SMEs are in dire need of a lifeline from banks

Image collected

Businesses are recovering however the small and medium enterprises (SMEs) are being left out.

Subsequently, easy and generous financing for them, particularly the micro, small and women entrepreneurs, has become urgent and imperative.

The SMEs contribute about one-fourth the country's gross domestic product and employ thousands of people.

Still, a huge number of the micro, cottage and small businesses have remained missing from formal financing and the government-announced Tk 20,000 crore stimulus package for the sector.

This is shared at an online discussion jointly organised by LankaBangla Finance and The Daily Star on supporting the SMEs to handle the Covid-19 pandemic.

Planning Minister MA Mannan was present amongst others.

Discussants said the pandemic induced an extended shutdown, that was a catastrophe for the SMEs, especially micro and smaller businesses that mostly operate informally.

The SMEs suffered Tk 92,000 crore in losses through the shutdown, said Monzur Hossain, a senior research fellow of the Bangladesh Institute of Development Studies (BIDS).

They are yet to recuperate despite the fact that there are signs of a resumption of financial activities, he said, citing one of is own latest studies on the impact of the pandemic on the SMEs.

"Therefore, the implementation of the stimulus package is essential for the SMEs."

Most the micro and smaller businesses do not have usage of bank finance because they operate informally and cannot prepare documents good requirements of formal financial institutions.

A certain part of the stimulus could be delivered through microfinance institutions along with taking support from SME Foundation for the benefit for smaller businesses, Hossain added.

The SMEs will be the engine of development and it is particularly true for a developing country given that they provide diversity, employment and value addition, said Selim RF Hussain, managing director and ceo of BRAC Bank.

Some 55 per cent of value-addition in Japan comes through the SMEs, he said.

Small clients of BRAC Bank were on the way to recovery following the withdrawal of the countrywide shutdown by the federal government from June.

BRAC Bank, one of the biggest financiers of the SMEs, also brought changes in its loan products to match with the needs of its borrowers, he said.

Initially, responses from the SMEs for the stimulus package were low because of a lack of awareness, said Md Mahbub ul Alam, managing director of Islami Bank Bangladesh.

Awareness increased later and Islami Bank, another major lender to the SMEs, got more applications. The lender provided loans to 2,100 out of 3,600 applicants, he added.

To support micro businesses, Islami Bank also finances through its microfinance window in rural areas, he added.

The macro scenario of loan disbursement will not match with the micro picture, said Mohammad Abu Eusuf, professor of the Department of Development Studies at the University of Dhaka.

Many micro and smaller businesses and women entrepreneurs continue being overlooked from the stimulus package for the SMEs.

"A one size fits all approach will not help."

Citing his recent study among women entrepreneurs, he said 95 % of the respondents didn't get the fund.

They are begging at the doors of banks for loans however in vain, said Eusuf, also director of the Centre on Budget and Policy at the University of Dhaka.

"Their situation is different and they should be treated differently," he added.

Khwaja Shahriar, MD and CEO of LankaBangla Finance, echoed the same.

"We all should work so that SMEs can recover," he added.

The health of micro and cottage enterprises was very weak and these businesses need support on easy terms, said Ferdaus Ara Begum, leader of Business Initiative Leading Development (BUILD).

She urged for increasing the repayment amount of loans for small entrepreneurs.

Citing that India offered Rs 3 lakh in collateral-free loans, she demanded granting Tk 2 lakh as collateral-free loans for small and micro businesses.

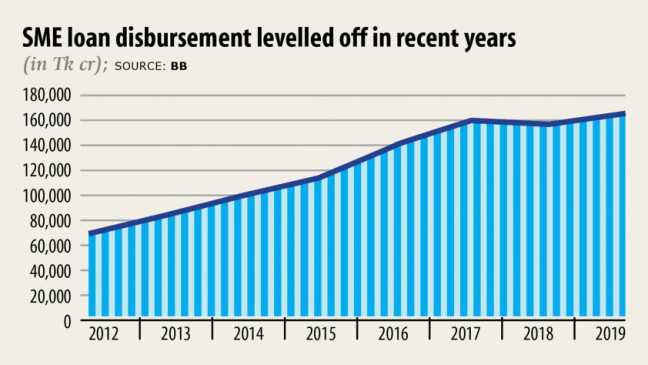

"Overall, we are lagging behind loan disbursement," said Centre for Policy Dialogue Research Director Khondaker Golam Moazzem.

The government's intentions were good but banks were not properly doing their job of implementing the stimulus plan.

They are focusing on lending to those who have. They are showing slackness, he said, demanding that the central bank disclose bank-wise loan disbursements against targets.

"If the economy recovers, why will the SMEs not get loans?" he asked.

Frustration has gripped many micro and small entrepreneurs as they were not getting any finance, said Nazeem Sattar, general manager of SME Foundation.

Banks are giving priority to their existing clients, he said, while demanding measures to make sure loans for the SMEs that don't get it from banks.

"It is necessary to develop an alternative mechanism for all those small businesses that are not served by banks."

State banks have branches all over the country and they have an important role to play, Sattar added.

The central bank eased application procedures for loans and cut documentation requirements for the SMEs, said Asif Iqbal, joint director of the Bangladesh Bank.

"We have to anticipate to serve a huge demand surge in the post-pandemic period," said Planning Minister MA Mannan.

He suggested that the central bank consider ways to relax repayment schedules for the SMEs and energise state banks in order that they lend to the SMEs more aggressively.

"The pandemic has generated a shift toward virtual marketplaces from physical stores. We must utilise the digital prospect," he said.

Md Kamruzzaman Khan, senior vice-president and head of SME Financial Services of LankaBangla Finance, said the non-bank financial institution gives give attention to lending to manufacturing SMEs.

Syed Ashfaqul Haque, executive editor of The Daily Star; Borhan Uddin, executive director of the Institute of International Business & Management; and Shabbir Shawkut, technical advisor-capacity building and public-private dialogue of The Asia Foundation, also spoke.

Source: https://www.thedailystar.net

Tags :

Previous Story

- 67% of SMEs forced to shut businesses because...

- Entrepreneurship and SMEs are more important than ever...

- 'Easier SME financing the main element to recovery'

- Corona-induced fault-lines on Bangladesh economy

- SME sector hit hard amid corona crisis

- Accelerit launches SA's no cost video conferencing

- Support SMEs for swift economic recovery

- Will update SME data source soon: Industries Minister