Pandemic may result in corporate, household debt defaults

Image: Collected

Pandemic may result in corporate, household debt defaults

The monetary crisis stemming from the fallouts of the coronavirus pandemic is likely to trigger a series of corporate and household debt defaults, said Mahbubur Rahman, president of the International Chamber of Commerce Bangladesh, yesterday.

Bangladesh has recorded among the world's most effective growth rates before couple of years with a well balanced economic performance, lessening poverty and public inequalities, he told a good virtual 25th gross annual council of the chamber's executive board.

Quoting a recent International Labour Organisation (ILO) article, Rahman said Bangladesh was now confronted with battling both pandemic and its monetary fallouts.

In that situation, economic risks aren't only limited by the short-term but also extend to major future productivity losses equally through labour and capital, according to a news release from the chamber.

Like the majority of other emerging economies, Bangladesh must reach several key targets to attain the desired GDP development, which include that in health care, export, foreign direct investment (FDI) and remittance.

In Bangladesh, there are around 7.8 million enterprises and 90 % of these are micro-enterprises.

The cottage, micro, small and medium business sector contributes 25 % to the GDP, amounting to around $79 billion. This sector accounts for 30 per cent of the country's total job aswell, said Rahman.

The high cost of doing business is affecting these firms. Besides, various have been suffering incredible setbacks in conditions of production, marketing and revenue, he said.

Bangladesh's status graduation from a good least developed to a good developing country by 2024 will lead to the loss of tastes, including those in trade with key export destinations. Hence, the united states must give attention to reaching no cost trade agreements (FTAs) with key trading countries, Rahman added.

Mentioning the executive panel report, the chamber's assertion also said the next wave of Covid-19 had been sweeping through European countries and the US which would even more prolong the monetary downturn.

Like the majority of other emerging economies, Bangladesh may also be affected and will need to tackle the required GDP growth issues, which include saving the small-scale organizations, getting expatriate workers back to their workplaces to maintain remittance inflow and attracting more FDI.

Saving the small-level enterprises is vital to maintain sustainable growth, keep source chains practical and stay cost-successful, it said.

The pandemic created a massive economic contraction which will be followed by a financial crisis in many elements of the world, as nonperforming corporate loans accumulate alongside bankruptcies.

Sovereign defaults on the growing world are also poised to spike. This crisis will observe a path like the last crisis and the crisis will hit lower-income households and countries harder than their wealthier counterparts, the article observed.

The G20, together with the WHO, the International Monetary Fund, the World Lender Group, US and other international organisations, are mobilised to take active steps to overcome the pandemic, and the International Chamber of Commerce (ICC) is collaborating as a trusted business adviser.

The report mentioned that as part of this campaign, the ICC has released a call to action encouraging governments to make sure that stimulus efforts flow rapidly in to the real economy and provide direct and immediate support to the small firms and their staff to make sure their continued operation.

Given the cross-border nature of source chains, such stimulus and safeguard measures should be used a coordinated approach at both national and international levels.

Countries around the world are implementing economic and fiscal methods, including emergency tax methods to aid their economies under the Covid-19 pandemic.

In this respect, the ICC has highlighted numerous key tax measures that governments could take to save the small-scale companies and relieve cash flow stress.

The council approved the auditor's report of 2019 and appointed the auditor for 2020, the ICC Bangladesh also said.

The annual council paid tribute to Latfiur Rahman, founding member and vice-president of the ICC Bangladesh, Waliur Rahman Bhuiyan, a previous executive board member, Barrister Rafique-Ul Huq, Niloufer Manzur, wife of Apex Group Chairman Syed Manzur Elahi, and national professors Jamilur Reza Choudhury and Anisuzzaman.

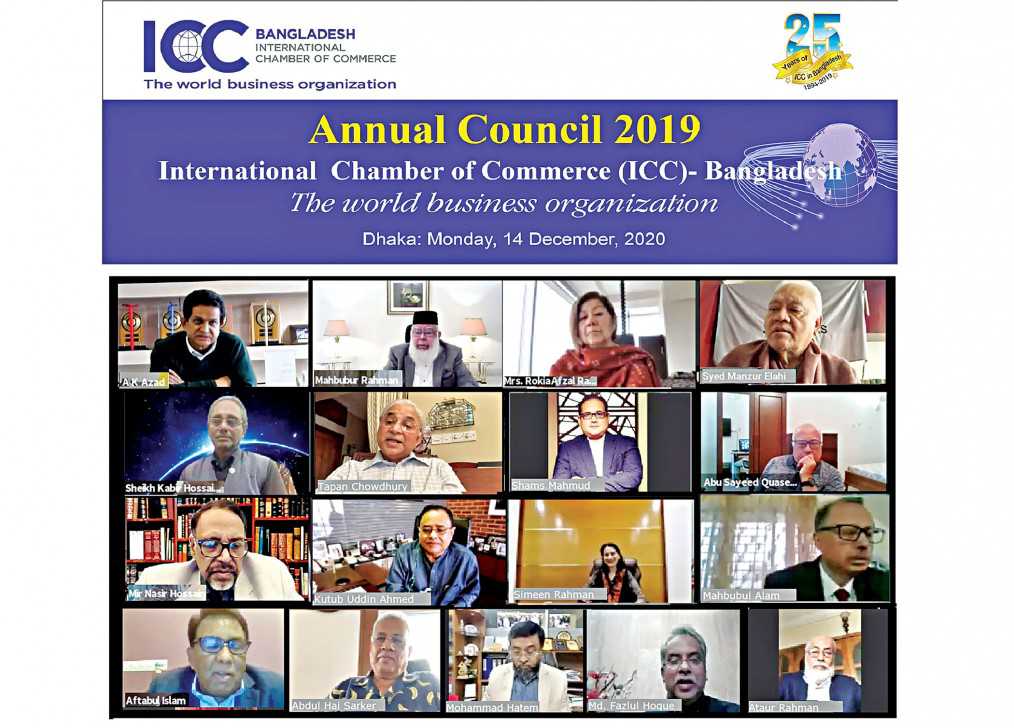

The council was attended by ICCB Vice President Rokia A Rahman, Syed Manzur Elahi, Dhaka Chamber of Commerce and Industry President Shams Mahmud, Chattogram Chamber of Commerce and Industry President Mahbubul Alam, Bangladesh Insurance Association President Sheikh Kabir Hossain, and Nordic Chamber of Commerce and Industry in Bangladesh President Tareq Rahman.

ICCB executive plank members ASM Quasem, Aftab ul Islam, AK Azad, Abdul Hai Sarker, Md Fazlul Hoque, Kutubuddin Ahmed, Mir Nasir Hossain, Mohammad Hatem, Simeen Rahman and Tapan Chowdhury were also present.

Source: https://www.thedailystar.net

Tags :

Previous Story

- 'Bangladesh battling against Covid-19, its economic fallout'

- Bangladesh an inspiration to South Asian peers

- ‘Completion of Padma Bridge to boost Bangladeshi economy’

- Move away from growth delusion

- Remittance of over 10 billion dollars in 5...

- Bangladesh boosts Bay of Bengal blue economy

- Learn from Germany, concentrate on SMEs for monetary...

- Bangladesh on the right track to becoming a...