Remittance: the only shiny spot

Image collected

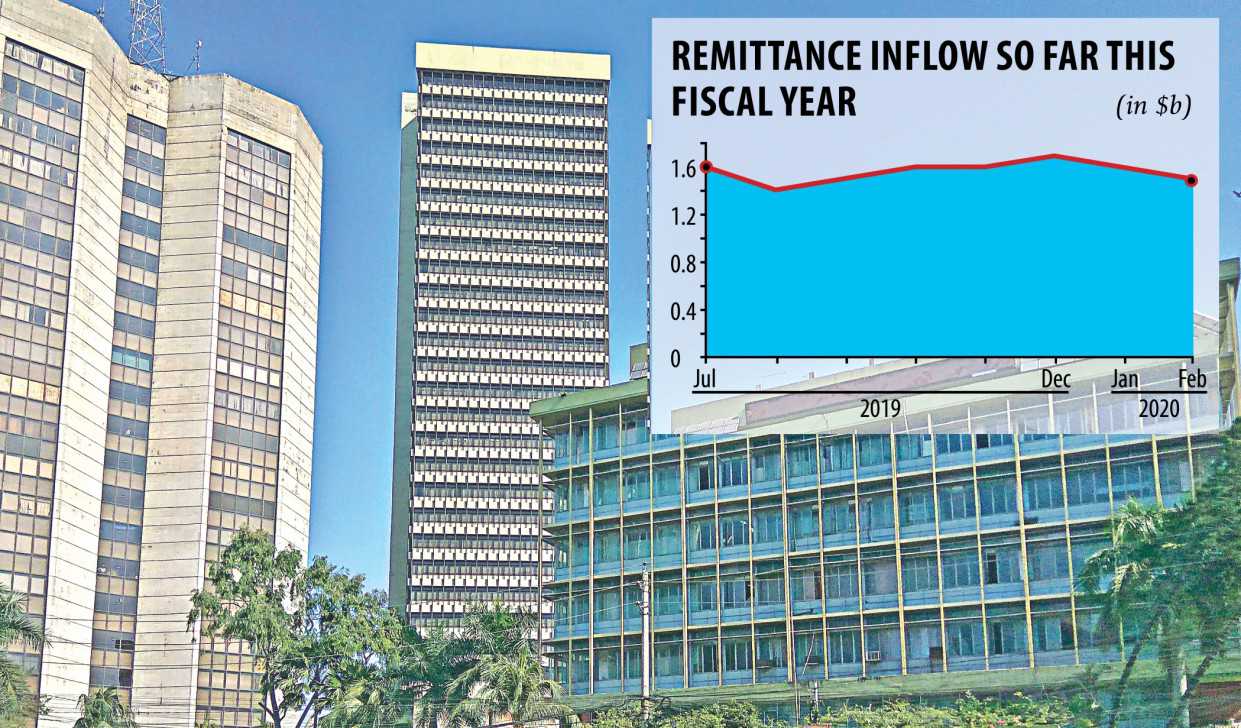

Remittance kept up its strong progress momentum last month seeing as migrant workers sent home 10.16 per cent more than they performed a year earlier, in a significant increase to the economy under stress from sliding exports.

Exports fell 5.21 % year-on-year to $22.92 billion in the first seven months of the fiscal year, according to info from the Export Promotion Bureau.

In February, expatriate Bangladeshis dispatched residential home $1.45 billion to take the tally to $12.49 billion so far in fiscal 2019-20. The eight-month receipts had been up 20.05 per cent year-on-year, according to info from the Bangladesh Bank.

The 2 2 per cent income subsidy for remitters out of this fiscal season has been the main driver behind the spike, according to economists and BB officials.

If the trend continues, remittance will hit a milestone of $20 billion come the end of the fiscal year, said BB officials. Some $16.4 billion flew into the country carry on fiscal year.

"Remittance is among the most lifeline of the overall economy offered the frustrating performance of most other monetary indicators," stated Ahsan H Mansur, executive director of the Plan Research Institute of Bangladesh.

The country's balance of payment could have faced serious crisis if remittance had didn't keep up with the upward trend.

The current account deficit contracted 60 per cent year-on-year to $1.34 billion in the first 50 % of the fiscal year. The entire balance, another major element of the balance of repayment, stood at $27 million during the period. A time earlier, it had been $513 million in the deficit.

Besides, the foreign exchange reserve reaches a comfortable level because of the strong development of remittance, said Mansur, also a former economist of the International Monetary Fund.

"The favourable exchange price of the taka against the united states dollar and a solid stance taken by the central bank against illegitimate money transfers experienced a positive effect on remittance," said Md Arfan Ali, managing director of Lender Asia.

On March 1, the inter-bank exchange fee stood at Tk 84.95 per dollar, up practically 1 % from a year earlier, BB data showed.

Banks experience recently improved their expertise to mobilise remittance in order to tackle the shortage of foreign exchanges, Ali said.

The expanding remittance move has already established a good effect on GDP growth as well, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"This has increased the spending power of the close to and dear kinds of remitters."

The country's rural economy has been around good shape recently thanks to the robust flow of remittance, said Rahman, also an instantaneous past chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banks.

The strong growth in the flow of remittance will fuel domestic require, said the finance ministry recently.

Bangladesh's current profile deficit is in an excellent form compared with the prior two fiscal years because of increased remittance flow, it again said.

But Mansur went on expressing fears that remittance might decline in the coming months as the cost of petroleum items has sharply fallen in the international marketplace in the wake of the coronavirus outbreak.

Moreover, workers going abroad have been declining going back two years, in an alarming indication for the economy.

"The federal government should explore avenues to maintain the upward tendency of remittance by sidestepping the latest spates of global crisis," Mansur said.

A lot of the banks now use application protocol interface (API) to get remittance on a real-time basis, encouraging remitters to send their hard-earned money through the banking channel, Ali said.

An API is a set of digital development code that allows data transmission between software program products. In addition, it contains the conditions of data exchange.

The software has become an important part of today's banking system as loan providers use data as a way to perform several functions, including sending remittance from one bank to another.

Source: https://www.thedailystar.net

Previous Story

- China’s Fruit Import and Export Statistics for 2019...

- Export-import with China not hampered up to now:...

- Member of European Parliament praises Bangladesh economic process

- Tough times for the apparel industry: BGMEA president

- Bangladesh: Foreign Min for more initiatives under PPP...

- Bangladesh Economy Continues Robust Growth with Rising Exports...

- What Bangladesh PM Sheikh Hasina told her cook...

- Asia’s emerging economies are winning US-China trade war