12 companies at risk of being delisted from DSE

Out of 14 companies, 2 companies have not announced any dividends for the current fiscal year

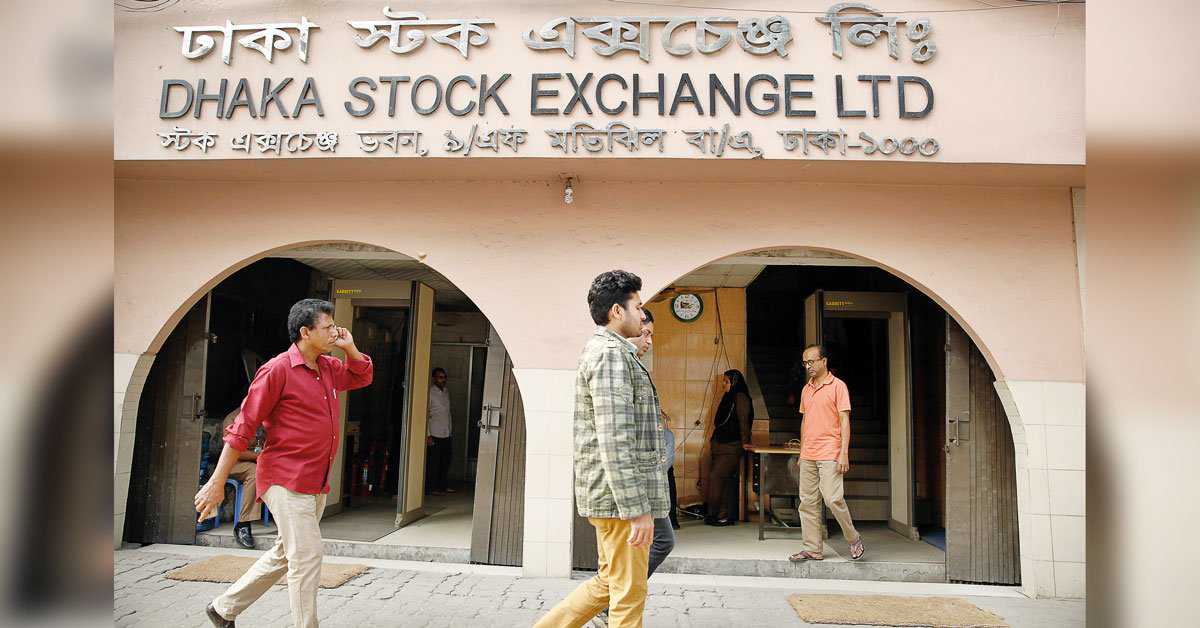

As many as 12 companies are at risk of being delisted from the Dhaka Stock Exchange (DSE), as they have failed to declare any dividends for the last five years, sources at the premier bourse have said.

DSE management is still mulling whether to delist the non-performing firms, in compliance with DSE Listing Regulation 51(1)(a).

Earlier, the DSE decided to review the performances of 15 listed companies. Among them, three firms recently declared dividends.

Although the companies have failed to declare dividends, their shares have been trading at unusually high prices, due to syndicate trading and manipulation of the stock market, analysts said.

Out of 14 companies, 2 companies have not announced any dividends for the current fiscal year.

The failing companies are: Meghna Pet Industries, Dulamia Cotton Spinning Mills, Samata Leather Complex, Shyampur Sugar Mills, Zeal Bangla Sugar Mills, Beximco Synthetics, Imam Button Industries, Meghna Condensed Milk Industries, Savar Refractories, Jute Spinners, Sonargaon Textiles and Shinepukur Ceramics Limited.

The Board of Directors of Kay & Que (Bangladesh) has recommended 5% cash dividend for the year ended on June 30, 2018. The Annual General Meeting (AGM) of the company will be held on December 9. The Company has also reported earnings per share (EPS) of Tk0.91, net asset value (NAV) per share of Tk76.55 and NOCFPS of Tk1.26 for the year ended on June 30, 2018, as compared to Tk0.05, Tk11.45, and Tk0.48, respectively, in the same period of the previous year.

Information Services Network’s (ISN) Board of Directors has recommended 1% cash and 4% stock dividend for the year ended on June 30, 2018.

Both Kay & Que and ISN escaped becoming delisted as they declared dividends, though minimal, sources said.

If any of the companies fail to satisfy the upcoming reviews by DSE, they may be delisted from the stock exchange. Shares of these companies have been trading in the ‘Z’ category.

“The performances of the non-performing listed securities will be reviewed by DSE in line with regulation 51(1) (a) of the Dhaka Stock Exchange (Listing) Regulations 2015. The companies have failed to declare dividends (cash/stock) for a period of five years from the last date of declaration of dividends or the date of listing with the exchange,” a DSE statement said in the first week of August.

According to DSE Listing Regulation 51(1)(a), if the issuer fails to declare dividends (cash/ stock) for a period of five years from the last date of declaration of dividends or the date of listing with the exchange, the listed securities may be delisted.

On July 18, the DSE authorities delisted Rahima Food Corporation Ltd, as well as Modern Dyeing & Screen Printing Ltd, as both companies had been incurring constant losses and had not been in production for over five years. The companies concerned did not declare any dividends for the last five years.

The DSE Listing Regulations 2015 also say listed securities may be delisted if commercial operation, production, or exploration stops for three consecutive years.

DSE Managing Director KAM Majedur Rahman told the Dhaka Tribune, “We are conducting our investigations of junk companies to protect the interests of shareholders and the image of the market. Any company that failed to declare dividends for the last five years will be delisted for the interest of the market.”

AFC Capital Limited CEO Mahbub H Mazumder told the Dhaka tribune: “The non-performing companies that are failing to declare dividends should be punished for the overall development of the bourse. Any stern decision from the DSE will send a message to rough stock traders.”

Policy Research Institute (PRI) Executive Director Ahsan H Mansur said: “People should invest carefully. They should stay away from investing in junk shares.”

Source: https://www.dhakatribune.com

Tags :

Previous Story

- Stocks end 3-week losses on bargain hunting

- Most of mutual funds suffer profit fall in...

- Summit to invest $8m in India to improve...

- ISN, Kay & Que declare dividends after 5...

- Bangladesh’s burgeoning pharmaceutical sector: Ruling local market, stock...

- Stocks close week down

- 90 more DSE members receive sales proceeds

- Banks' earnings per share saw fall in Q3