Remittance declines 7.17% from top countries in Q4 of 2020

Image: Collected

Remittance earnings declined found in such countries where expatriates were found in more trouble & most lost their jobs

Remittance, a good lifeline of the country’s market, declined from the most notable countries found in the fourth one fourth of last year as a result of global Covid-19 pandemic that negatively damaged migration.

Bangladeshi expatriates sent $6.23 billion in remittances during the October-December quarter of last year, down 7.17 % from the previous quarter, according to a quarterly report of the central bank.

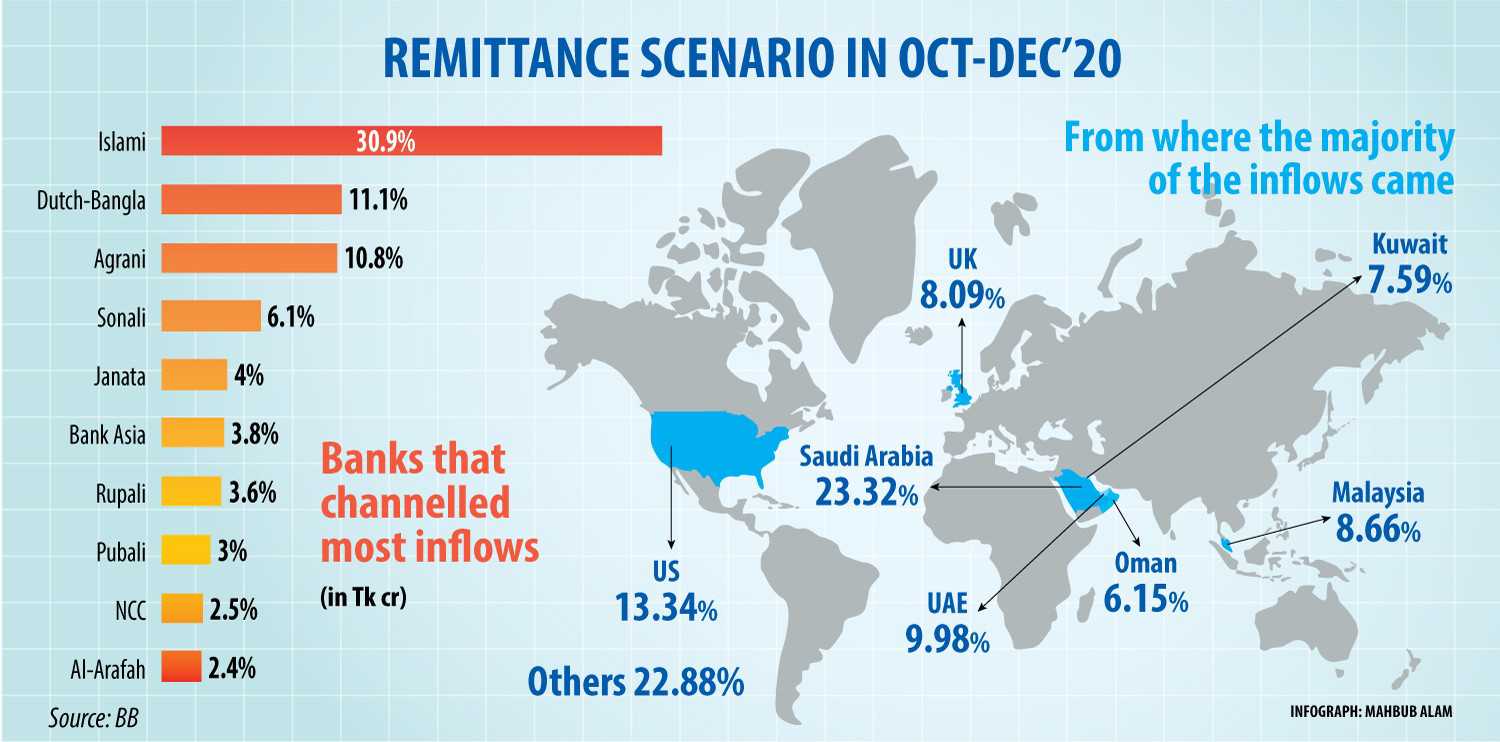

Remittance inflow from top countries, including Saudi Arabia -- the major remittance resource -- UAE, Oman, Bahrain, Qatar, Italy, and Singapore witnessed a good decline in the fourth quarter.

Remittance earnings declined in such countries where expatriates were found in more trouble and most lost their careers, said Zahid Hussain, past lead economist in the World Lender Dhaka Office.

Most Bangladeshi migrants will work in Middle Eastern countries; expatriates in these countries possess lost their jobs because of the fall in essential oil prices due to the Covid-19 pandemic, he added.

From October to December this past year, Bangladesh received $1,453.14 million as remittance from Saudi Arabia, down 9.97 % from the prior quarter.

For the reason that quarter, the remittance inflow declined 17.27 % from UAE; 21.09 per cent from Oman; 10.19 per cent from Bahrain; 5.43 % from Qatar; 10.17 % from Italy; 17.77 per cent from Singapore; and 11.16 per cent from Malaysia, according to the BB report.

Bangladesh received an archive $6.71 billion as remittance in July to September quarter of this past year due to the collapse of the informal channels like the hundi program -- an illicit cross-border deal network -- because of the travel ban due to the pandemic, said central bank officials.

But the informal channels began to recover from September last year as the majority of the countries had withdrawn the travel bans, resulting in the downward trend of remittance in the fourth one fourth of last year, explained the BB officials looking for anonymity.

A great number of migrant personnel returned home after losing their jobs, that was another reason, the officials said.

A complete of 408,408 migrant staff returned home from 29 countries once they lost their jobs following Covid-19 outbreak, in line with the Bureau of Manpower, Career and Training (BMET).

Besides, some 550,000 aspirants who were likely to migrate abroad for careers during the period didn't get the chance to do so.

Then another 150,000 personnel could not go back to their workplaces soon after ending their vacations in the home, said migration officials and researchers.

The migrant personnel had sent additional money with their relatives amid the pandemic to manage the unfamiliar situation, said Faruq Mainuddin Ahmed, managing director of Trust Lender.

However the inflows declined in the coming days as a sizable number of migrant personnel have packed their bags and returned home for good, he added.

During the 4th quarter of this past year, Bangladesh received $3,402.56 million as remittance from the Gulf countries -- Saudi Arabia, UAE, Qatar, Oman, Bahrain, and Kuwait; $724.47 million from EU countries -- UK, Germany and Italy; $752.34 million from Asia-Pacific countries; $831.27 million from the US; and $520.91 million from other countries, in line with the central bank report.

The Bangladesh Lender report showed that only five banks hold a 60 per cent share of the full total remittance earned in the October to December quarter of this past year, owing to their strong distribution channels, good management, and incentives to market Bangladeshi expatriates to send funds through banking channels.

Of the full total $6.23 billion remittances earned during the period, Islami Bank Bangladesh gets the highest marketplace share in remittance earnings, that was 30.9 % of the total remittance earned through the banking channels, followed by Dutch Bangla Bank at 11.1 %, Agrani Bank at 10.8 per cent, Sonali Bank at 6.1 %, and Janata Lender at 4.0 per cent.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- Investment in Bangladesh govt securities fetches record profit...

- Women entrepreneurs need particular financial support: experts

- Bank of America to attain net-zero emissions before...

- 'Bangladesh has the virtually all complicated LC opening...

- BB brings changes in MPS for FY21

- Monetary policy issue of Bangladesh Bank

- Rules need further reforms for steady global trade...

- The future of mobile financial services in Bangladesh