Rich in Bangladesh rising faster than anywhere

Bangladesh has topped the list of countries that saw the quickest growth in the number of ultra-wealthy people between 2012 and 2017, according to a new report from New York-based research firm Wealth-X.

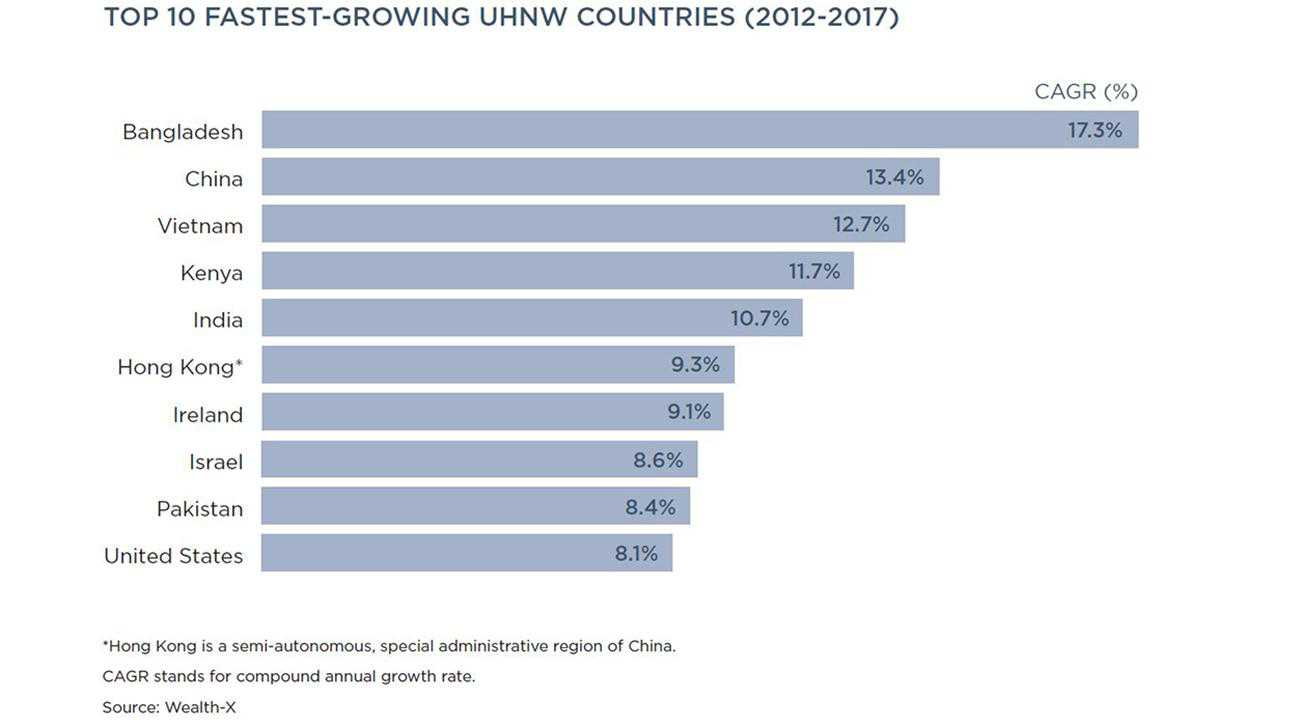

The number of ultra-high net-worth (UHNW) individuals in Bangladesh rose by 17.3 percent during the period, the World Ultra Wealth Report 2018 shows.

UHNW individuals are defined as people with investable assets of at least $30 million, usually excluding personal assets and property such as a primary residence, collectibles and consumer durables.

In terms of growth, Bangladesh is ahead of China, Vietnam, Kenya, India, Hong Kong, Ireland, Israel, Pakistan and the US.

Although the US recorded the weakest growth in its ultra-wealthy population, it remained by far the leading country for UHNW individuals in 2017, accounting for a 31 percent share.

The US was home to 79,595 ultra-wealthy individuals last year, followed by Japan, China, Germany, Canada, France, Hong Kong, the UK, Switzerland and Italy.

Among the top 10 countries, China and Hong Kong have achieved the strongest gains in their ultra-wealthy populations over the past five years. In contrast, those of Japan, Canada, Italy and the UK have largely stagnated. Looking at a broader range of nations, China – perhaps surprisingly – is not the global leader.

“That status lies with Bangladesh, which has registered compound annual growth in its UHNW population of 17 percent since 2012,” said the report.

“Double-digit increases have also been posted by Vietnam, Kenya and India, illustrating the significant opportunities for wealth creation across the emerging world.”

To size and forecast the ultra-wealthy population and its combined wealth, Wealth-X uses proprietary Wealth and Investable Assets Model, which covers the top 75 economies that account for 98 percent of the global GDP.

To estimate total private wealth, it uses econometric techniques that incorporate a large number of national variables such as stock market values, GDP, tax rates, income levels and savings from sources such as the World Bank, the International Monetary Fund, the Organisation for Economic Cooperation and Development and national statistics authorities.

Wealth-X estimates wealth distribution across each country's population.

According to the report, in 2017, the world's UHNW population rose by 12.9 percent to 255,810, a sharp acceleration from a year earlier. Their combined wealth surged by 16.3 percent to $31.5 trillion, implying healthy gains in average net worth.

The finance, banking and investment sector was the primary industry focus for the largest proportion of the global ultra-wealthy population in 2017, accounting for a 14.2 percent share.

Manufacturing was the second most significant industry, with its share edging higher to 7.6 percent.

The proportion of the global ultra-wealthy population whose fortunes are predominantly self-made continued to increase last year, hitting 67.5 percent.

Source: https://www.thedailystar.net