3 Absurdly Cheap Clean Energy Stocks

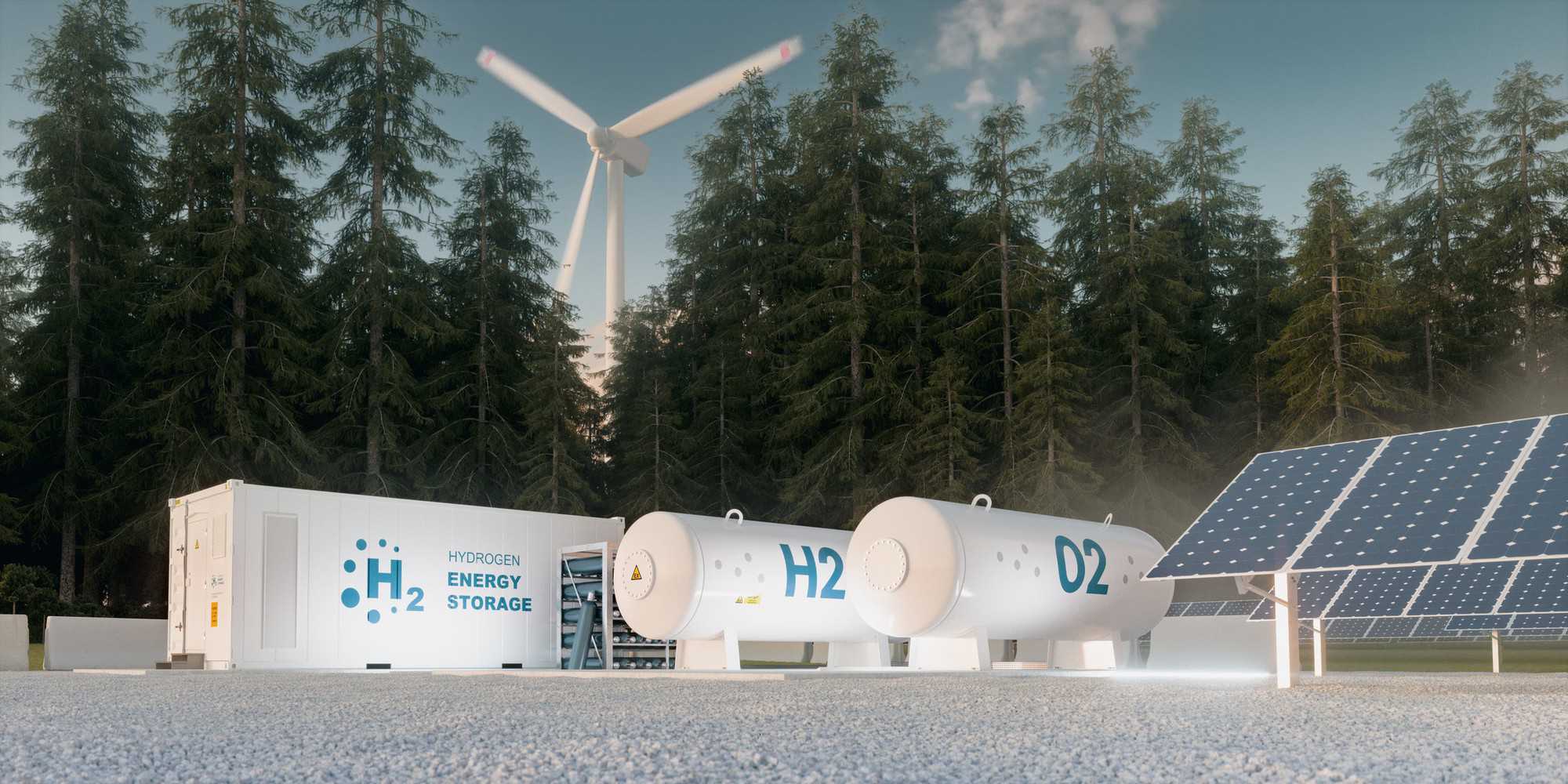

Image: Collected

Saying "cheap" anywhere close to clean energy stocks seems extremely difficult today. Some companies happen to be trading at over 100 times revenue, and valuations of everything from wind to solar to electronic vehicles possess skyrocketed with reckless abandon in the last six months.

As strong mainly because the marketplace has been for clean strength stocks, you may still find some values out now there for long-term investors. Three of our Foolish contributors think Primary Solar (NASDAQ:FSLR), XL Fleet (NYSE:XL), and Clearway Strength (NYSE:CWEN) are too cheap to pass up today.

A rock-solid solar energy stock

Travis Hoium (Initial Solar): Hardly any renewable energy businesses have the history of profitable businesses and rock-solid harmony sheet that Initial Solar has. During the third quarter 2020 earnings release, administration stated it expects to close the entire year with $1.2 billion to $1.3 billion of net cash on the total amount sheet and $3.65 to $4.15 per share in earnings. Given the existing stock price, that is clearly a price-to-earnings multiple of 22, which is certainly inexpensive for a renewable strength stock today.

First Solar has tested that it has solar power panels that can command reduced available in the market and has increased production quickly to meet up demand. If the solar industry continues to grow, the company could have an opportunity to increase production further. And with the price advancements from competing silicon solar power panels seeming to level out, we might not exactly see the pricing pressure of the previous 10 years in solar manufacturing.

As most solar companies make an effort to expand the offerings they provide to the marketplace, First Solar is focusing on what it does best: produce solar panels. That's served the business well, and provided how inexpensive the stock is, I think it creates shares value for money today.

Vehicle electrification opportunity

Howard Smith (XL Fleet): When investors analysis the electrification of transport, most thoughts head to famous electric-vehicle (EV) manufacturers like Tesla (NASDAQ:TSLA) or the myriad of EV makers which have gone public through exceptional purpose acquisition companies (SPACs).

XL Fleet likewise took the SPAC path to the general public markets, but it isn't one of the most well-known EV corporations and is not a power vehicle manufacturer. But a number of things make the company beautiful for investors, incorporating its current valuation.

The company configures commercial and municipal fleets with electrification options. It offers hybrid and plug-in hybrid electric drive systems for professional fleet vehicles made by automakers and for large fleet owners like PepsiCo and FedEx. It is also developing a fully electrical offering and can be adding XL Grid, a division to handle the charging infrastructure desires of its a lot more than 200 customers.

XL Fleet closed its SPAC merger found in December 2020 to enter the general public marketplaces. Investors won't see its first of all quarterly earnings report before end of March 2021. Unlike many newly open public EV corporations, XL Fleet is not "pre-revenue." Operations said in its latest investor demonstration that it expects to triple its 2020 earnings to about $75 million in 2021. And as its item portfolio expands into Class 7 and 8 trucks, and with international expansion, it estimates income to crank up quickly to around $1.4 billion in 2024. That expansion has recently begun, with a fresh partnership released this month for totally electric and plug-in hybrid Class 3 to Class 8 waste management trucks.

The company's market capitalization is approximately $2 billion. That's significantly less than 1.5 times 2024 sales if XL Fleet achieves its expansion expectations. Though there are always risks, the business already comes with an established merchandise with a recognised customer base. So that it appears plausible XL Fleet can achieve those goals. Relative to other EV valuations, which makes XL Fleet stock look low cost at current levels.

Among my top stocks for 2021 is on sale at this time

Jason Hall (Clearway Energy): Renewable energy maker Clearway Energy was an excellent stock to possess in 2020, returning more than 60% in total gains to investors. And even with these enormous benefits under its belt, I referred to as Clearway out as you of my top shares for 2021 -- and beyond -- in January.

Source: https://www.fool.com

Previous Story

- Sunrun sets brand-new quarterly and total annual residential...

- GE subsidiary to apply AI for wind electric...

- 'Bangladesh needs to address the widening monetary gap...

- Bangladesh: The Rising Economic Power

- ABB, ORION sign contract to ramp up efficiency...

- Rohas Tecnic bags power line jobs worthwhile RM192m...

- Metito-led consortium wins 55MWe solar project with $0.0748/kWh...

- Four-fold jump in LPG consumption but industry faces...