Stocks continue to bleed, Tk 23,142cr lost in 3 weeks

Image collected

Stock investors lost Tk 23,142 crore in the last three weeks but the regulator is yet to take any action to stem the tide.

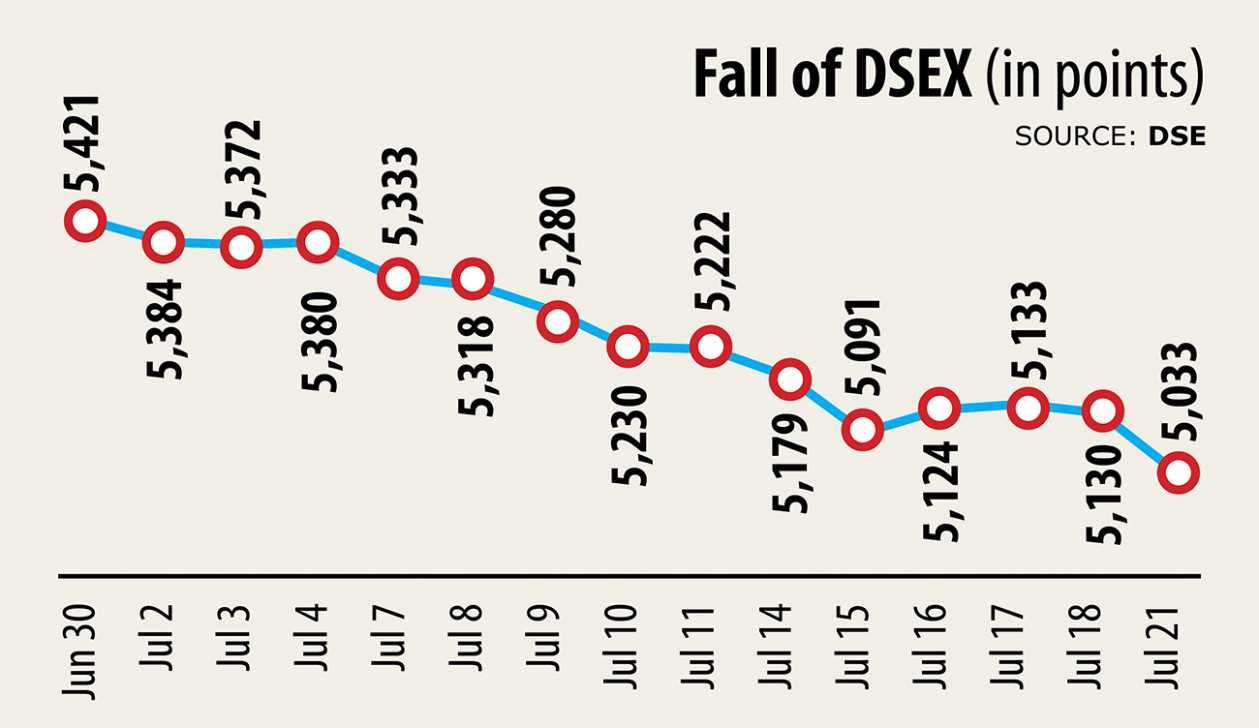

Since June 27, the DSEX, the benchmark index of the Dhaka Stock Exchange, shed a staggering 397 points to close at 5,033 yesterday, which is the lowest in two-and-a-half years.

The slide began when news emerged that fiscal 2019-20’s budget would be passed in the parliament on June 30 without any significant incentive for stocks and the market hardly rebounded since.

And yet, the Bangladesh Securities and Exchange Commission is not taking action to calm down the jittery retail investors and lift their confidence.

Its actions thus far have been to form a committee to find out the reason for the slump and ask institutional investors to bump up their investment.

Retail investors are of the belief that the regulator has failed to implement the rules and regulations properly and has subsequently called for an overhaul of the commission. They have demanded that the chairman and commissioners bow out from the BSEC.

“The present commission has simply failed,” said Abu Ahmed, a former chairman of the Dhaka University’s economics department.

It was nei-ther able to punish the sponsors of the listed companies who sold off their holdings without informing investors nor it was able to bring good stocks to the market. It also allowed the misuse of placement shares and has failed to warn the finance ministry of the possible consequences of the budget measures.

“What the present commission succeeded in was spooking the investors,” Ahmed added.

The commission should have forced the listed companies to follow the rules and regulations, said Mizanur Rahman, a professor of the Dhaka University’s accounting and information systems department.

“This would have made the wrongdoers think twice before cheating the investors.”

The liquidity crisis in financial institutions is another reason behind the erosion of investors’ confidence.

The impending liquidation of Peoples’ Leasing and Financial Services has dampened investors’ spirits as they will lose all the money they have put in the non-bank financial institution.

“Such a situation may happen to some other companies and this has impacted their confidence badly,” Rahman added.

In response, a top BSEC official requesting anonymity said it is not possible to rebuild the confidence of investors in a day.

“We were not successful in doing so in the past for many reasons, but now we are really trying to bring the confidence back,” he said, while citing the initiatives taken on initial public offering recently to further his point.

The telecom regulator’s move to declare Grameenphone a significant market power (SMP) in February has played a huge role in dampening the confidence of stock investors, said a top official of a leading stock broker.

As an SMP, higher charges will be applied on Grameenphone, which will squeeze the business growth of the country’s leading mobile phone operator.

“Grameenphone is the largest listed company, so its woes are bound to spill over into the whole stock market.”

The slide in Grameenphone shares ultimately impacted the institutional and foreign investors’ confidence, so they are retreating from the market entirely, the official added.

The DSEX dropped 96.95 points, or 1.88 percent, yesterday, while turnover dropped 6.7 percent to Tk 368.64 crore.

Of the traded issues, 61 advanced and 273 declined, while 18 remained unchanged.

Fortune Shoes dominated the turnover chart with its transaction of 49.63 lakh shares worth Tk 20.03 crore, followed by United Power Generations, Federal Insurance, JMI Syringes and Beximco.

Vanguard AML Rupali Bank Balanced Fund was the day’s best performer with its 10 percent gain, while Aziz Pipes was the worst loser, shedding 9.97 percent.

Chittagong stocks also fell, with the bourse’s benchmark index, CSCX, declining 185.03 points, or 1.93 percent, to finish the day at 9,373.25.

Losers beat gainers as 231 declined and 42 advanced, while 11 finished unchanged on the Chittagong Stock Exchange. The port city bourse traded 79.29 lakh shares and mutual fund units worth Tk 17.10 crore.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Stocks plunge for 3rd week on panic sales

- Stocks inch up as institutional investors keep supporting...

- Dhaka Bourse to Develop Tradeable Capital Market Indices

- Investors continue demo against stock market slump

- DSE plans to make indices tradable

- PLFS liquidation move keeps hammering stocks

- Stocks fall in 5 out of 6 days...

- Stocks slump on new tax measures, GP woes