Covid-19-related R&D.

Unlike most MedTech industries, the nanomedicine market remained relatively unscathed by the Covid-19 pandemic, primarily due to the severity of health conditions for which nanomedicines are used. GlobalData expects the market to continue to grow until at least 2026, with regulatory bodies continuing to approve any repurposing of microbubbles for the delivery of therapeutic compounds adding to the momentum.

Sponsored Article

AI in the energy sector: Middle East must leverage machine learning to better track and reduce emissions

Amid increased pressure and urgency around climate change, how can energy operators in the Middle East better measure emissions and help lead the decarbonization agenda? Given the scale of global greenhouse emissions and the intractability of fossil fuel use from industry performance, businesses within the oil and gas sector must collate and pinpoint exact areas for improvement, building a bridge between intention and action.

The oil and gas industry is responsible for approximately 10% of direct and 40% of indirect global greenhouse gas emissions, according to a report from McKinsey & Company. At COP26, more than 450 businesses from across the finance sector, collectively worth $130trn, committed to pledge funds to reach net-zero carbon emissions by 2050, putting increased pressure on the energy sector to improve performance, as investors increasingly seek to divest from fossil fuel assets.

FDA regulation of nanotechnology

Historically, nanotechnologies in medicine have followed the 510(k) US Food and Drug Administration (FDA) regulatory pathway in a manner similar to other medical devices. However, this pathway led to complications when trying to gain approval, since there was no specific category for these types of products. In 2018, the FDA announced that it would expand the 510(k) programme to take into consideration the opinion of other organisations, such as the Nanotechnology Characterisation Lab and the Nano Task Force.

While this change has the potential to streamline the approval pathway for nanotechnologies in medicine, GlobalData expects the approval of new nanomedicines in 2020 to slow down as the FDA shifts its focus to the approval of diagnostics and therapies for the SARS-CoV-2 virus.

Government and regulatory agencies

While North America dominated the market in 2020, accounting for the largest share, GlobalData expects that government funding for new nanomedicines will increase again in 2022, as national budgets and economies recover from the Covid-19 pandemic

Patents and intellectual property (IP)

The design of new nanomedicines sometimes involves the use of a previously existing nanotechnology or drug. This can potentially result in ambiguity when determining if a new nanomedicine is indeed novel. In some cases, licensing agreements might be required between companies for the approval of nanomedicines to occur. As such, clear definitions on what satisfies the requirements for a new patent are required. This industry is unique, as it combines the fields of medical devices and pharmaceuticals.

Therefore, patent officers with expertise in these fields would be a benefit to the industry and improve rates of commercialization. GlobalData expects the number of new patents and IP for nanomedicines in 2021 to rise, while patents and IP for Covid-19-related therapies decrease, as companies divert resources away from Covid-19-related R&D.

Tags :

Previous Story

- 4 key challenges in sustaining compliance in the...

- How a sports apparel company helped one Virginia...

- Moving beyond paper workflows for medical device trials

- Irish medtech start-up SymPhysis Medical raises €1.9m

- Salary remains a key motivator for 74% Indians;...

- Can a dangerous microbe offer a new way...

- 'Your doctor is in:' Physicians test humanoid robot...

- The Tuscan retreat where you can live like...