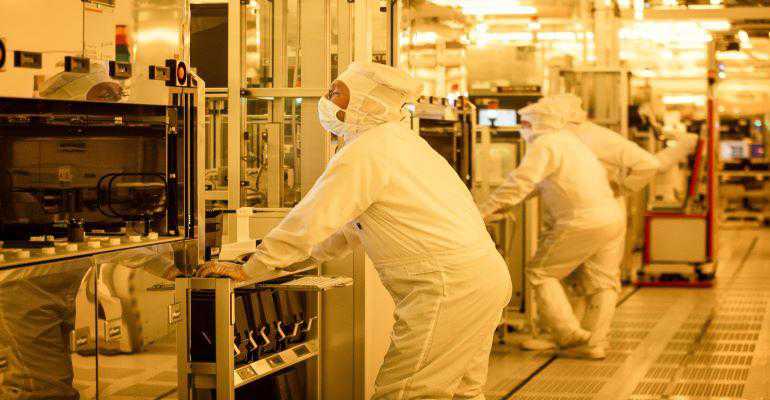

Semiconductor Equipment Market Surging to Meet Electronics Demand

Collected Image

The global COVID-19 pandemic, coupled with robust demand for next-generation electronics, has kept the capital equipment market humming. Last year, global sales of semiconductor manufacturing equipment surged 44% to an all-time record of $102.6 billion from $71.2 billion in 2020, according to data from SEMI, an industry association representing the global electronics product design and manufacturing supply chain.

The robust sales of semiconductor manufacturing equipment are not surprising, given that electronics manufacturers have been in a race to increase global manufacturing capacity to keep up with demand for semiconductors and other electronic components. But because additional manufacturing capacity typically takes several years to bring online, the effects of the additional investments are often not felt immediately, which accounts for ongoing parts shortages. "The 44% increase in manufacturing equipment spending in 2021 highlights the global semiconductor industry's aggressive push to add capacity," said Ajit Manocha, SEMI president and CEO, in a statement. "This drive to expand production capabilities extends beyond the current supply imbalance, as the industry continues to ramp up to address a wide range of emerging high-tech applications that will enable a smarter digital world with countless social benefits."

According to SEMI, China was the largest market for semiconductor equipment for the second time, with sales expanding 58% to $29.6 billion to mark the fourth consecutive year of growth. Korea, the second-largest equipment market, saw sales soar 55% to $25.0 billion, after showing strong growth in 2020.

Following China and Korea, Taiwan equipment sales grew 45% to $24.9 billion. Annual semiconductor equipment spending increased 23% in Europe and 17% in North America, which continues to recover from a contraction in 2020. Sales in the remainder of the world jumped 79% in 2021.

The survey found that global sales of wafer processing equipment rose 44% in 2021, while other front-end segment sales grew 22%. Assembly and packaging equipment increased 87% across all regions in 2021, while total test equipment sales rose 30%.

The robust sales of semiconductor manufacturing equipment are not surprising, given that electronics manufacturers have been in a race to increase global manufacturing capacity to keep up with demand for semiconductors and other electronic components. But because additional manufacturing capacity typically takes several years to bring online, the effects of the additional investments are often not felt immediately, which accounts for ongoing parts shortages. "The 44% increase in manufacturing equipment spending in 2021 highlights the global semiconductor industry's aggressive push to add capacity," said Ajit Manocha, SEMI president and CEO, in a statement. "This drive to expand production capabilities extends beyond the current supply imbalance, as the industry continues to ramp up to address a wide range of emerging high-tech applications that will enable a smarter digital world with countless social benefits."

According to SEMI, China was the largest market for semiconductor equipment for the second time, with sales expanding 58% to $29.6 billion to mark the fourth consecutive year of growth. Korea, the second-largest equipment market, saw sales soar 55% to $25.0 billion, after showing strong growth in 2020.

Following China and Korea, Taiwan equipment sales grew 45% to $24.9 billion. Annual semiconductor equipment spending increased 23% in Europe and 17% in North America, which continues to recover from a contraction in 2020. Sales in the remainder of the world jumped 79% in 2021.

The survey found that global sales of wafer processing equipment rose 44% in 2021, while other front-end segment sales grew 22%. Assembly and packaging equipment increased 87% across all regions in 2021, while total test equipment sales rose 30%.

Source: https://www.designnews.com

Tags :

Previous Story

- LG launches new digital medical device for pain

- As health concerns rise, car gadgets proliferate

- Chip stocks are on the up after Samsung...

- Body-monitoring tech trend comes with concerns

- Samsung Electronics forecasts 52.5% jump in Q4 profits...

- CES tech fair opens under pandemic shadow

- CES 2022: annual tech trade show to open...

- Amazon's India rival Snapdeal reports higher sales ahead...